Deed In Trust Vs Deed Of Trust In Virginia

Description

Form popularity

FAQ

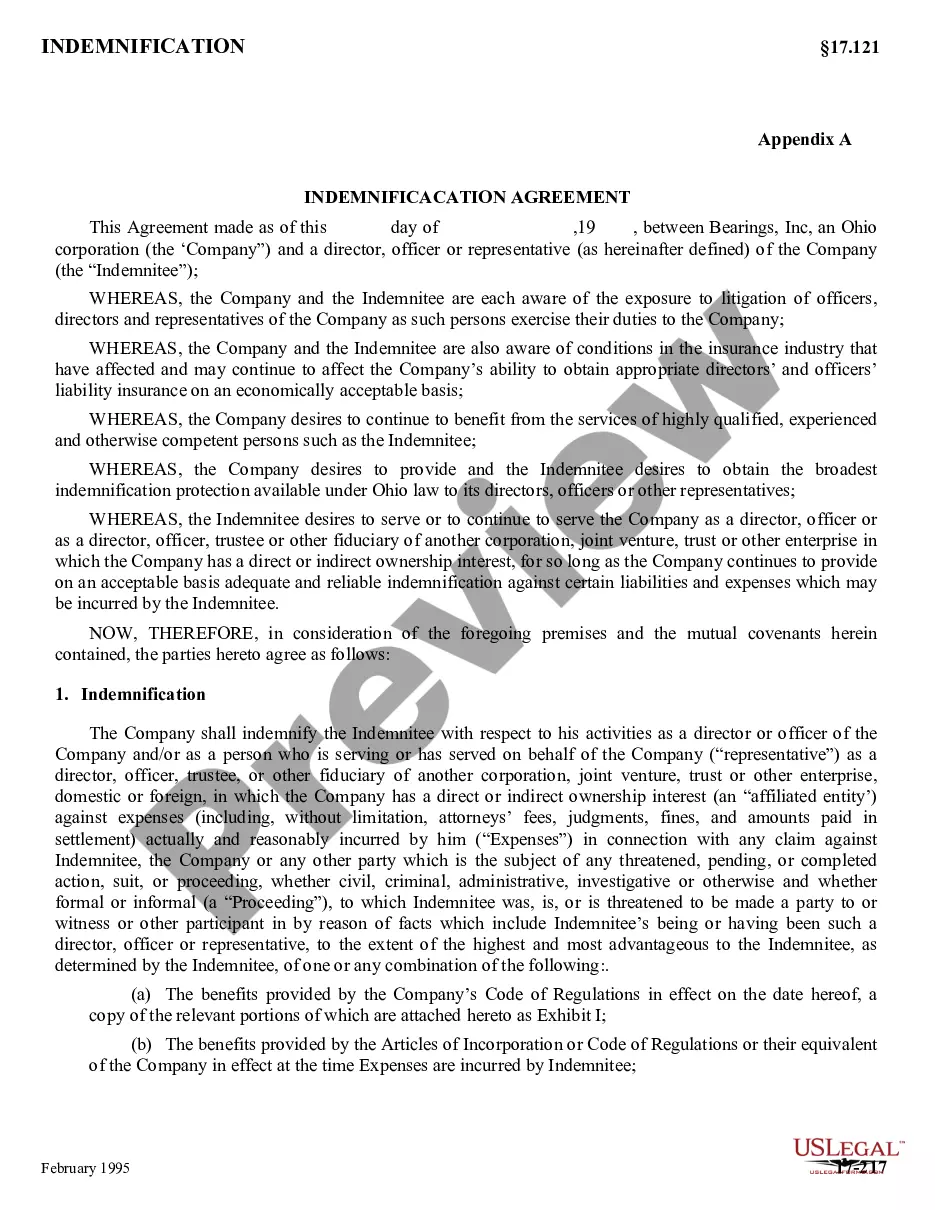

An indemnity deed is a type of agreement, which can be used in lieu of the sale or exchange of property. The deed makes the grantor liable for any damages caused by certain types of accidents on the property. This deed will also protect someone who might buy it from some liability.

What Are the Disadvantages of Putting Your House in a Trust in California? Putting a home, or any real estate, into a trust can be costly. The process can also take time, even with the help of an experienced attorney. If the home is in a trust, it can also make refinancing and changing your mortgage much harder.

Can You Sell a House with a Deed of Trust? Yes, you can sell a home with a Deed of Trust. However, just like a mortgage, if you're selling the home for less than you owe on it, you'll need approval from the lender.

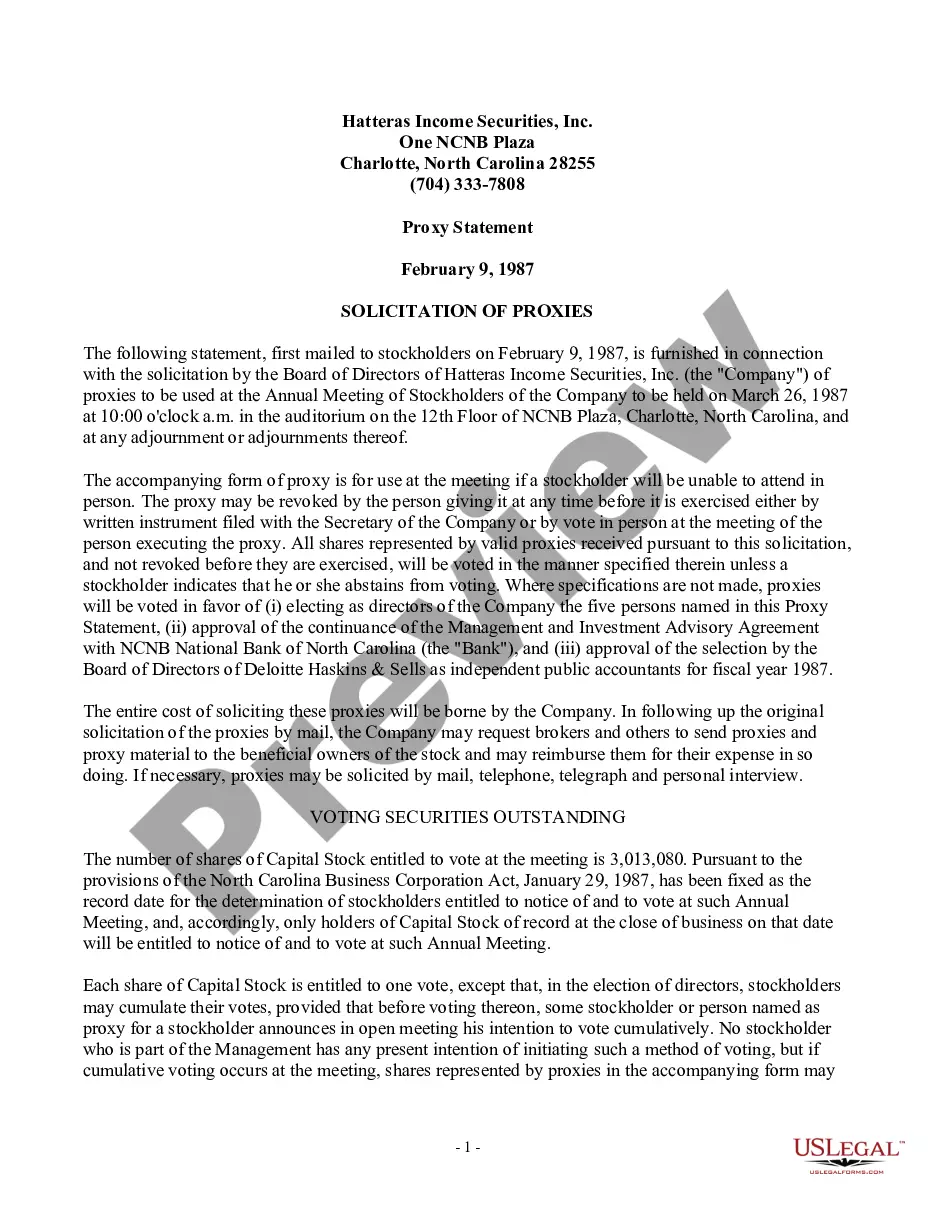

Deeds of trust are the most common instrument used in the financing of real estate purchases in Alaska, Arizona, California, Colorado, the District of Columbia, Idaho, Maryland, Mississippi, Missouri, Montana, Nebraska, Nevada, North Carolina, Oregon, Tennessee, Texas, Utah, Virginia, Washington, and West Virginia, ...

The settlor decides how the assets in a trust should be used – this is usually set out in a document called the 'trust deed'. Sometimes the settlor can also benefit from the assets in a trust – this is called a 'settlor-interested' trust and has special tax rules.

Is California a Mortgage State or a Deed of Trust State? California is a Deed of Trust state.

§ 55.1-320. How deed of trust construed; duties, rights, etc., of parties. Every deed of trust to secure debts or indemnify sureties is in the nature of a contract and shall be construed ing to its terms to the extent not in conflict with the requirements of law.

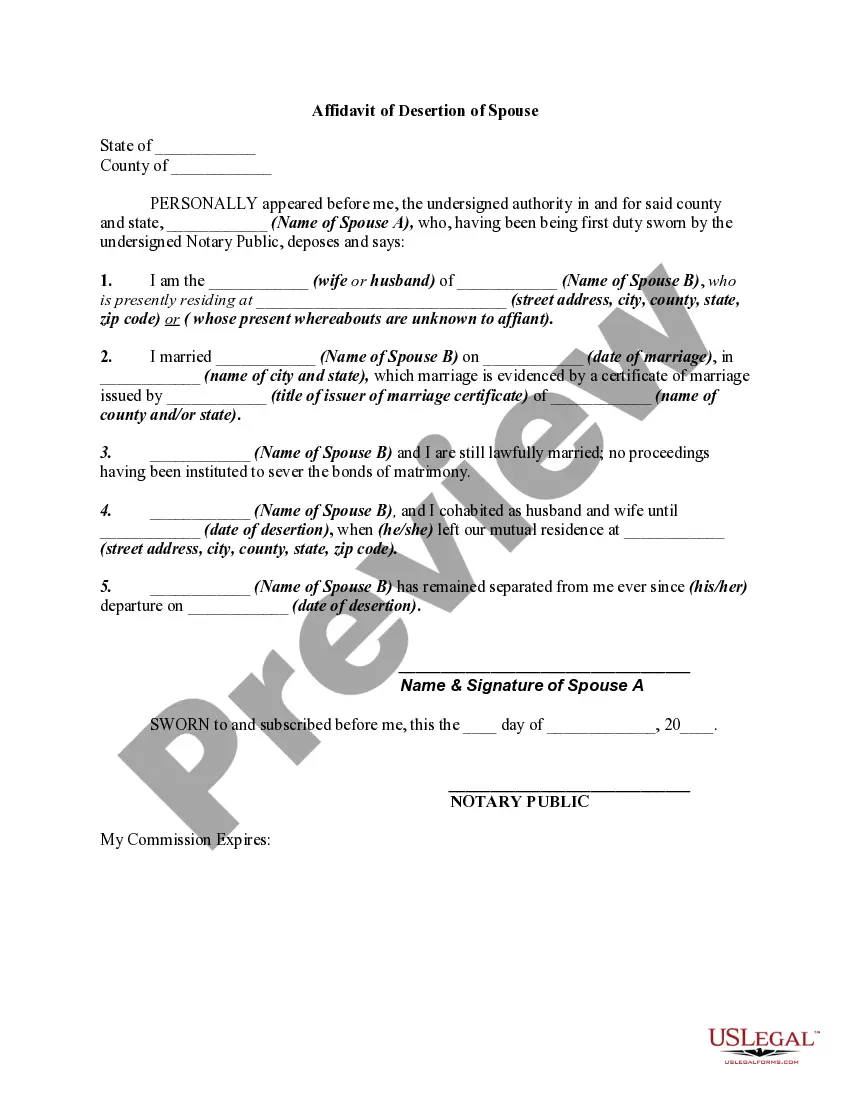

After or accompanying payment in full of the obligation secured by a deed of trust or judgment lien, a settlement agent or title insurance company intending to release a deed of trust or judgment lien pursuant to this subsection shall deliver to the lien creditor by certified mail or commercial overnight delivery ...

In Virginia, only attorneys or property owners can legally prepare a deed. To be legally recognized, a deed has to satisfy several key state-specific requirements: It should be an original or a first-generation printout as per Va.

After or accompanying payment in full of the obligation secured by a deed of trust or judgment lien, a settlement agent or title insurance company intending to release a deed of trust or judgment lien pursuant to this subsection shall deliver to the lien creditor by certified mail or commercial overnight delivery ...