Lien Payoff Letter Template With Example In Cuyahoga

Description

Form popularity

FAQ

A payoff request allows a third party to receive the current balance due to release a lien or facilitate a business transfer (bulk sale transfer or liquor license). To release a lien or facilitate a bulk sale transfer, businesses must be in good standing to receive a payoff request.

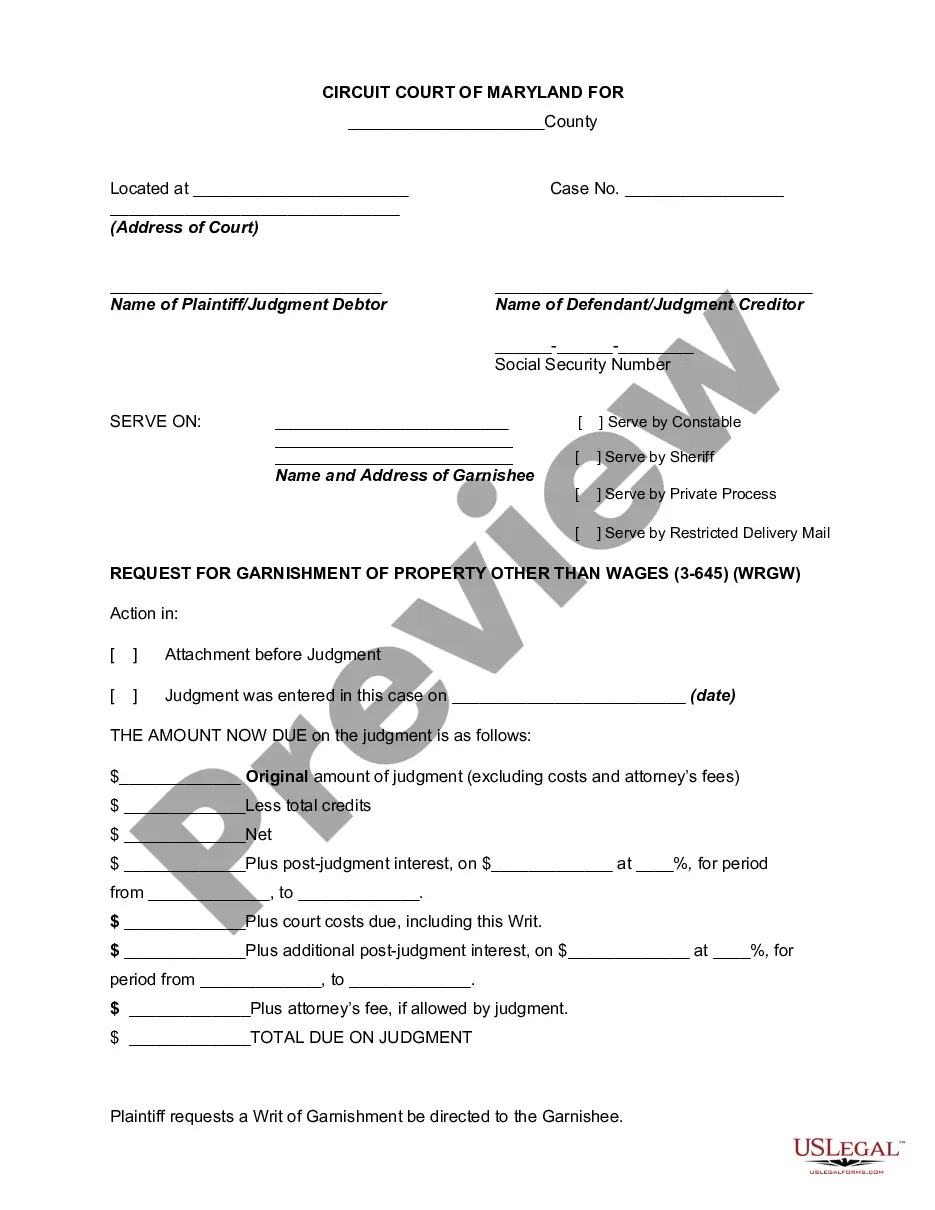

A creditor can obtain a judgment lien by filing a certificate of judgment with the clerk of the court of common pleas in any county where the debtor owns or may own real property in the future. Real property includes land and fixtures on land such as a single-family home or condo.

To ensure a proper payoff, sellers or closing agents must contact the lien holder or their attorney for an official payoff statement. This statement outlines the final payoff amount and includes details on principal balances, accrued interest, attorney's fees, and administrative costs.

If the Internal Revenue Service (IRS) has placed a tax lien on your property, once you've satisfied the debt, the IRS should notify you that the lien has been removed. To do so, the IRS should send you a “Certificate of Release of Federal Tax Lien,” also known as Form 668(Z).

For a Lien Released Manually If your lender does not participate in Ohio's Electronic Lien and Title Program, the lender will mark that the lien was discharged and mail the paper title to you. To remove the lien from BMV records: Take the title to any County Clerk of Courts Title Office.

Tax lien: The statute of limitations for a tax lien in Ohio is 15 years from the date the tax liability was assessed. This means that the government has 15 years to collect the taxes owed before the lien expires. Judgment lien: In Ohio, a judgment lien can be valid for up to 5 years.