Sba Loan Agreement With Collateral

Description

How to fill out Assumption Agreement Of SBA Loan?

There’s no longer a requirement to spend hours searching for legal documents to meet your local state obligations.

US Legal Forms has compiled all of them in one location and improved their accessibility.

Our platform provides over 85k templates for any business and personal legal situations organized by state and area of applicability.

Use the search bar above to look for another template if the previous one didn’t meet your needs. Click Buy Now beside the template name once you identify the suitable one. Select the most appropriate pricing plan and register for an account or sign in. Make a payment for your subscription with a card or via PayPal to continue. Select the file format for your Sba Loan Agreement With Collateral and download it to your device. Print your document to complete it by hand or upload the sample if you prefer to do it using an online editor. Creating legal documents following federal and state regulations is fast and uncomplicated with our platform. Try out US Legal Forms today to keep your paperwork organized!

- All forms are appropriately drafted and verified for accuracy, ensuring you can trust in acquiring an up-to-date Sba Loan Agreement With Collateral.

- If you are acquainted with our service and already possess an account, ensure your subscription is active before obtaining any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all saved paperwork whenever necessary by accessing the My documents tab in your profile.

- If you have never utilized our service before, the procedure will require a few additional steps to finish.

- Here’s how new users can acquire the Sba Loan Agreement With Collateral from our library.

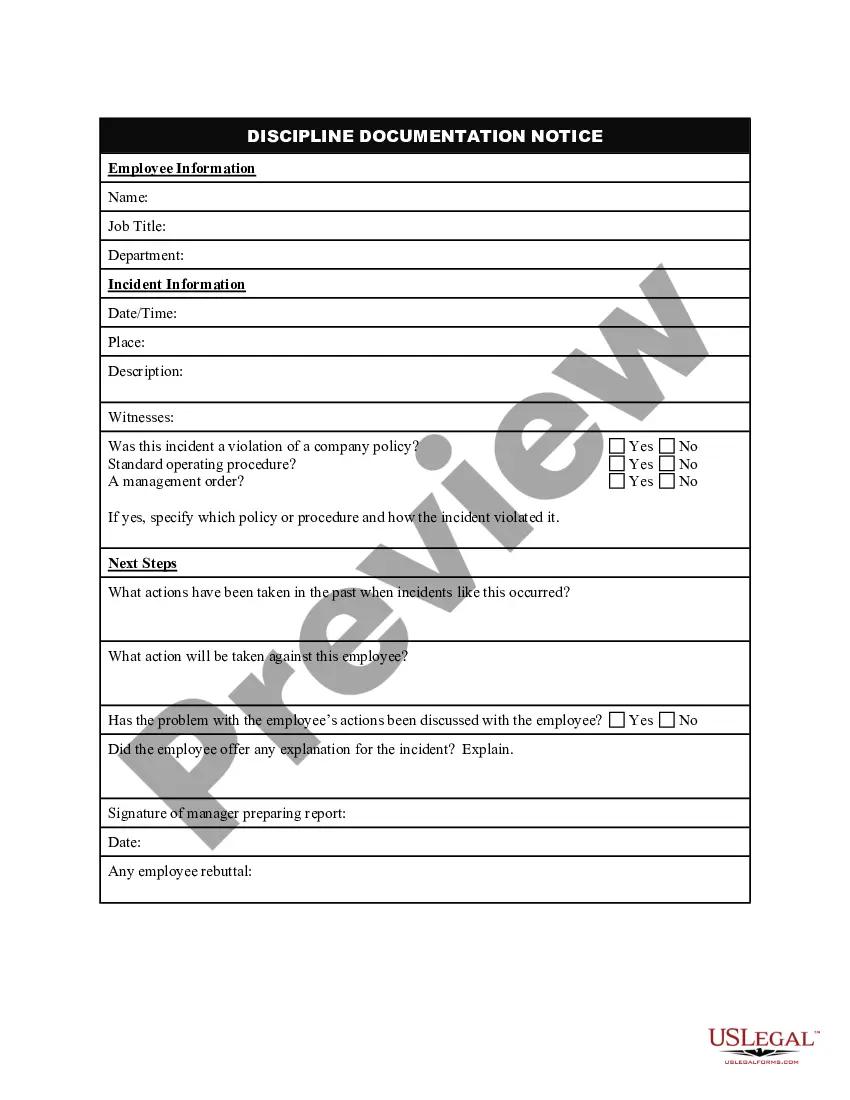

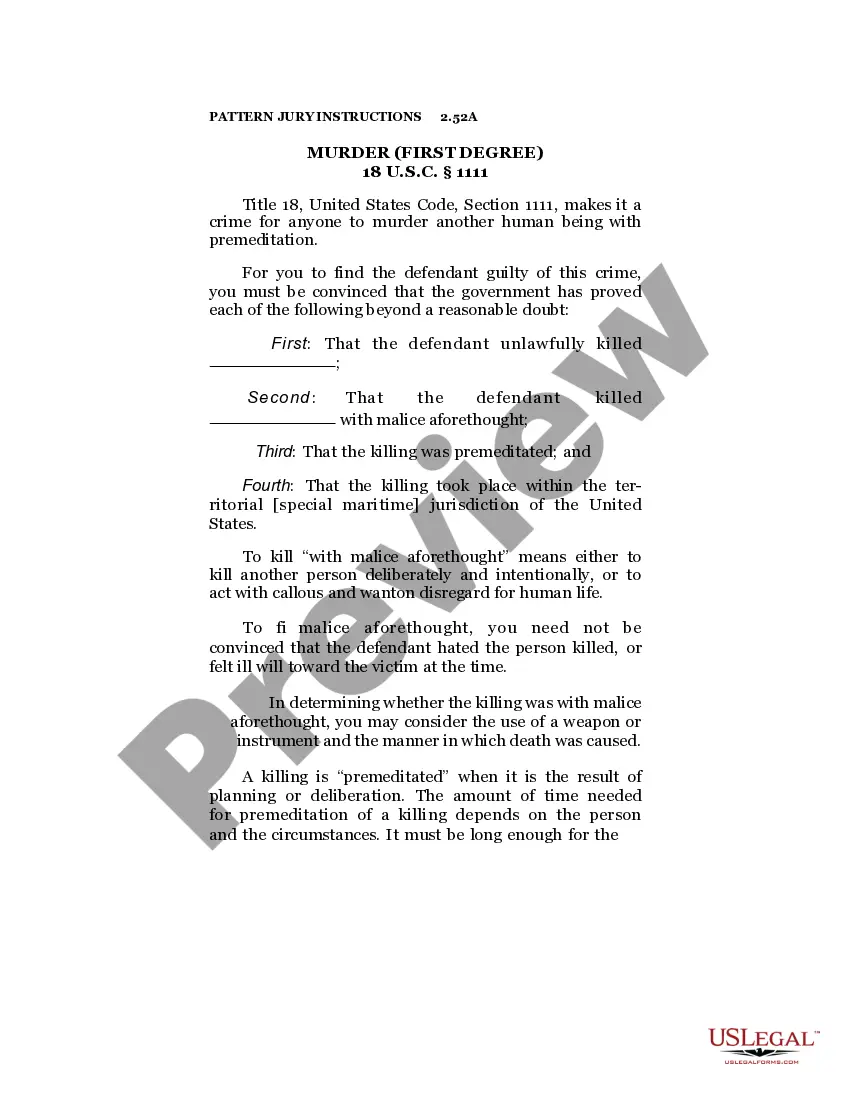

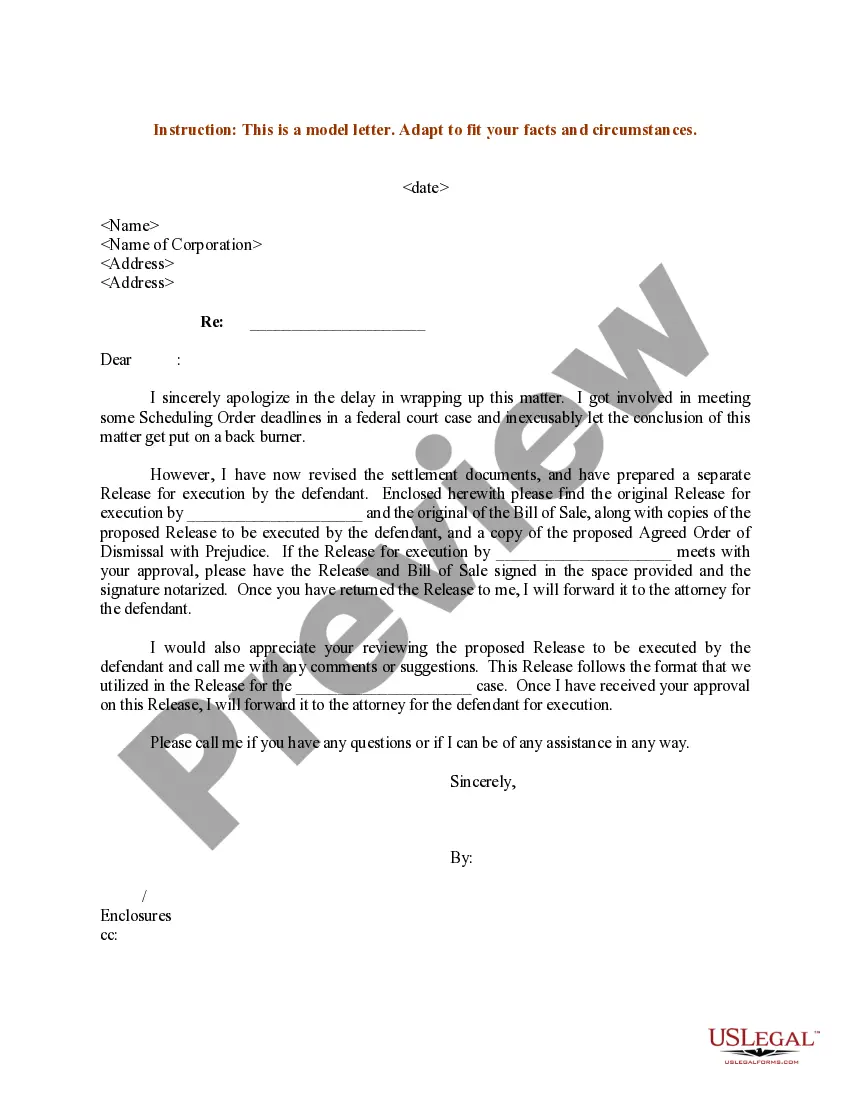

- Carefully review the page content to ensure it contains the example you require.

- To do this, use the form description and preview options if available.

Form popularity

FAQ

Accounts receivable and inventory may be pledged as collateral. Collateral may also include personal assets and commonly, a second mortgage on a home. Before approaching a lender, you should assume that all assets financed with borrowed funds will be used as collateral for the loan.

Lenders are not required to take collateral for loans up to $25,000. For loans in excess of $350,000, the SBA requires that the lender collateralize the loan to the maximum extent possible up to the loan amount.

Our platform generates unique escrow for it. Borrower deposits Bitcoin as collateral in the escrow directly from his wallet. Lender transfers loan amount to the Borrower according to the Contract. When the loan is repaid, Lender releases Bitcoin back to Borrower's wallet.

What are the collateral requirements? Economic Injury Disaster Loans over $25,000 require collateral. SBA takes real estate as collateral when it is available. SBA will not decline a loan for lack of collateral, but requires borrowers to pledge what is available.

When you apply for an SBA loan, you will be subject to an ABA (All Business Assets) lien, or blanket lien. Essentially, this means everything your business owns is collateral required for your SBA loan. Your primary collateral is usually assets purchased through the SBA loan.