Printable Donation Receipt With Tracking Number In Minnesota

Description

Form popularity

FAQ

Use the IRS Tax Exempt Organization Search tool to find or verify qualified charities. Donations to these real charities may be tax deductible. Research a charity before sending a donation to confirm that the charity is real and to know whether the donation is tax deductible.

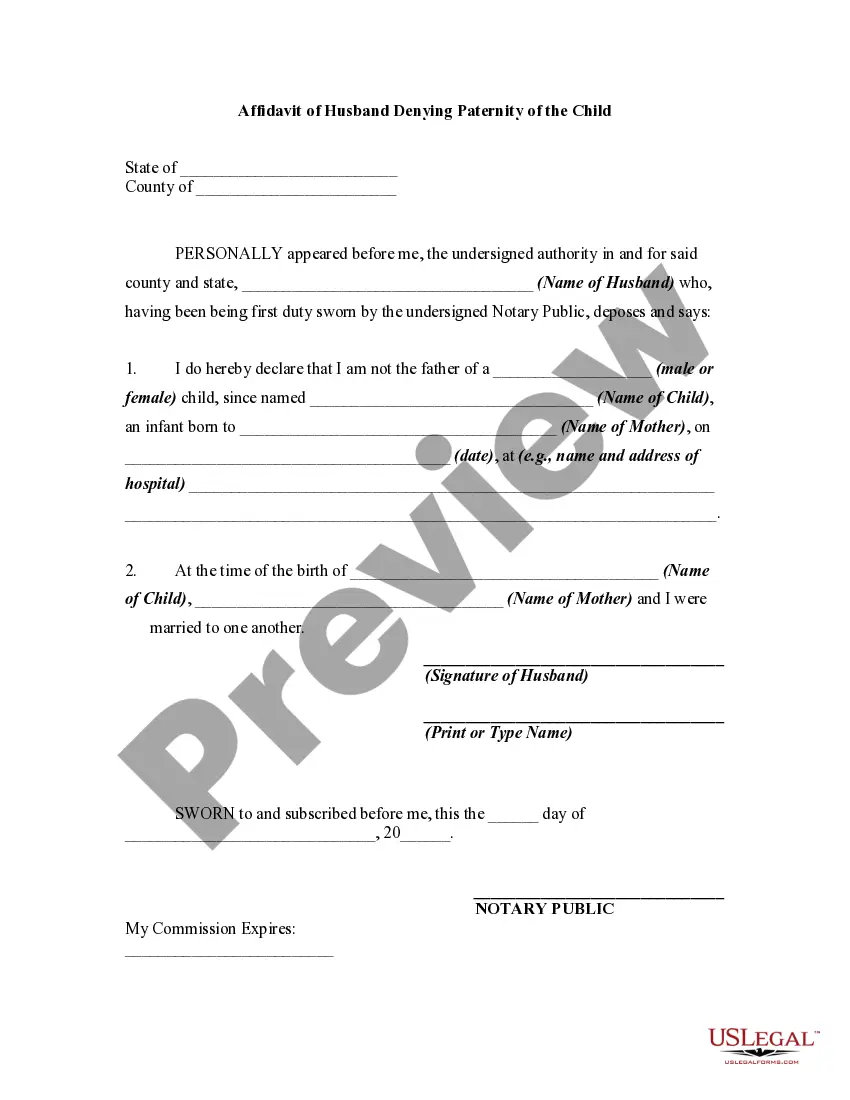

In general, a well put together donation receipt should include the nonprofit organization's basic information such as name, the donation date, the donation amount, and a statement indicating that the organization is indeed an official nonprofit with their corresponding nonprofit ID nonprofit listed.

Substantiation. If you want to take a charitable contribution deduction on your income-tax return, you need to substantiate your gifts. You must have the charity's written acknowledgment for any charitable deduction of $250 or more. A canceled check is not enough to support your deduction.

How to Reissue a Donation Receipt Open the Donation Record: Navigate to the donation record for which you need to reissue the receipt. Edit Personal Information. Modify the First Name. Restore the First Name. Download the Reissued Receipt:

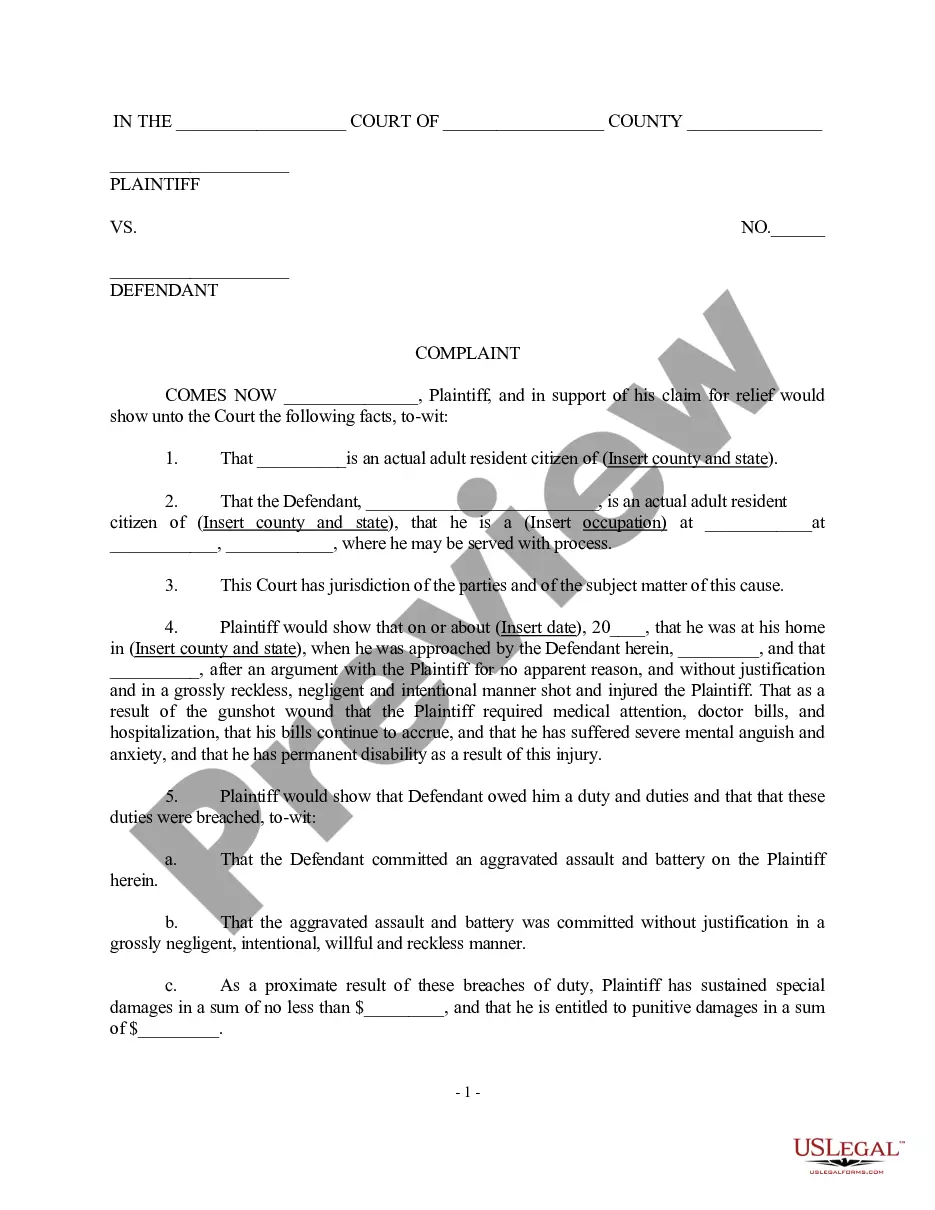

Proof can be provided in the form of an official receipt or invoice from the receiving qualified charitable organization, but it can also be provided via credit card statements or other financial records detailing the donation.

Providing Receipts As soon as the donation is in your brokerage account, send the donor a nonprofit stock acknowledgment letter that includes a tax receipt for it.

This letter should acknowledge the gift of stock, such as the name and number of shares. It should not list the value of the stock received since the organization is not in the business of valuing stock. Also, the donor should have a record of the transaction from the broker.

The same applies to stock gifts/donations. In this case, you should send a donation receipt comprising details such as the ticker symbol, the number of shares, and the donation date. Mentioning the value of the stock is not necessary since a nonprofit is not supposed to be assigning value to stocks or gifts.

To process stock donations, a nonprofit would have to work with each donor individually to send the donation form, track and record the gift, send an acknowledgment letter, ensure paperwork was correct, liquidate and reinvest funds, and avoid forgery and fraud—all by hand!

Individuals, partnerships, and corporations file Form 8283 to report information about noncash charitable contributions when the amount of their deduction for all noncash gifts is more than $500.