Sba Eidl Loan Rules In Kings

Category:

State:

Multi-State

County:

Kings

Control #:

US-00193

Format:

Word;

Rich Text

Instant download

Description

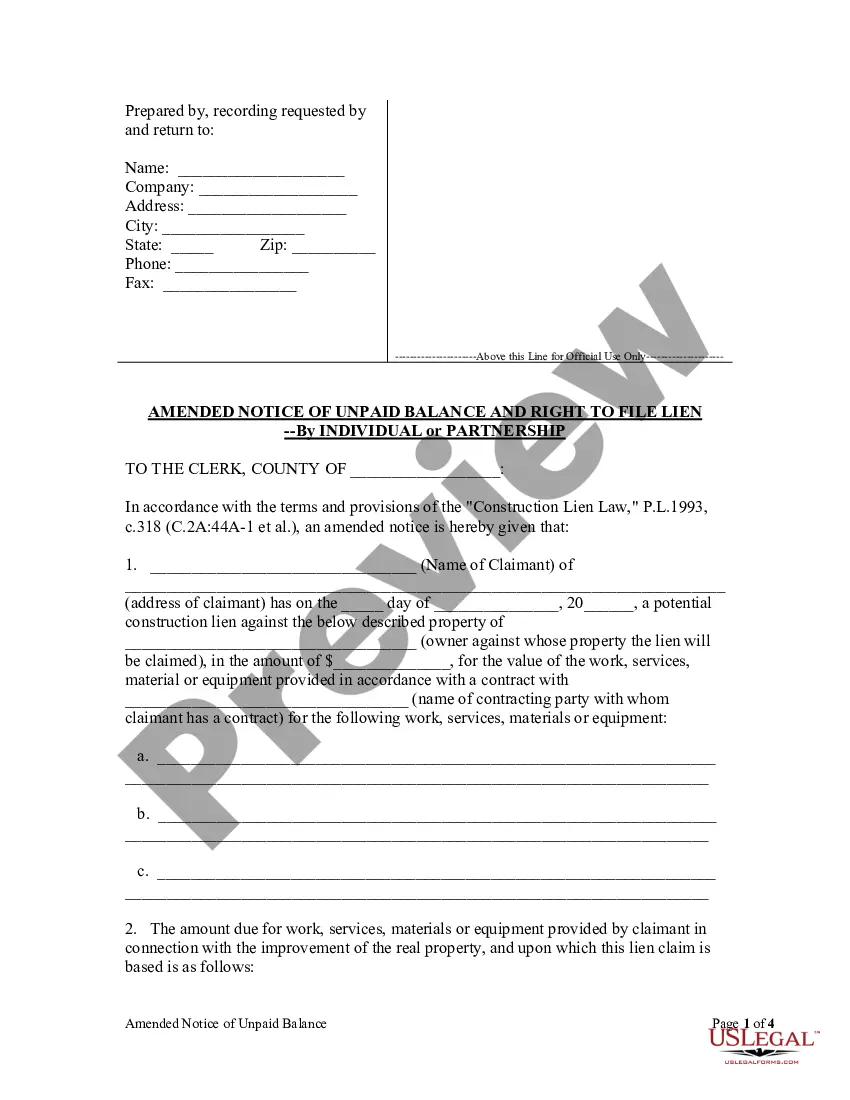

The document is an Assumption Agreement pertaining to the Sba eidl loan rules in Kings, which allows one party (Assumptor) to assume the financial obligations of another (Borrower) under a loan agreement governed by the Small Business Administration. This agreement outlines the original indebtedness, secured by a Deed of Trust, and details the conditions under which SBA permits the Assumptor to take over the financial responsibilities. Key features include the requirement for the Assumptor to adhere to the existing loan terms, a clear acknowledgment that Borrower remains responsible for the obligations, and stipulations regarding the sale or further encumbrance of the property without SBA consent. Filling instructions emphasize the need for clear identification of all parties, precise amounts, and proper notarization. Attorneys, partners, owners, associates, paralegals, and legal assistants will find this form useful for ensuring compliance with SBA regulations, facilitating property transactions, and managing client obligations under existing loans. It is essential that the form be completed accurately to avoid future liabilities or misunderstandings. Its use is particularly relevant for businesses seeking to navigate financial responsibilities and real estate transactions involving government-backed loans.

Free preview

Form popularity

FAQ

As of January 2025, there are no plans to forgive outstanding SBA EIDL loans. There are a variety of challenges involved with widespread forgiveness.

When seeking a lien release, borrowers should approach the SBA with a well-prepared case that highlights the equity in their assets and the potential for a fair settlement. It is essential to gather documentation and evidence that supports your position and demonstrate your willingness to resolve the debt.

As of January 2025, there are no plans to forgive outstanding SBA EIDL loans.

As of January 2025, there are no plans to forgive outstanding SBA EIDL loans.