Trust Deed Format For Temple In Tarrant

Description

Form popularity

FAQ

The Grantee is the buyer, recipient, new owner, or lien holder. When "vs." appears on legal documents, the Grantor is on the bottom, the Grantee is on the top.

The deed of trust must then be recorded with the county where the property is located, and each of the parties (the trustor, trustee, and lender) should keep a copy of the recorded document.

The grantor transfers assets into the trust, which a trustee then manages for the benefit of the beneficiaries. The grantee, usually termed as the beneficiary in this context, receives financial benefits from the trust. The grantor defines the terms of the trust, ensuring assets are allocated ing to their wishes.

A grantee is the person in a transaction who receives something – such as a home. In terms of a real estate transaction, the buyer is the grantee, as they receive ownership of the property after the closing process ends.

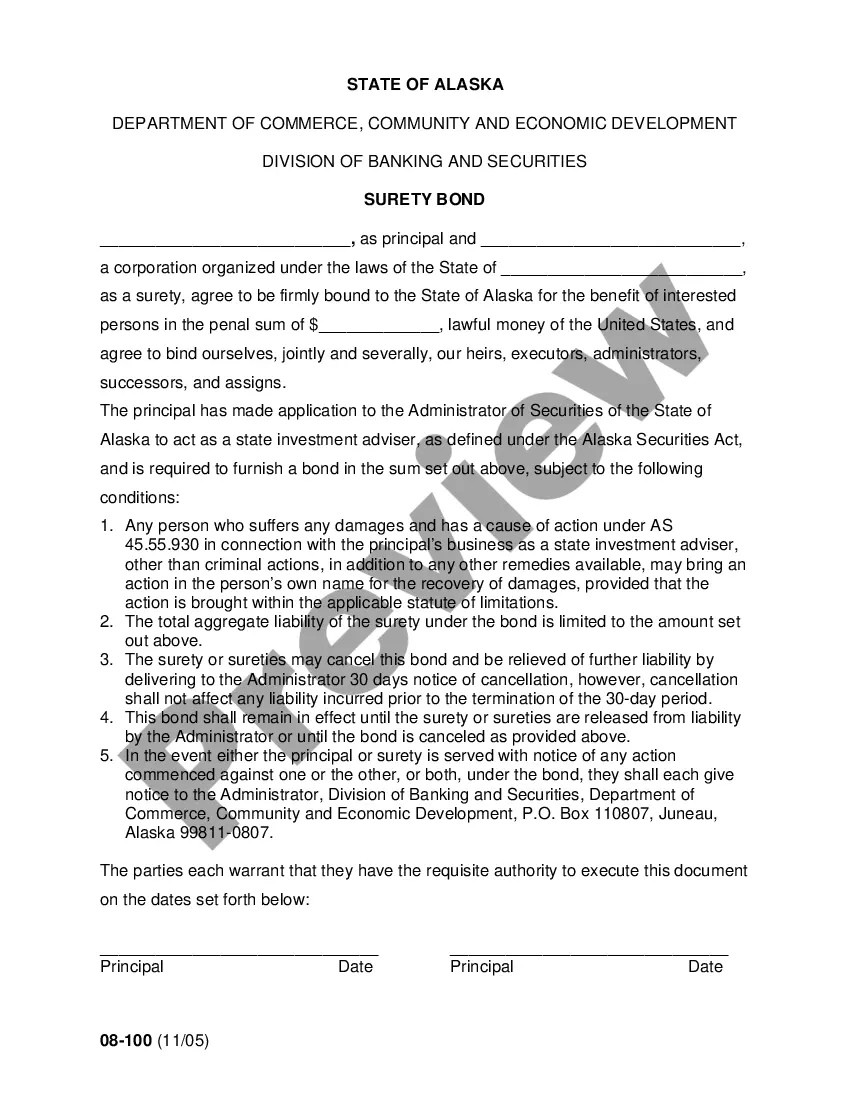

This Deed of Trust (the “Trust Deed”) sets out the terms and conditions upon which: Settlor Name (the “Settlor”), of Settlor Address, settles that property set out in Schedule A (the “Property”) upon Trustee Name (the “Trustee”), being a Company duly registered under the laws of state with registered number ...

The Grantor is the seller (on deeds), or borrower (on mortgages).

What Is a Grantee? A grantee is the recipient of a grant, scholarship, or some other asset such as real estate property. In contrast, a grantor is a person or entity that conveys ownership of an asset to another person or entity: the grantee.

A deed of trust will include the same type of information stated in a mortgage document, such as: The identities of the borrower, lender, and trustee. A full description of the property to be placed in trust. Any restrictions or requirements on the use of the property while it is in trust.

This Deed of Trust (the “Trust Deed”) sets out the terms and conditions upon which: Settlor Name (the “Settlor”), of Settlor Address, settles that property set out in Schedule A (the “Property”) upon Trustee Name (the “Trustee”), being a Company duly registered under the laws of state with registered number ...