Deed Of Trust Modification Form For Mortgage In San Diego

Description

Form popularity

FAQ

A deed of trust can benefit the lender because it allows for a faster and simpler way to foreclose on a home — typically months or even years faster.

When the debt or obligation secured by a deed of trust has been satisfied, the beneficiary, or successor, must execute a request for full reconveyance and any other documents necessary to cause the deed of trust to be reconveyed and submit these documents to the trustee.

By establishing a corrective deed, you're not overriding your existing deed or creating a new property interest. Rather, it is an additional document that references the original deed and points out and corrects any errors. For instance, the legal property description could have a piece of incorrect information.

Yes, you can sell a home with a Deed of Trust. However, just like a mortgage, if you're selling the home for less than you owe on it, you'll need approval from the lender.

A correction deed, also known as a confirmatory or corrective deed, is a legal document used to fix errors on a property title that is recorded. Property owners can use this special type of deed to amend common errors such as misspellings, incomplete names, and other missing information.

There are two main reasons a deed of trust may be considered invalid: (1) lack of required formalities in executing the deed of trust, or (2) there is some fact outside execution that makes the deed of trust invalid.

Deed of Trust Modification means, with respect to any Deed of Trust, a modification agreement entered into between the Borrower or the Project Owner, as applicable, and the Lender, modifying the terms and conditions of the Deed of Trust in order to (i) add to the lien of the Deed of Trust Additional Lots, or (ii) make ...

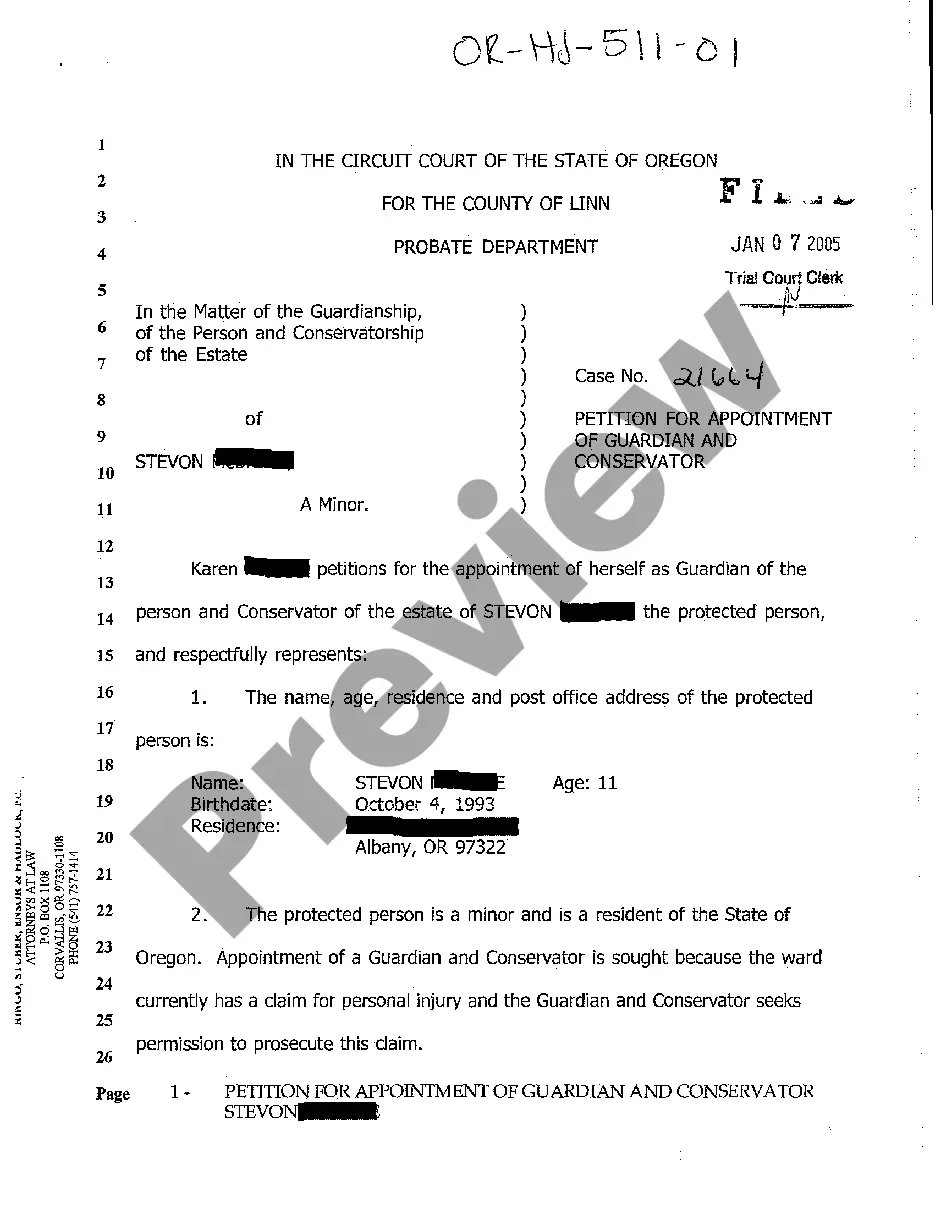

Where to Get a Deed of Trust? To get a Deed of Trust, you must file the proper paperwork with the proper court as generally outlined above. These documents must be filed with the county clerk or recorder, and the lender typically sends them to the recording office after the property closing.

Step-by-Step Instructions Determine the Parties to The Agreement. There will be three parties to these agreements. Prepare the Deed of Trust and Promissory Note. Get the Signatures Notarized. Record the Signed Documents at the County Recorder's Office. What Happens Next?