Time Extension Format In Nevada

Description

Form popularity

FAQ

Good news! Nevada does not have a personal income tax, so that's one tax return you won't need to file. Just use 1040 to file your federal return, and any returns you need to file for states that do have an income tax.

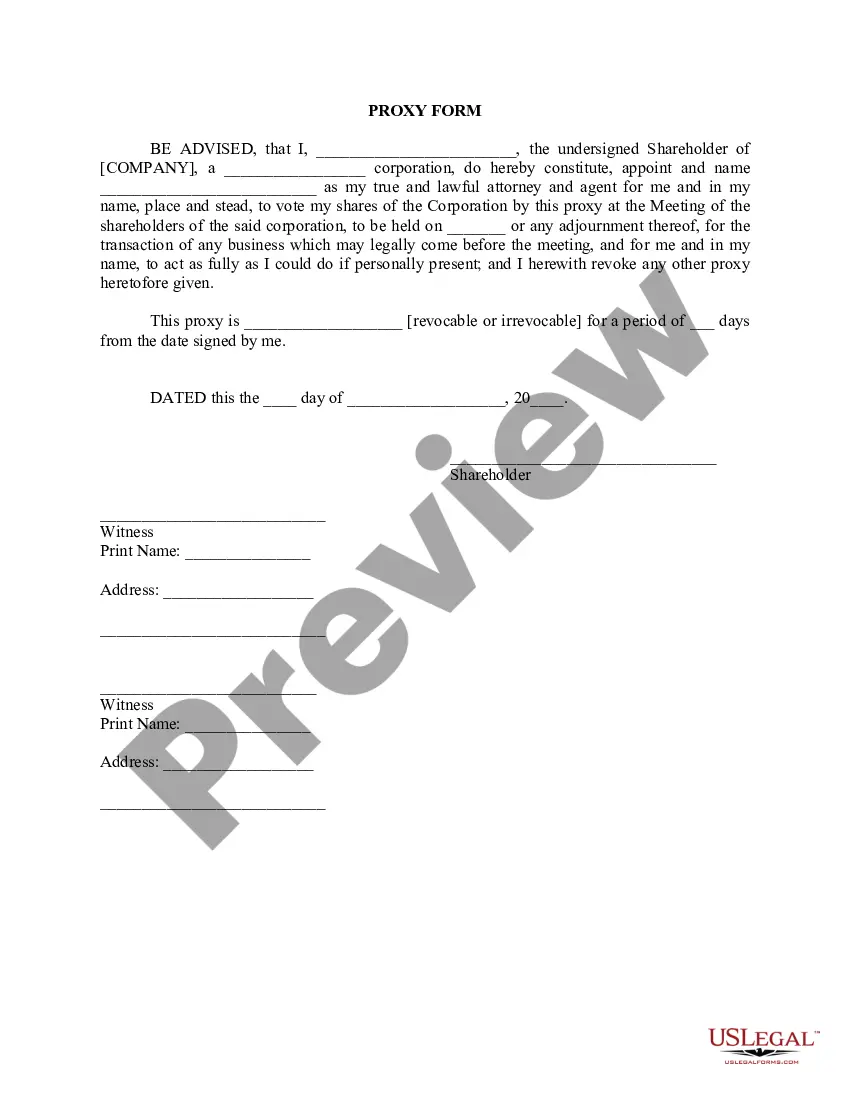

The power of attorney must be in writing and contain your signature to be effective. It may also – but need not be – notarized. The document may alternatively be witnessed by two adult witnesses who personally know you.

If you want to authorize an individual to represent you, use Form 2848, Power of Attorney and Declaration of Representative which can be found on the IRS website.

To close your Modified Business Tax (MBT), you must also contact the Employment Security Division (ESD) at (775) 684-6300 and provide the date of your last payroll to close your Unemployment Insurance (UI) account. Once your UI account is closed with ESD, your MBT account will be closed with the Department.

The State of Nevada does not impose an individual income tax so there is no need to request a state tax extension for filing a personal tax return. If you received email confirmation from TaxExtension that your Federal tax extension was approved by the IRS, there is nothing else you have to do.

You can use Form 2848, Power of Attorney and Declaration of Representative for this purpose. Your signature on the Form 2848 allows the individual or individuals named to represent you before the IRS and to receive your tax information for the matter(s) and tax year(s)/period(s) specified on the Form 2848.

Use Form 2848 to authorize an individual to represent you before the IRS. The individual you authorize must be a person eligible to practice before the IRS.

Nevada's Commerce Tax is applied to businesses operating within the state whose gross revenue in a fiscal year exceeds $4,000,000. It applies to revenue generated in Nevada and varies by industry, with different tax rates for sectors such as retail, manufacturing, and services.

The State of Nevada does not impose an individual income tax so there is no need to request a state tax extension for filing a personal tax return. If you received email confirmation from TaxExtension that your Federal tax extension was approved by the IRS, there is nothing else you have to do.

Extensions - To receive an automatic extension until October 15, file Form 204, Application for Filing Extension. Arizona will also accept the federal extension for the period covered by the federal extension. When filing the Arizona return, check box 82F, top of page 1, to indicate an extension was filed.