Receipt Donation Form Sample For Single In Illinois

Description

Form popularity

FAQ

How do you write a fundraising letter? Key steps Start with a personalized greeting. Explain your mission. Describe your current initiative. Outline your project's needs and what you hope to accomplish. Add meaningful photographs or infographics. Show the tangible impact associated with specific donation amounts.

If you donate to a person or individual cause, no matter how worthy, it's typically not tax-deductible.

How do you write a fundraising letter? Key steps Start with a personalized greeting. Explain your mission. Describe your current initiative. Outline your project's needs and what you hope to accomplish. Add meaningful photographs or infographics. Show the tangible impact associated with specific donation amounts.

Charitable contributions or donations can help taxpayers to lower their taxable income via a tax deduction. To claim a tax-deductible donation, you must itemize on your taxes. The amount of charitable donations you can deduct may range from 20% to 60% of your AGI.

Generally, you can only deduct charitable contributions if you itemize deductions on Schedule A (Form 1040), Itemized Deductions. Gifts to individuals are not deductible. Only qualified organizations are eligible to receive tax deductible contributions.

Craft a concise, direct donation message by clearly stating your cause, the impact of donations, and specific calls-to-action with emotional language. For example: "Your $25 gift provides a week of meals for a family in need. Text FEED to 55555 to More Meals today!"

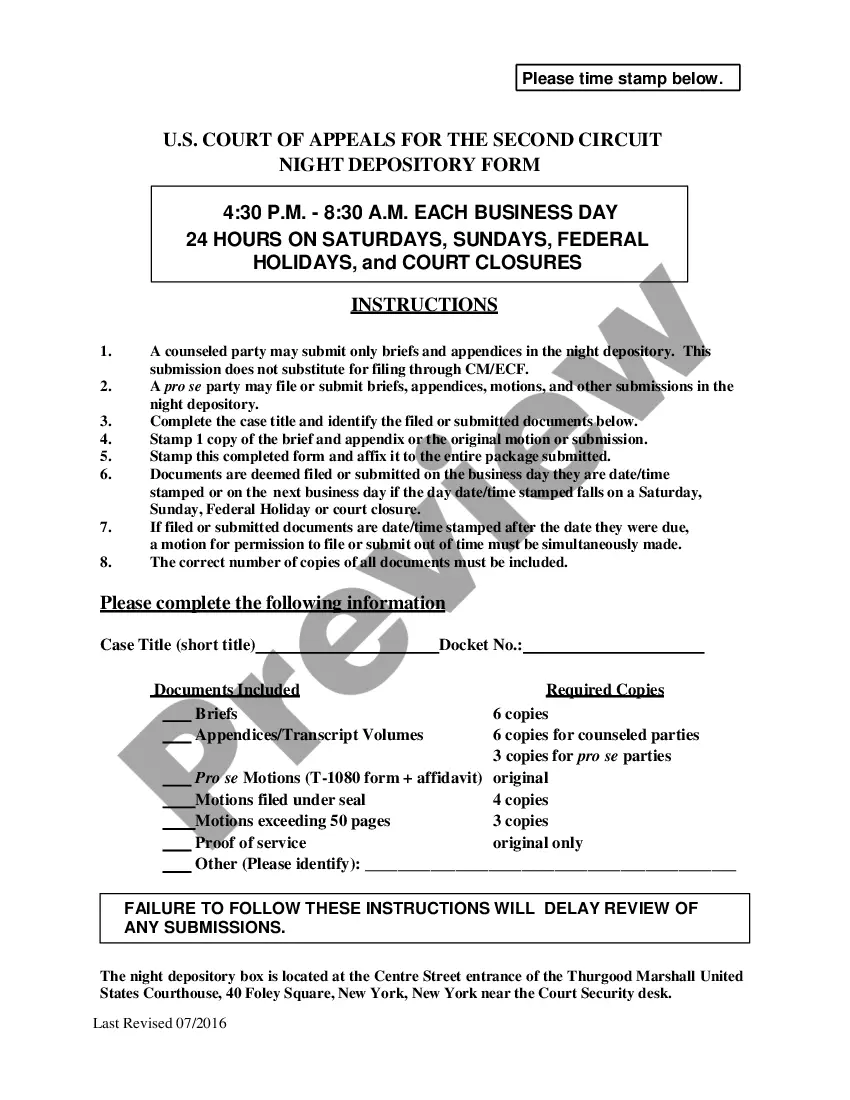

The receipt should include the organization's name, the date of the event, and the names and values of each item the attendee purchased. End-of-year donation receipts.

Example 2: Individual Acknowledgment Letter Hi donor name, We're super grateful for your contribution of $250 to nonprofit's name on date received. As a thank you, we sent you a T-shirt with an estimated fair market value of $25 in exchange for your contribution.

Start with a clear statement of purpose. Share personal stories or anecdotes that illustrate the impact the donations will have. Quantify the need and how the donations will be used. Convey gratitude and appreciation for any amount the reader is able to contribute.