Lien Payoff Letter Template For Property In Clark

Description

Form popularity

FAQ

A judgment lien in Oregon will remain attached to the debtor's property (even if the property changes hands) for ten years.

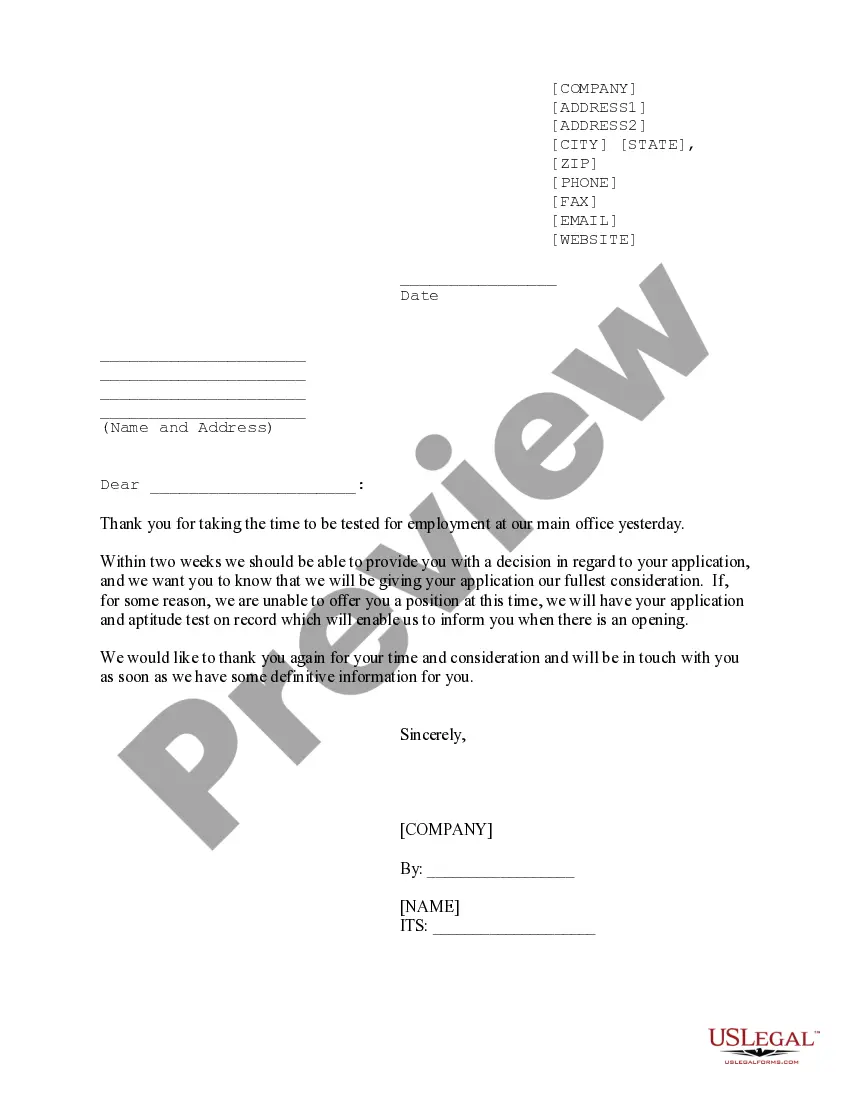

A payoff request allows a third party to receive the current balance due to release a lien or facilitate a business transfer (bulk sale transfer or liquor license). To release a lien or facilitate a bulk sale transfer, businesses must be in good standing to receive a payoff request.

In Minnesota, an action to enforce a mechanics lien must be initiated within 1 year from the date of the lien claimant's last furnishing of labor or materials to the project. If a claimant records their lien close to Minnesota's 120-day filing deadline, they will have about 8 months to enforce the claim.

First: Nevada mechanics lien claimants must send a Notice of Intent to Lien before filing a lien on residential property. That Notice of Intent must be sent at least 15 days before the lien gets filed. So, in order to file a valid lien, that step will need to be taken.

Wyoming, Texas, and Mississippi are the only states that require a person signing a lien waiver to have it notarized. The notarization requirement does not apply in Washington and Oregon, the two states we primarily serve at Northwest Lien.