Amortization Excel Sheet For Home Loan In Bronx

Description

Form popularity

FAQ

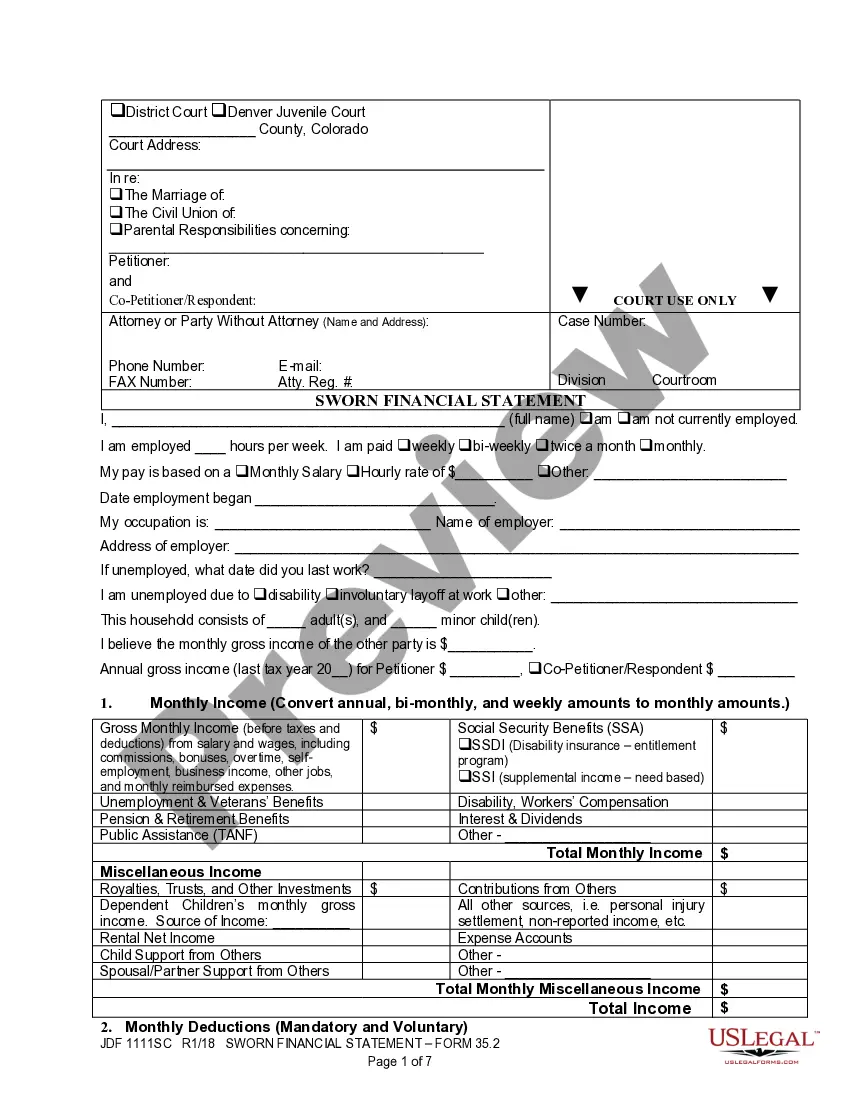

To use our amortization schedule calculator, you will need a few pieces of information, including the principal balance for your mortgage, your annual interest rate, the term of the mortgage and your state of residency. You can also enter additional payments to see how this affects your overall mortgage length.

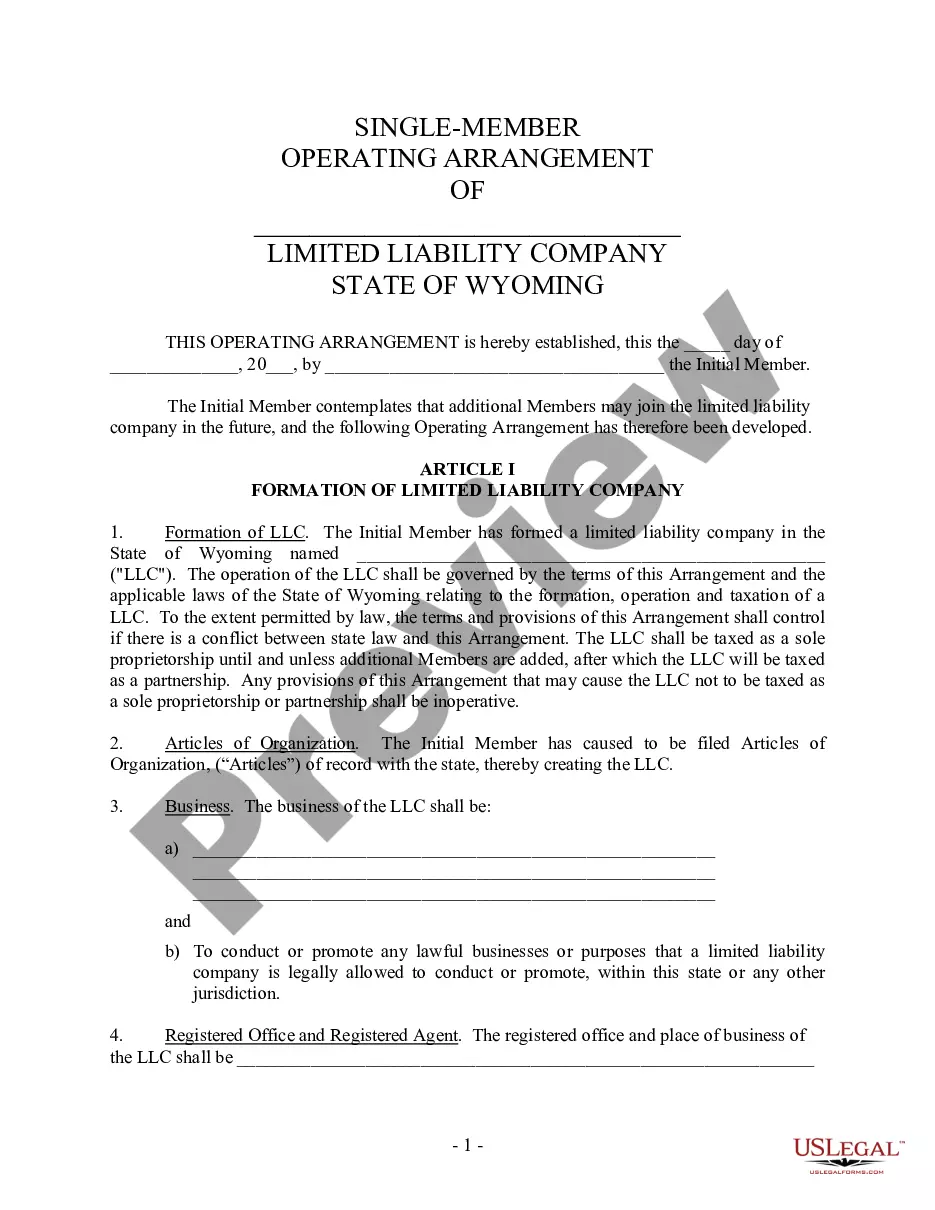

Fortunately, Excel can be used to create an amortization schedule. The amortization schedule template below can be used for a variable number of periods, as well as extra payments and variable interest rates.

Example of Amortization In the first month, $75 of the $664.03 monthly payment goes to interest. The remaining $589.03 goes toward the principal. The total payment stays the same each month, while the portion going to principal increases and the portion going to interest decreases.

Journal entry for depreciation records the reduced value of a tangible asset, such a office building, vehicle, or equipment, to show the use of the asset over time. In a depreciation journal entry, the depreciation account is debited and the fixed asset account is credited.

Record amortization expenses on the income statement under a line item called “depreciation and amortization.” Debit the amortization expense to increase the asset account and reduce revenue. Credit the intangible asset for the value of the expense.

Fortunately, Excel can be used to create an amortization schedule. The amortization schedule template below can be used for a variable number of periods, as well as extra payments and variable interest rates.

Step 1: Download the Excel budget template. The first thing you need to do is to download the budget template. Step 2: Enter your income in your budget template. To enter your income, go to the "Income" sheet. Step 3: Enter your expenses in your budget template. Step 4: Add extra columns to your budget template.