Form 17 Deed Of Trust Example In Tarrant

Description

Form popularity

FAQ

Cons of Manufacturer Warranties Limited Coverage Scope: Manufacturer warranties often have limitations on the specific components or issues they cover. Certain parts or conditions may be excluded from the warranty coverage, requiring you to review the warranty terms and conditions carefully.

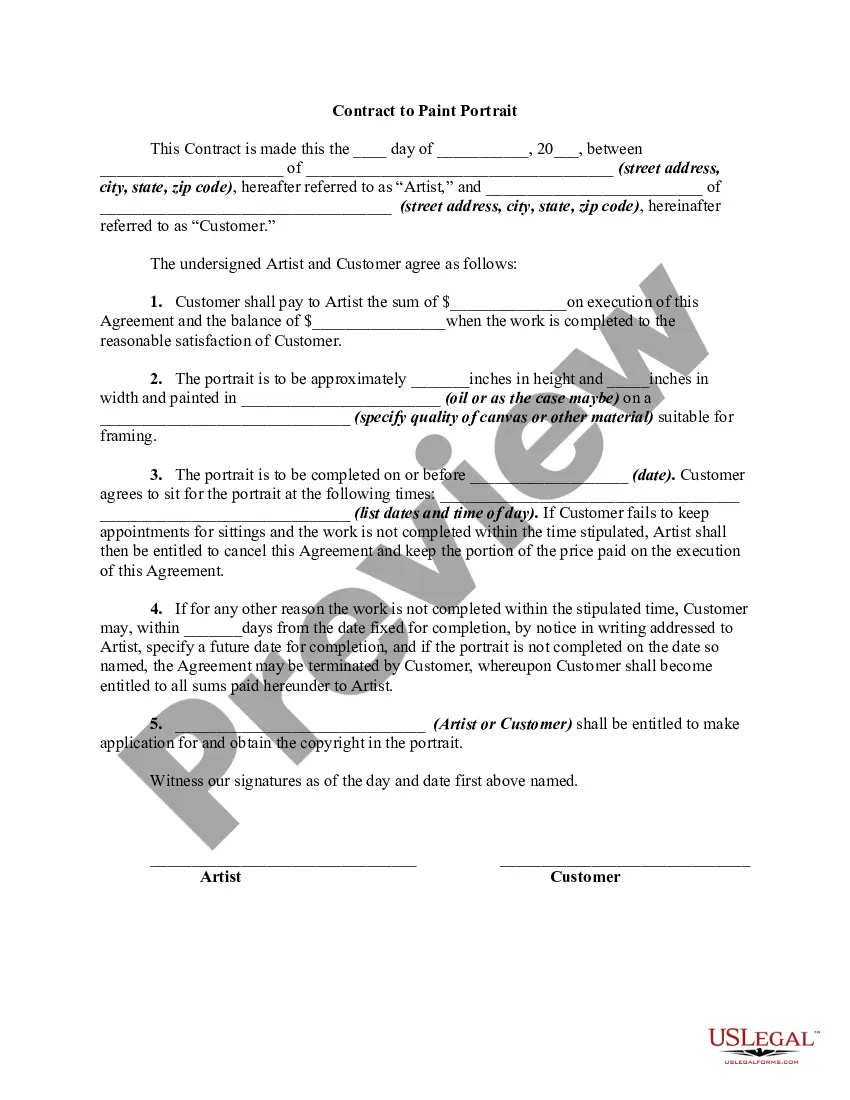

General warranty deeds give the grantee the most legal protection, while special warranty deeds give the grantee more limited protection. A quitclaim deed gives the grantee the least protection under the law.

You can seek assistance from an estate planning attorney or use online services like to guide you. After preparing the trust documents, have them executed in the presence of a notary public to render the whole trust agreement legally binding.

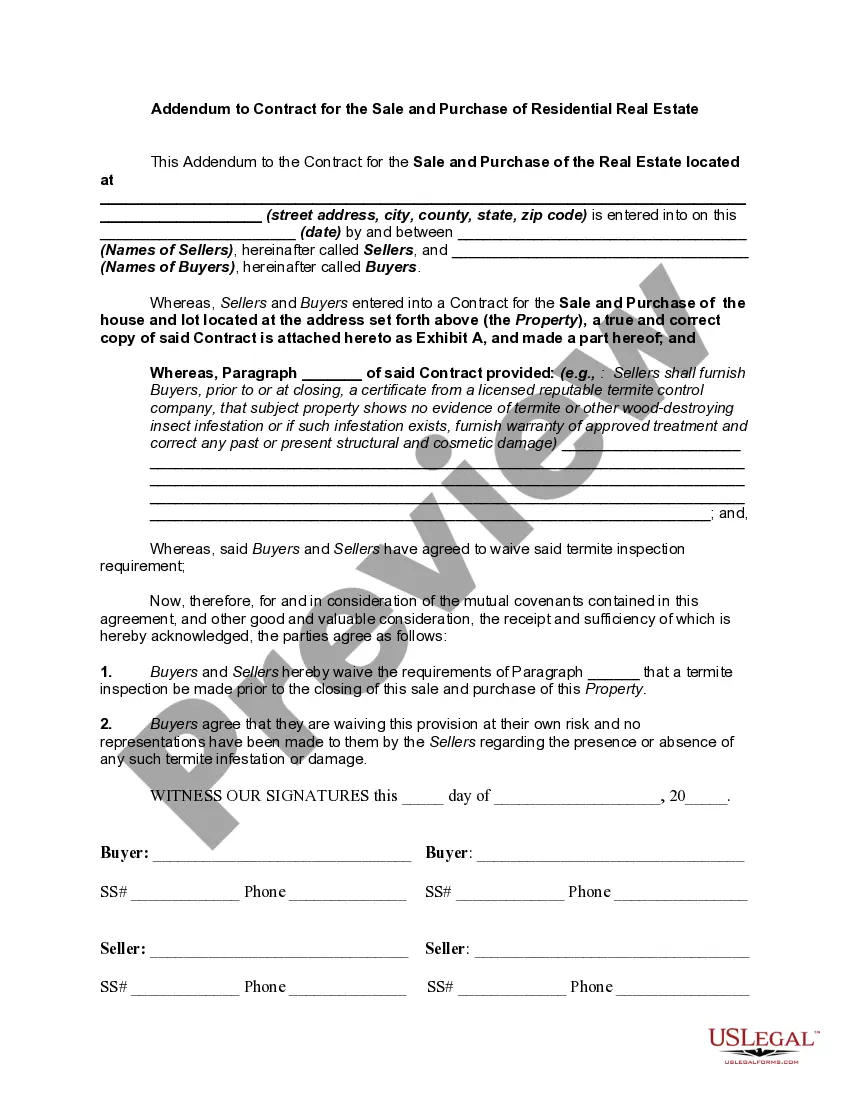

A deed of trust will include the same type of information stated in a mortgage document, such as: The identities of the borrower, lender, and trustee. A full description of the property to be placed in trust. Any restrictions or requirements on the use of the property while it is in trust.

Over 14 million Official Public Records held by the County Clerk are available online. Copies can be purchased and printed to a local printer for $1 per page and certified for an additional $5.

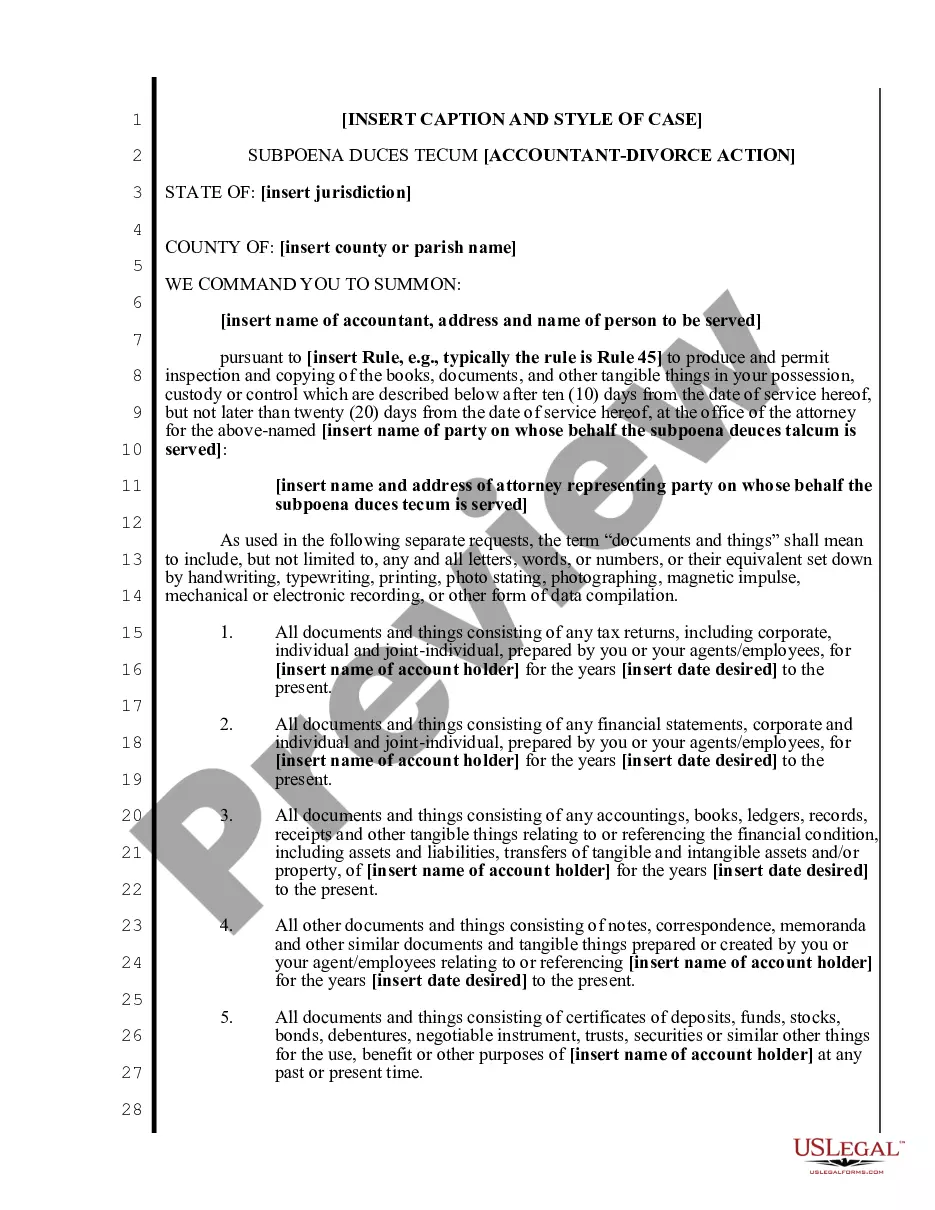

Where to Get a Deed of Trust? To get a Deed of Trust, you must file the proper paperwork with the proper court as generally outlined above. These documents must be filed with the county clerk or recorder, and the lender typically sends them to the recording office after the property closing.

After the deed has been signed and notarized, the original needs to be filed and recorded with the county clerk in the county where the property is located. You can mail the deed or take it to the county clerk's office in person. Only original documents may be recorded.

Texas doesn't require you to record your trust. As long as it's signed, notarized, and properly funded, it's valid.

Requirements for Release of Deed of Trust Accurate Information: The release must include precise details of the original deed of trust, including recording information and property description. Authorized Signatures: The lender or an authorized representative must sign the release, and it often requires notarization.

Transfers of real property must be in writing and notarized. Deeds should be recorded in the county where the property is located. To ensure a legal change to the property title, you'll want the services of an attorney. A qualified attorney will prepare and file the real estate transfer deed.