Donation Receipt Format For Income Tax Purposes In Travis

Description

Form popularity

FAQ

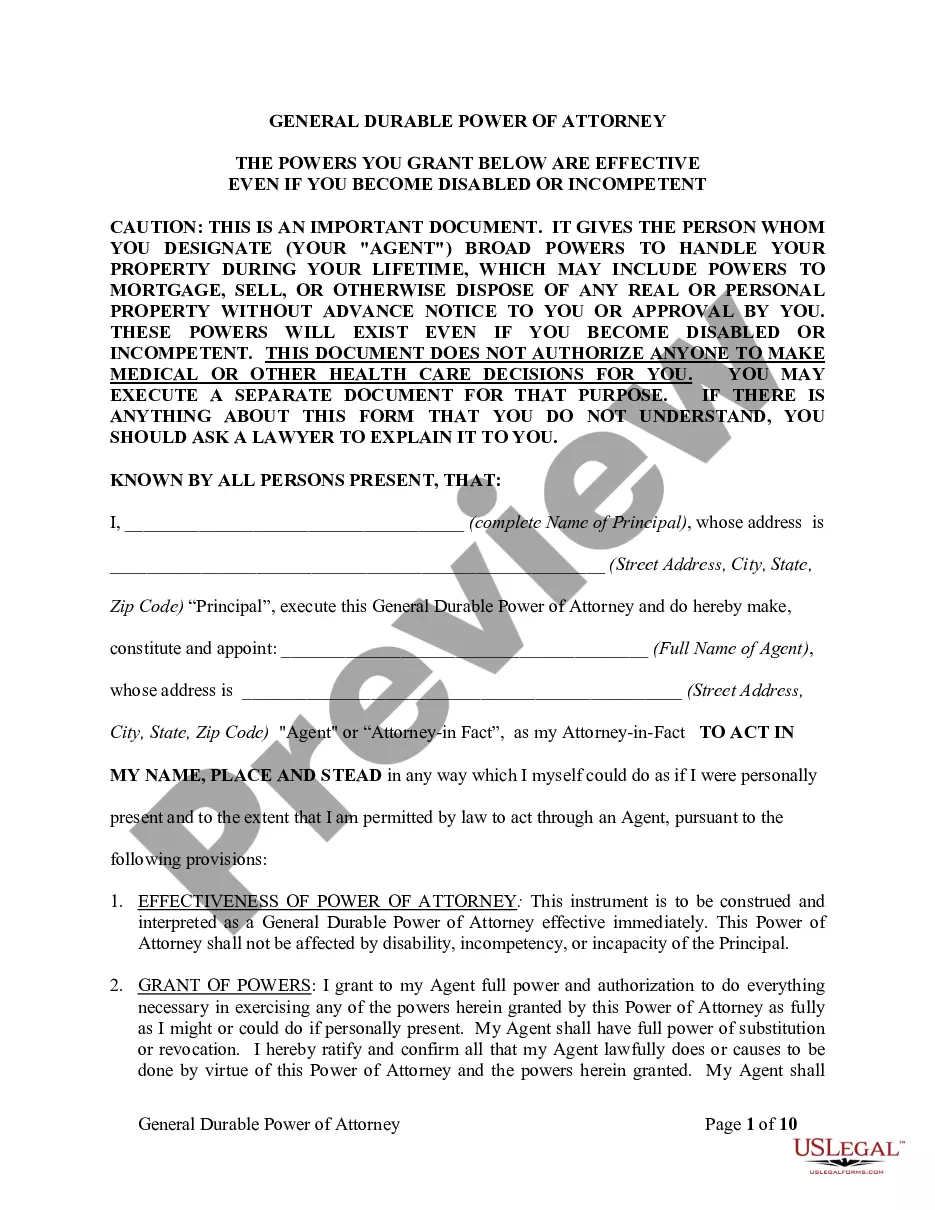

Proof can be provided in the form of an official receipt or invoice from the receiving qualified charitable organization, but it can also be provided via credit card statements or other financial records detailing the donation.

Although experts advise not to make your decision to donate to a cause based on your ability to get a tax deduction, there are benefits to charitable donations. “One of the key benefits of charitable deductions is that they can help you reduce taxable income.

Proof can be provided in the form of an official receipt or invoice from the receiving qualified charitable organization, but it can also be provided via credit card statements or other financial records detailing the donation.

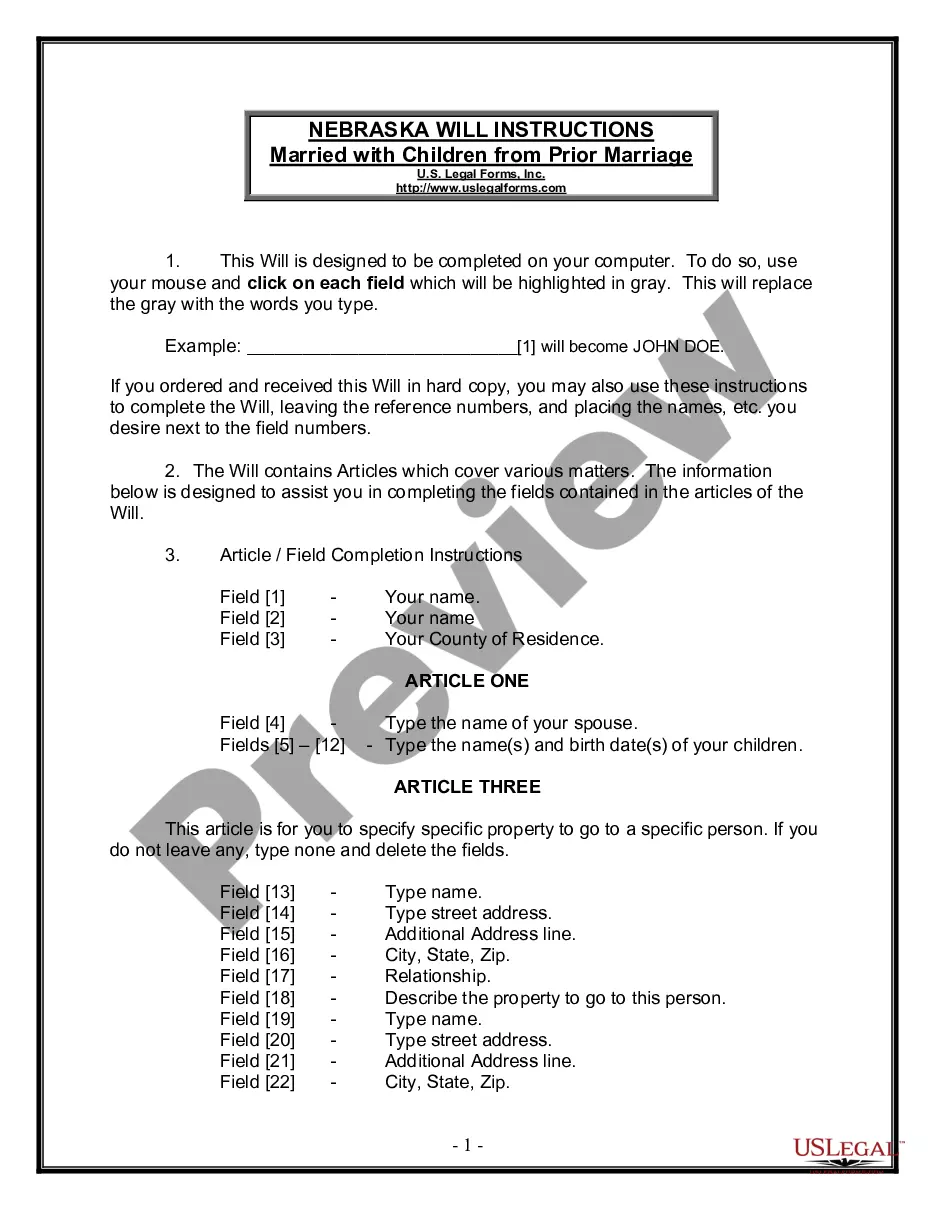

Ing to the IRS, donation tax receipts should include the following information: The name of the organization. A statement confirming that the organization is a registered 501(c)(3) organization, along with its federal tax identification number. The date the donation was made.

However, no matter the form, every receipt must include six items to meet the standards set forth by the IRS. Name of the Charity and Name of the Donor. Date of the Contribution. Detailed Description of the Property Donated. Amount of the Contribution.

You can qualify for taking the charitable donation deduction without a receipt; however, you should provide a bank record (like a bank statement, credit card statement, or canceled check) or a payroll deduction record to claim the tax deduction.

Consider different mediums for the acknowledgment: postcards, notecards, emails, videos, or phone calls. Include a photo or other small component with the message that would be meaningful to the donor.

Here are a few effective methods: Verbal Acknowledgment. Sometimes, a simple spoken acknowledgment carries the most weight. Written Acknowledgment. Written acknowledgment works just as well, especially for contributions that might otherwise go unnoticed. Tangible s. Digital Badges and Signifiers.

How do you write a fundraising letter? Key steps Start with a personalized greeting. Explain your mission. Describe your current initiative. Outline your project's needs and what you hope to accomplish. Add meaningful photographs or infographics. Show the tangible impact associated with specific donation amounts.

If a DGR issues a receipt for a deductible gift, the receipt must state: the name of the fund, authority or institution to which the donation has been made. the DGR's Australian business number (ABN) (some DGRs listed by name in the law may not have an ABN) that it is for a gift.