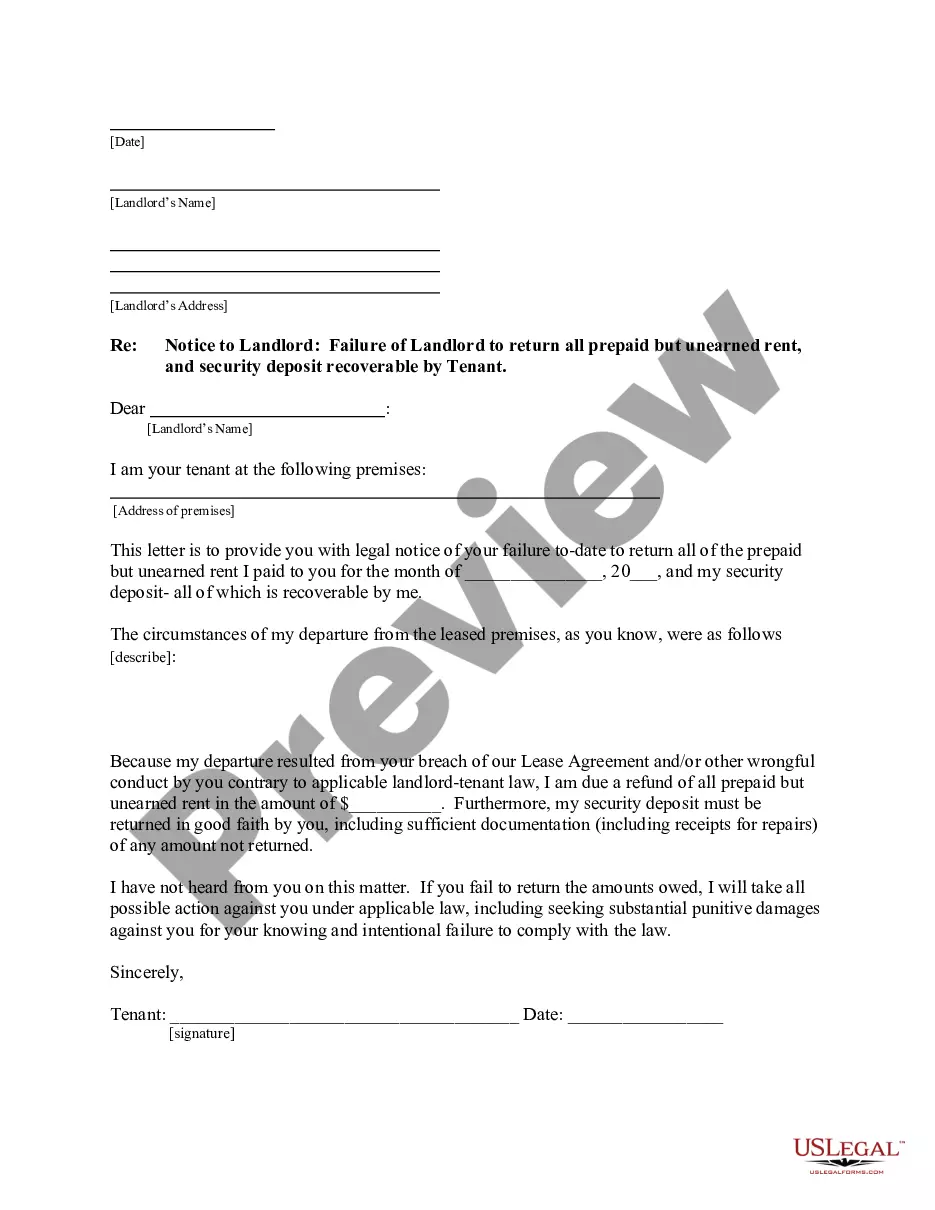

This form is a sample letter in Word format covering the subject matter of the title of the form.

Tax Letter For Donations For Sports Team In Kings

Description

Form popularity

FAQ

Each letter should include the following information: The donor's name. The full legal name of your organization. A declaration of your organization's tax-exempt status. Your organization's employer identification number. The date the gift was received. A description of the gift and the amount received.

How do you write a fundraising letter? Key steps Start with a personalized greeting. Explain your mission. Describe your current initiative. Outline your project's needs and what you hope to accomplish. Add meaningful photographs or infographics. Show the tangible impact associated with specific donation amounts.

Therefore, because public schools are subdivisions of a government organization, donations made to or for a public school qualify as tax-deductible Charitable Contributions.

Start by introducing yourself and your role on the team, then explain why you're seeking donations. It can be for equipment, uniforms, or travel expenses. Follow this with specifics about what kind of support you need and how it will help the team, making a clear call to action for them to donate.

Example 2: Individual Acknowledgment Letter Hi donor name, We're super grateful for your contribution of $250 to nonprofit's name on date received. As a thank you, we sent you a T-shirt with an estimated fair market value of $25 in exchange for your contribution.

There are several details that the IRS requires you to include: The name of your donor. The full legal name of your organization. A declaration of your organization's tax-exempt status. Your organization's employer identification number. The date the gift was received. A description of the gift and the amount received.

Key Takeaways. The IRS allows you to claim a deduction for donations you make to qualified organizations, including school district programs that are not operated for profit and are solely supported by state and local governments.

How Do You Write a Fundraising Letter for a Sports Team? Start with a Strong Opener. The first few sentences of your sports fundraising letter will be crucial. Be Clear About What You're Asking For. Explain How the Sponsorship Will Benefit the Sponsor. Provide Extra Information About the Team. Include a Call-to-Action.

The question some of you may ask – is sponsorship and/or donations a tax deduction? Donations are not a tax deduction unless the sporting club is registered as a deductible gift recipient (DGR), and most sporting clubs cannot be a DGR. Sponsorship, however is tax deductible.