Gift Letter Form With Spouse In Fairfax

Description

Form popularity

FAQ

Answer. The IRS does not currently support electronic filing for the 706 - Estate Tax return or 709 - Gift Tax return.

You cannot e-file Form 709, United States Gift (and Generation-Skipping Transfer) Tax Return. The Instructions for Form 709 direct you to mail it to the applicable address listed below.

IRS Form 709 – Filing requirements Generally, Form 709: U.S. Gift (and Generation-Skipping Transfer) Tax Return is required if any of the following apply: An individual makes one or more gifts to any one person (other than his or her citizen spouse) that are more than the annual exclusion for the year.

Use Form 709 to report: Transfers subject to the federal gift and certain generation-skipping transfer (GST) taxes.

Gifts to a spouse are not reported on a tax return, regardless of the amount gifted. Generally gifts to a spouse are not subject to the requirement to file a Form 709. What you have described is not an exception so there would be no reporting of the gift on a form 709.

Still, filling out Form 709 can get complicated. This article will walk you through the process step-by-step. It'll also help you determine if you need to fill out Form 709 in the first place.

We don't support Form 709, but you can download it from the IRS website and fill it out per the Form 709 instructions.

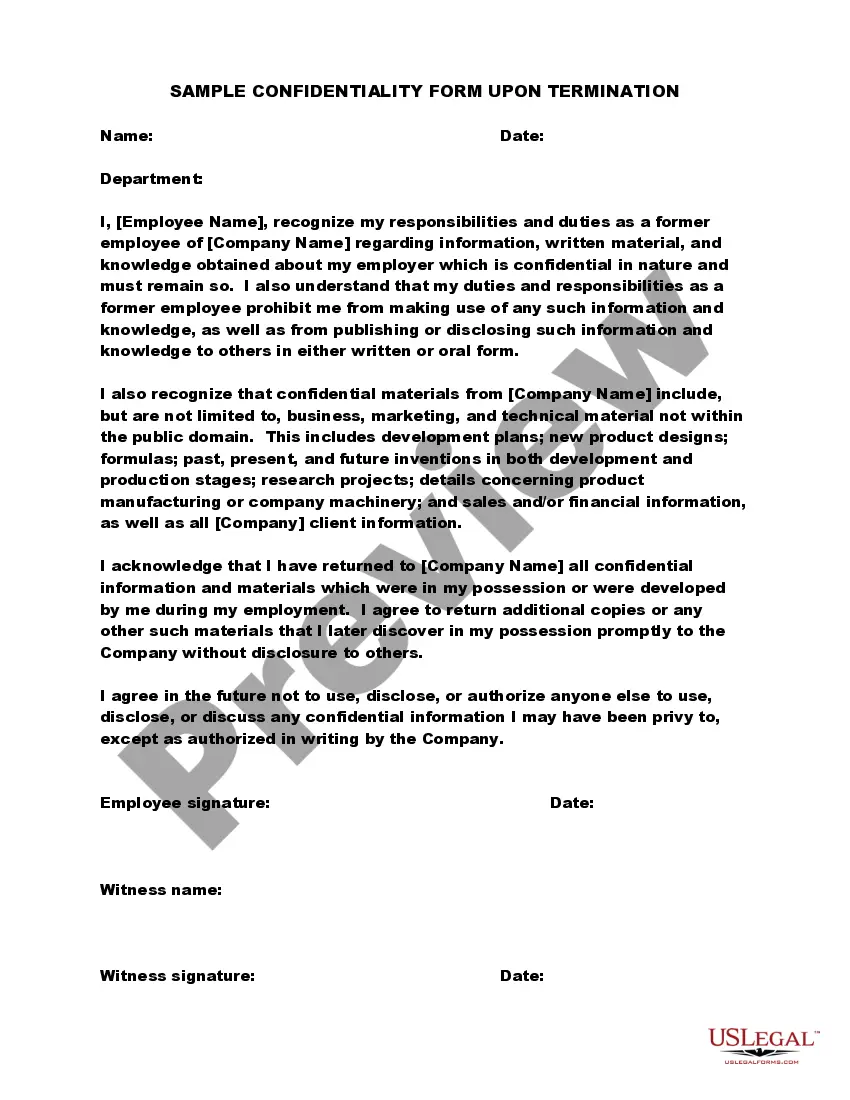

They are legally binding — While giving a family member a financial gift may not feel like a big deal to some people, gift letters are not only a formality. They are a legally binding document that both parties must sign.

At minimum, a gift letter should include: The giver's name and relationship to the borrower. The dollar amount of the gifted funds. The source of the gifted funds, such as an account number and statements.

How Do I Write a Gift Letter? The donor's name, address and phone number. The donor's relationship to the client. The dollar amount of the gift. The date when the funds were (or will be) transferred. A statement from the donor that no repayment is expected. The donor's signature.