Time Extension In Malay In Bronx

Description

Form popularity

FAQ

1. The filing of this application on or before the due date automatically provides an extension of six months after such due date for the filing of your completed tax return, provided the tax is properly estimated and the application is accompanied by a remittance for the amount shown on line 6.

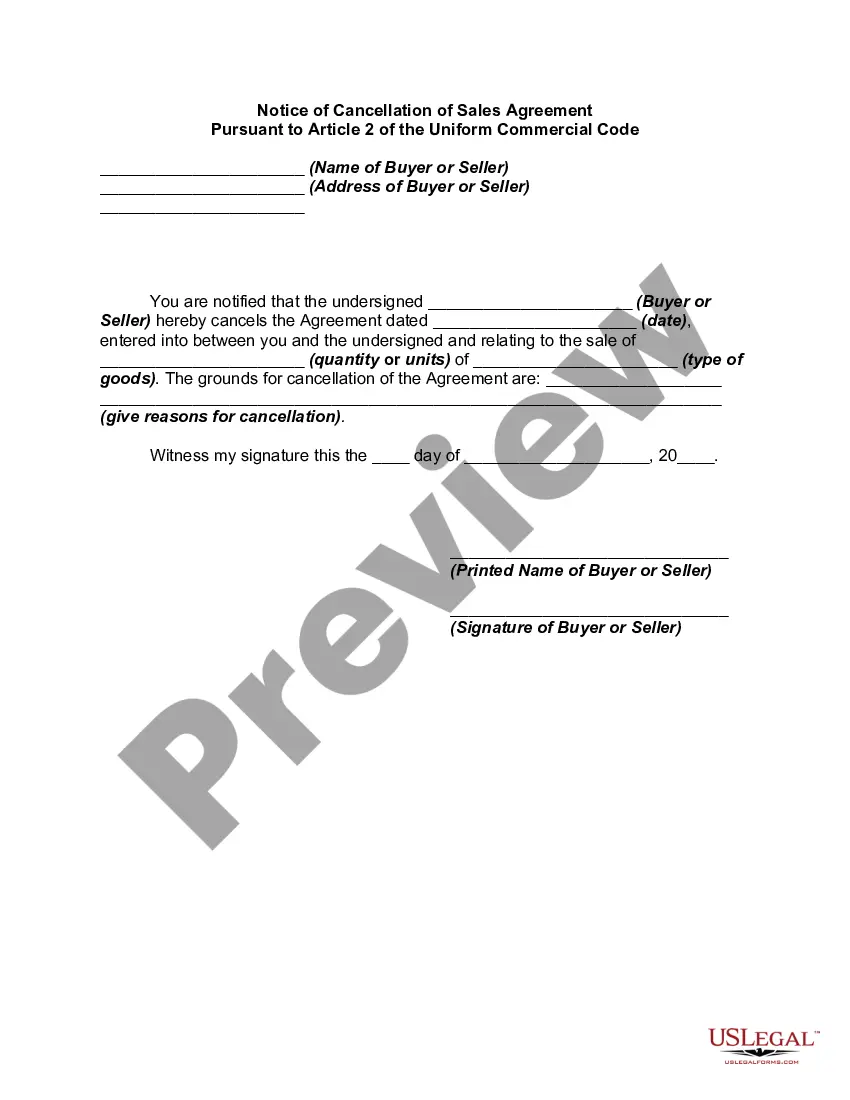

This often requires the claiming party to give a particular notice, sometimes followed by a further notice and/or more detailed information, to the other party and/or contract administrator, which may have to be in a particular format and meet specific requirements as to content.

Extended Deadline with New York Tax Extension: New York State offers a 6-month extension, which moves the individual filing deadline from April 15 to October 15 (for calendar year filers). New York Tax Extension Form: To apply for a New York extension, file Form IT-370 by the original due date of your return.

Check your DRIE status. Call 311 or 212-NEW-YORK (212-639-9675) if you need more help.

For a one-year lease beginning on or after October 1, 2024, and on or before September 30, 2025: 2.75% For a two-year lease beginning on or after October 1, 2024, and on or before September 30, 2025: 5.25%

The only way to know if your apartment is rent stabilized is to contact NYS Homes and Community Renewal (HCR), the state agency which administers the rent laws. You can use the Ask HCR web portal to find out if your apartment is rent stabilized.