Receipt Donation Form Sample For Charitable Trust India In Travis

Description

Form popularity

FAQ

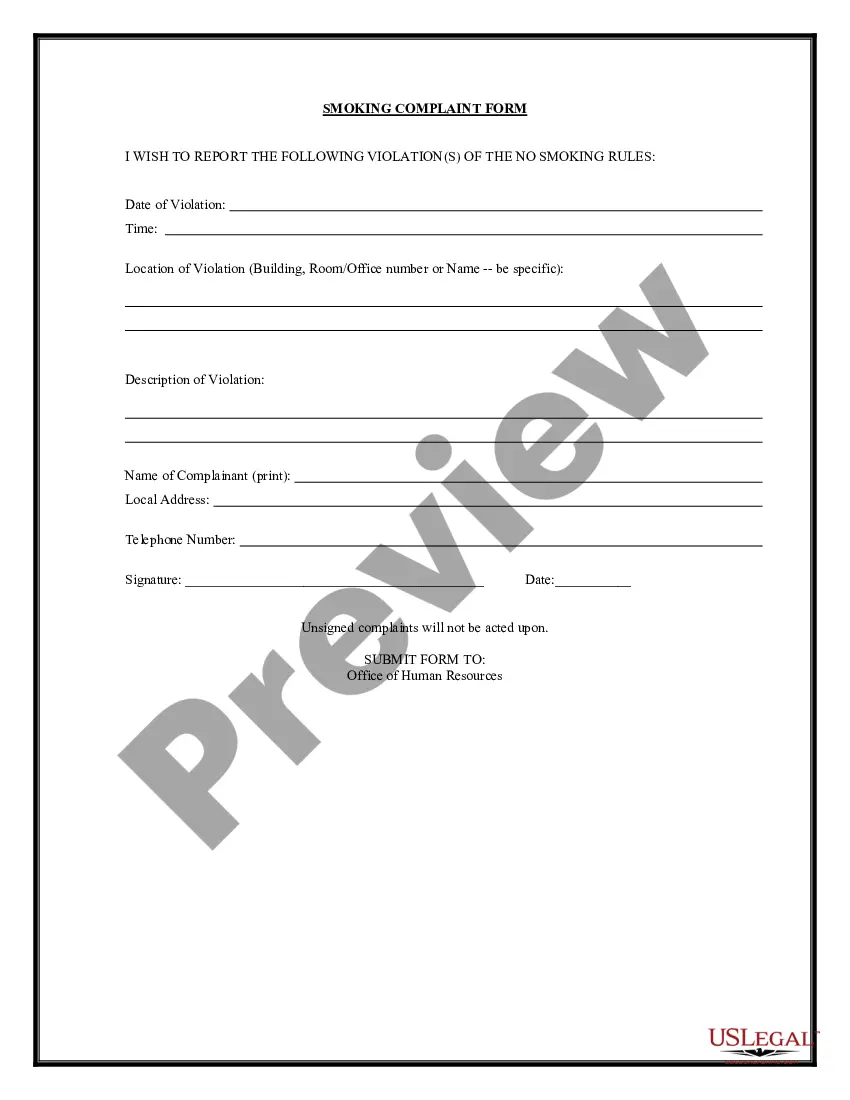

A donor can deduct a charitable contribution of $250 or more only if the donor has a written acknowledgment from the charitable organization. The donor must get the acknowledgement by the earlier of: The date the donor files the original return for the year the contribution is made, or.

How do you write a fundraising letter? Key steps Start with a personalized greeting. Explain your mission. Describe your current initiative. Outline your project's needs and what you hope to accomplish. Add meaningful photographs or infographics. Show the tangible impact associated with specific donation amounts.

If you want to take a charitable contribution deduction on your income-tax return, you need to substantiate your gifts. You must have the charity's written acknowledgment for any charitable deduction of $250 or more. A canceled check is not enough to support your deduction.

You can qualify for taking the charitable donation deduction without a receipt; however, you should provide a bank record (like a bank statement, credit card statement, or canceled check) or a payroll deduction record to claim the tax deduction.

Five tips for writing a donation thank you letter Being prompt can lead to more donations. Be sincere and you will inspire people to give. Show your supporters how their donations will be used. Add a personalized touch. Reread your letter.

Sincere gratitude: Start by expressing your heartfelt appreciation for their generosity. Make it personal and genuine. Impact statement: Clearly explain how their donation has made a difference. For example, ``Your contribution has helped us provide meals for 100 families in need this month.''

How do you write a fundraising letter? Key steps Start with a personalized greeting. Explain your mission. Describe your current initiative. Outline your project's needs and what you hope to accomplish. Add meaningful photographs or infographics. Show the tangible impact associated with specific donation amounts.

We recommend sending either a donation acknowledgment letter or a donation thank you letter every time a donor gives. This lets you express gratitude for donors' support, share your progress and future goals, and ensure they know you received their gift.

Not only can you deduct the fair market value of what you give from your income taxes, you can also minimize capital gains tax of up to 20 percent.

Charitable contributions are entered on Schedule A (Form 1040) Itemized Deductions, Lines 11-12.