Sba Loan Guarantee Agreement Form 750 In Queens

Description

Form popularity

FAQ

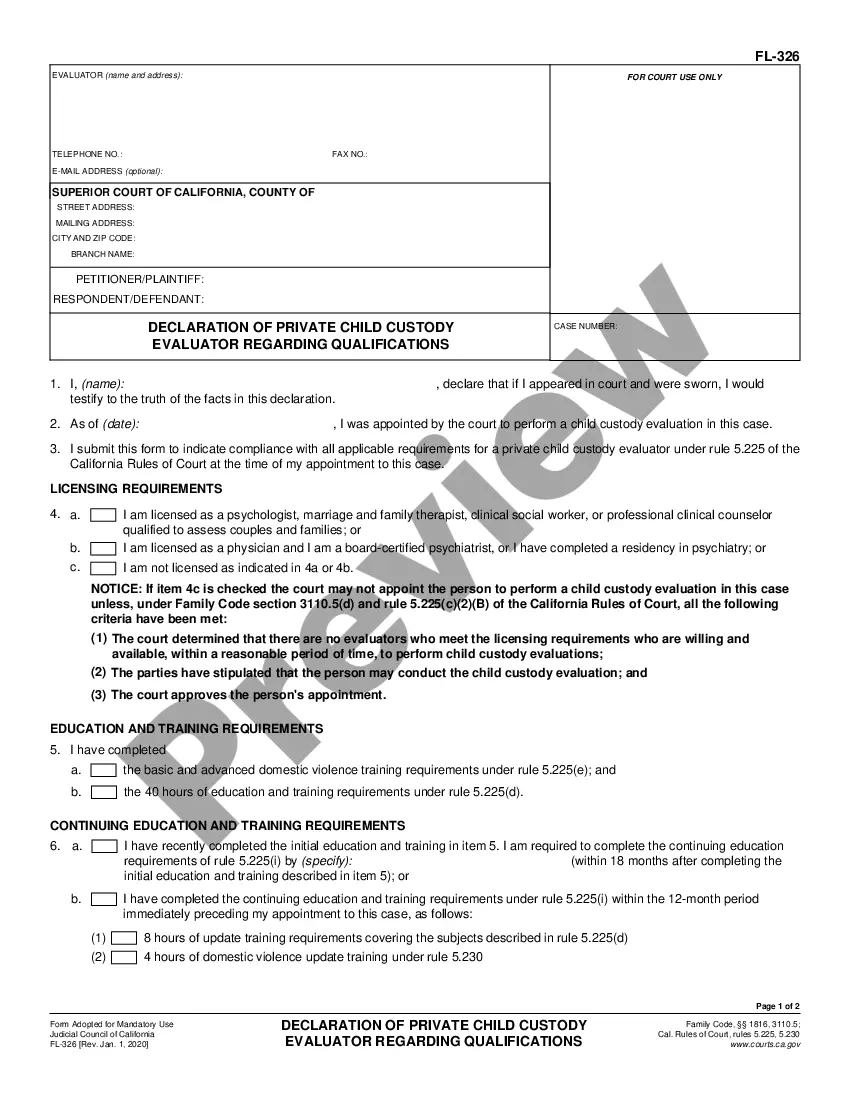

All loans insured by the SBA require a personal guarantee from every owner with a 20 percent or greater equity stake in the business.

If a business hasn't been in business for five years, multiply its average weekly revenue by 52 to determine its average annual receipts. SBA calculates annual receipts in ance with 13 CFR 121.104.

Pursuant to 13 CFR § 120.160(a), all SBA 7(a) loans must be guaranteed by at least one person or entity. Generally, guarantees are required of any individual or entity who owns 20% or more of a borrower entity.

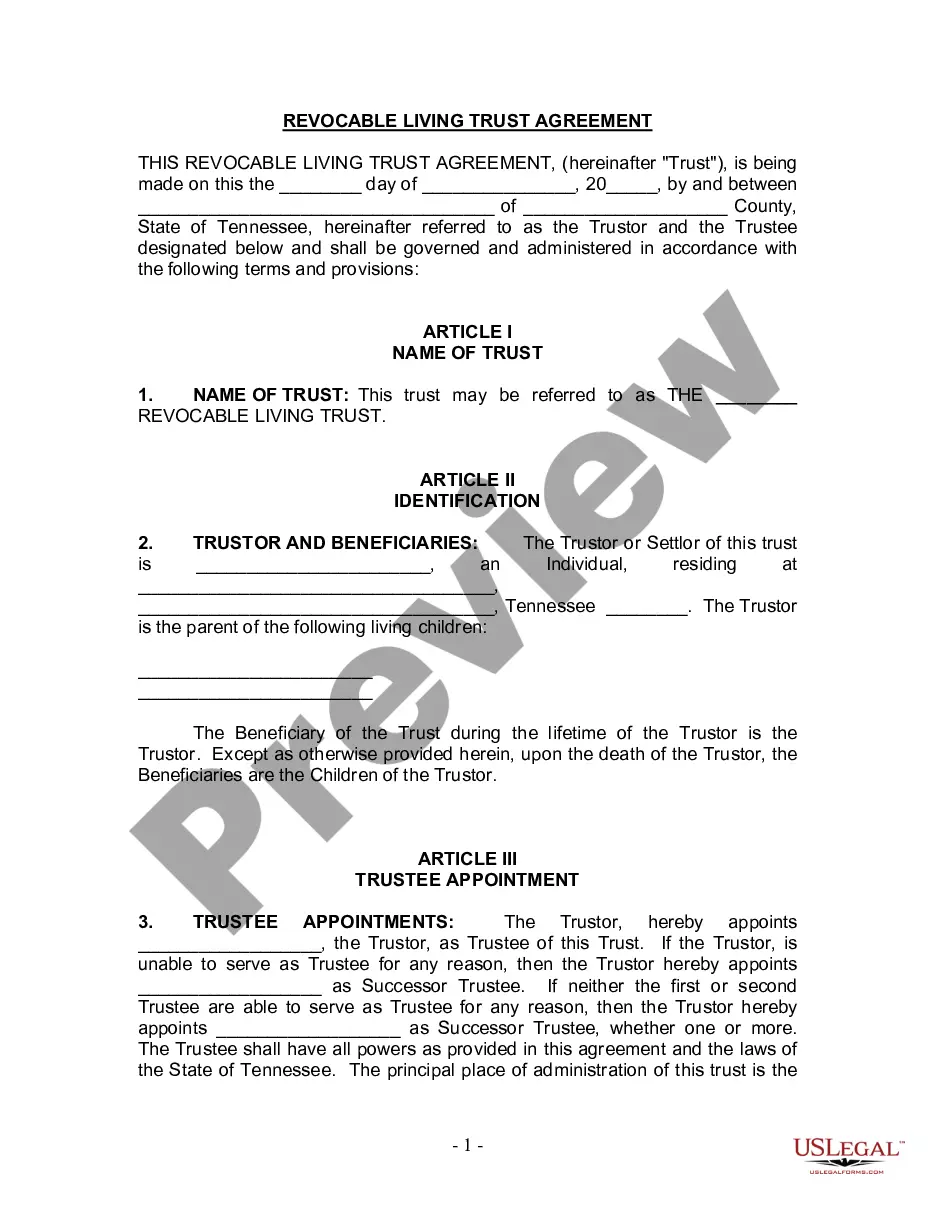

The ConsensusDocs' 750 Constructor and Subcontractor Agreement provides a standard agreement between a constructor and subcontractor, with the general terms and conditions and the construction agreement terms conveniently integrated into one document.

Individuals who own 20% or more of a small business applicant must provide an unlimited personal guaranty. SBA Lenders may use this form.

The inflation adjustment increases the size standard's level for tangible net worth to $20 million and for net income to $6.5 million. SBA is also adopting, as proposed, the inflation-adjusted thresholds applicable to the statutory ( print page 11707) limits for contract size under the SBG Program.

School Based Assessment (SBA)

The Stand-by Arrangement (SBA) provides short-term financial assistance to countries facing balance of payments problems. Historically, it has been the IMF lending instrument most used by advanced and emerging market countries.