Donation Receipt For Goods In Tarrant

Description

Form popularity

FAQ

You must have the charity's written acknowledgment for any charitable deduction of $250 or more. A canceled check is not enough to support your deduction.

You can take a deduction for a contribution of an item of clothing or a household item that isn't in good used condition or better if you deduct more than $500 for it and include a qualified appraisal of it with your return.

How much can you deduct for the gently used goods you donate to Goodwill? The IRS allows you to deduct fair market value for gently-used items. The quality of the item when new and its age must be considered. The IRS requires an item to be in good condition or better to take a deduction.

You can qualify for taking the charitable donation deduction without a receipt; however, you should provide a bank record (like a bank statement, credit card statement, or canceled check) or a payroll deduction record to claim the tax deduction.

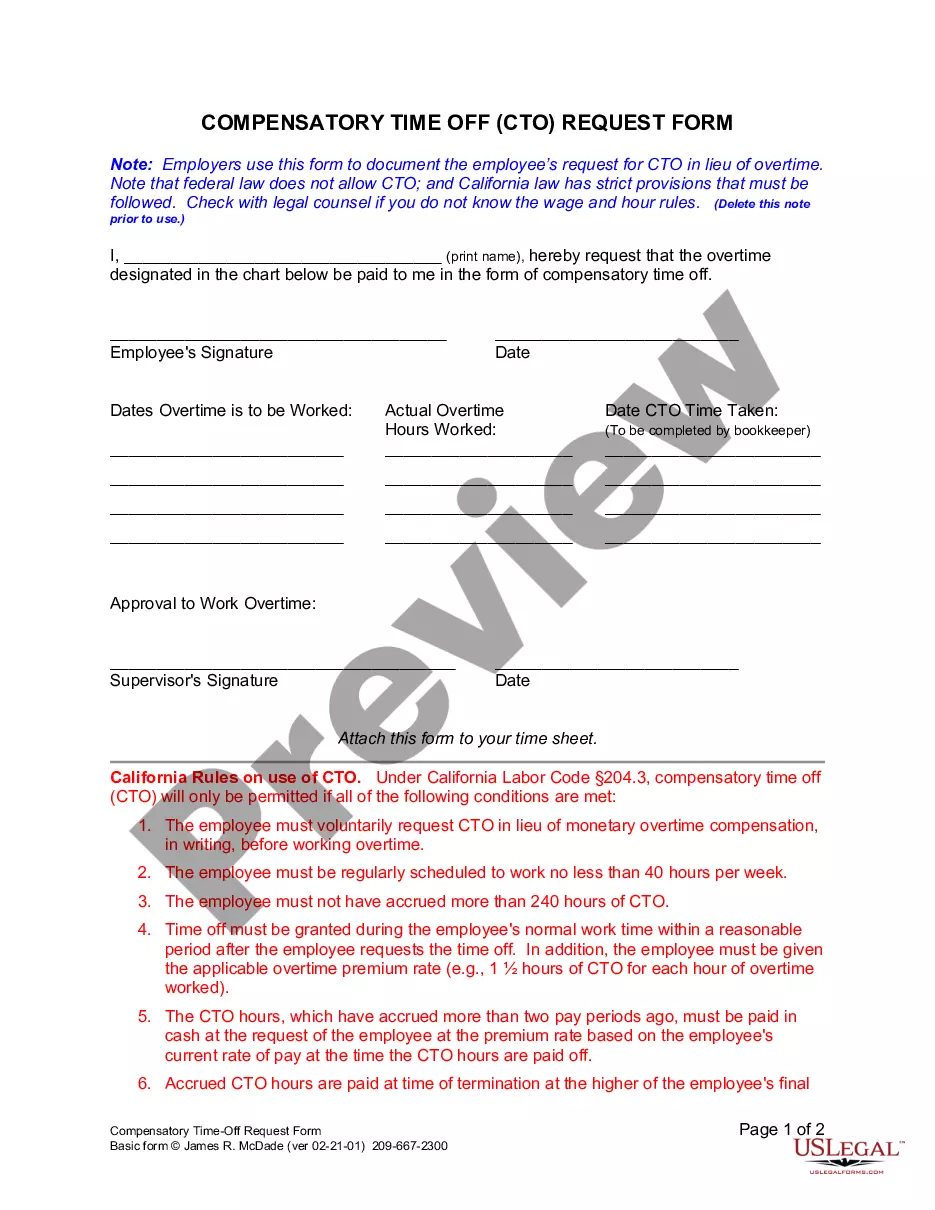

Keep Donation Records: Maintain records of all contributions, including bank statements, receipts, and checks. 2. Document Donations: For donations over $250, get a written acknowledgment from the charity. For noncash donations over $500, complete Form 8283 and include an appraisal for items valued over $5,000.

Open your TurboTax software. Under Federal Taxes, select Deductions & Credits. When asked, How do you want to enter your deductions and credits?, select I'll choose what I work on. Scroll down to Charitable Donations and click the Visit All button.

Ing to the IRS, any kind of donation above $250 should require a donation receipt. The same applies to stock gifts/donations.

How do you write a fundraising letter? Key steps Start with a personalized greeting. Explain your mission. Describe your current initiative. Outline your project's needs and what you hope to accomplish. Add meaningful photographs or infographics. Show the tangible impact associated with specific donation amounts.

Example 2: Individual Acknowledgment Letter Hi donor name, We're super grateful for your contribution of $250 to nonprofit's name on date received. As a thank you, we sent you a T-shirt with an estimated fair market value of $25 in exchange for your contribution.