Deed Of Trust Modification Form For Mortgage In Texas

Description

Form popularity

FAQ

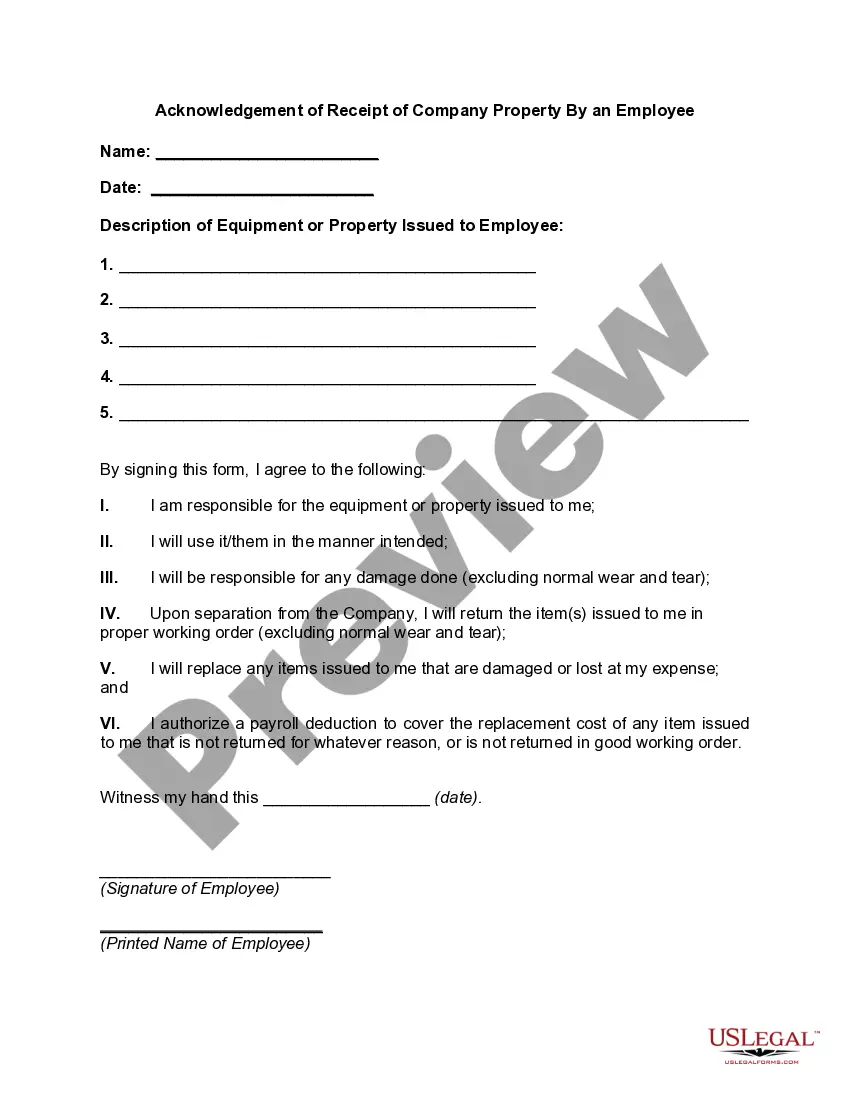

A deed of assignment is a legal instrument used to transfer interest, rights, and title of a property from the assignor (seller) to the assignee (buyer). This document is typically prepared by a legal practitioner and must be duly signed by both parties.

In short, Deeds of Assignment transfer existing property rights, while Deeds of Conveyance create new property rights and prove ownership. Understanding these differences is crucial in real estate transactions to ensure legal compliance and protect property interests.

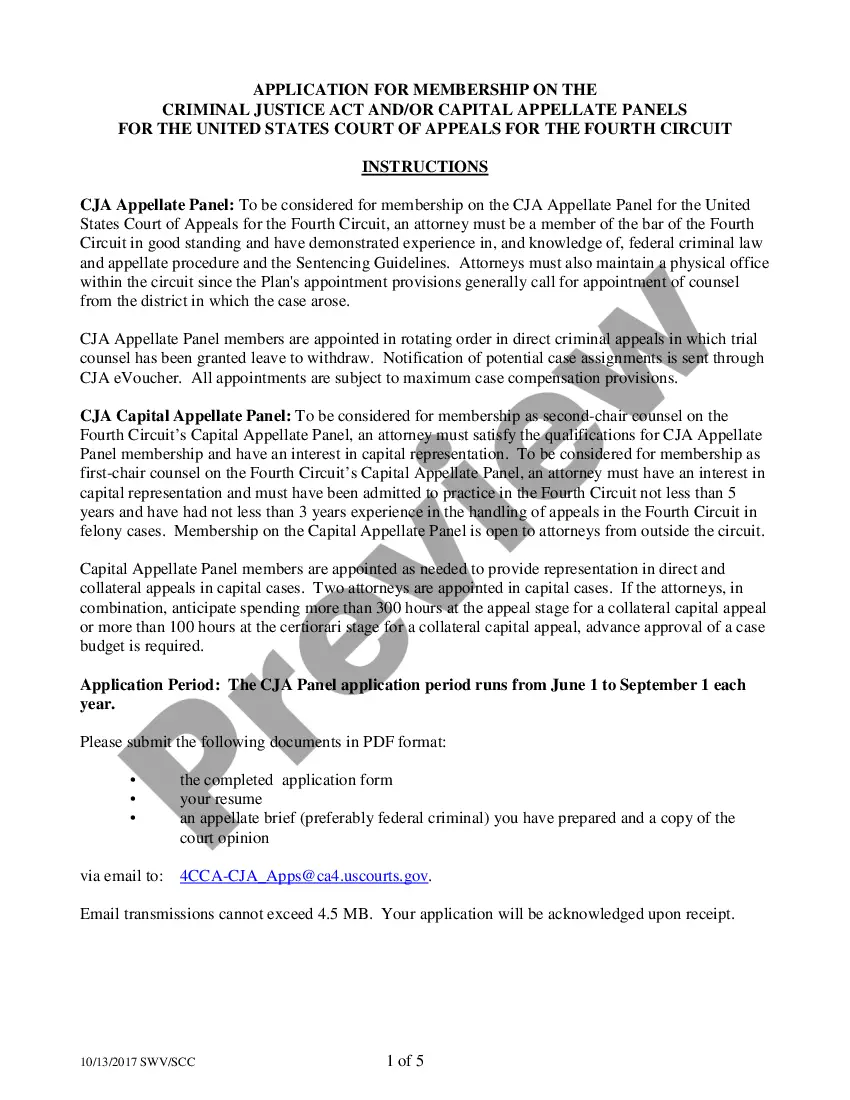

Deed of Trust Modification means, with respect to any Deed of Trust, a modification agreement entered into between the Borrower or the Project Owner, as applicable, and the Lender, modifying the terms and conditions of the Deed of Trust in order to (i) add to the lien of the Deed of Trust Additional Lots, or (ii) make ...

In Texas, a deed of trust, also known as a trust deed, is the commonly used instrument for the purpose of creating mortgage liens on real estate. A mortgage is an executed contract in which the legal or equitable owner of the real property pledges the title thereto as security for performance of an obligation.

A deed of trust can benefit the lender because it allows for a faster and simpler way to foreclose on a home — typically months or even years faster.

The two main differences between a mortgage and a deed of trust are: a mortgage involves two parties, while a deed of trust has three, and. mortgages are usually foreclosed judicially, while deeds of trust typically go through a nonjudicial foreclosure process (but not always).

Deed of Trust Modification means, with respect to any Deed of Trust, a modification agreement entered into between the Borrower or the Project Owner, as applicable, and the Lender, modifying the terms and conditions of the Deed of Trust in order to (i) add to the lien of the Deed of Trust Additional Lots, or (ii) make ...

The Trustee is usually the person that prepares the Deed of Trust. It is usually a lawyer or an employee of the Lender. The Lender can change the Trustee at any time.

Transfers of real property must be in writing and notarized. Deeds should be recorded in the county where the property is located. To ensure a legal change to the property title, you'll want the services of an attorney. A qualified attorney will prepare and file the real estate transfer deed.