Trust Deed And Rules In Queens

Description

Form popularity

FAQ

Trusts offer amazing benefits, but they also come with potential downsides like loss of control, limited access to assets, costs, and recordkeeping difficulties.

Yes, you can sell a home with a Deed of Trust. However, just like a mortgage, if you're selling the home for less than you owe on it, you'll need approval from the lender.

Trust is preferable over a Will because the assets that are in the Trust are non-public assets. Example: If you take your house and you transfer it into the Trust and your parents passed away, then you don't have to open an estate to transfer the asset, and it remains confidential.

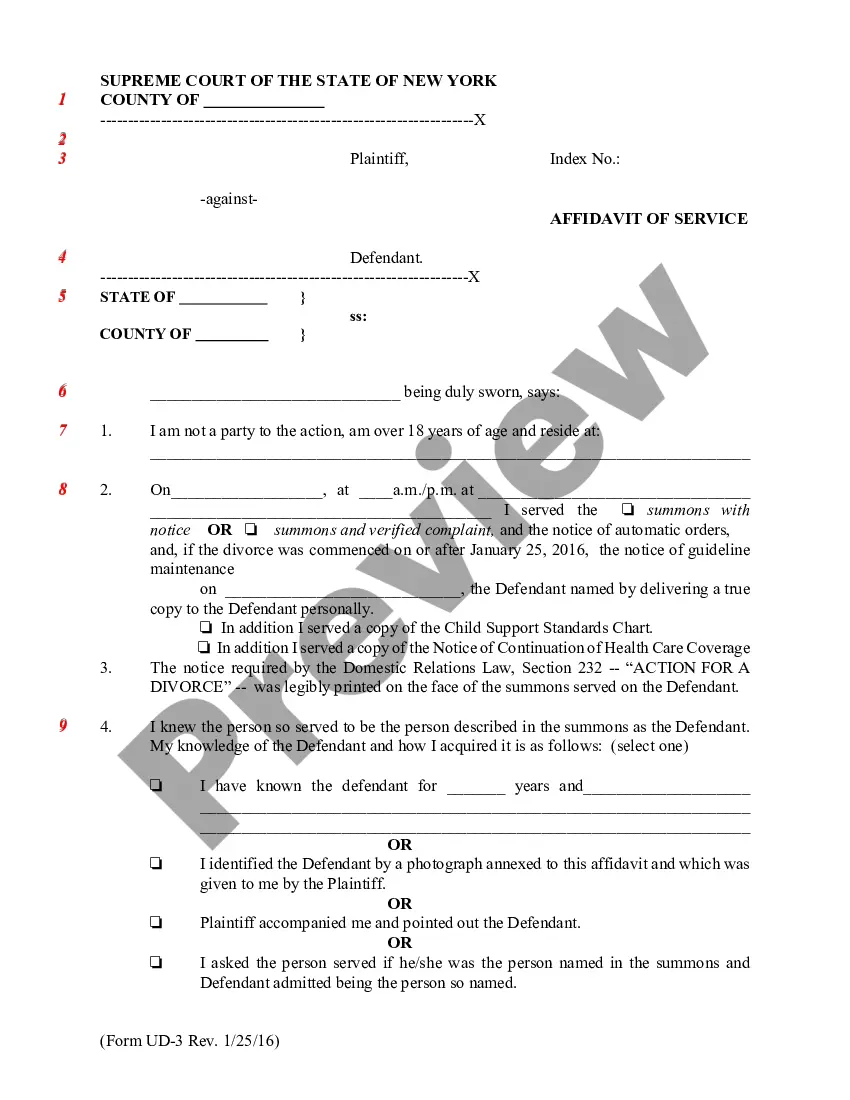

Under New York trust laws, a lifetime trust is created by a person who is still alive rather than upon a person's death through a will. Any person 18 or older may dispose of property through a lifetime trust. Every estate held in property may be disposed by a lifetime trust.

Rigidity: Family trusts are often inflexible, making it difficult to alter the terms once they are established. This rigidity can be problematic if family circumstances change, such as in cases of divorce, remarriage or changes in financial status.

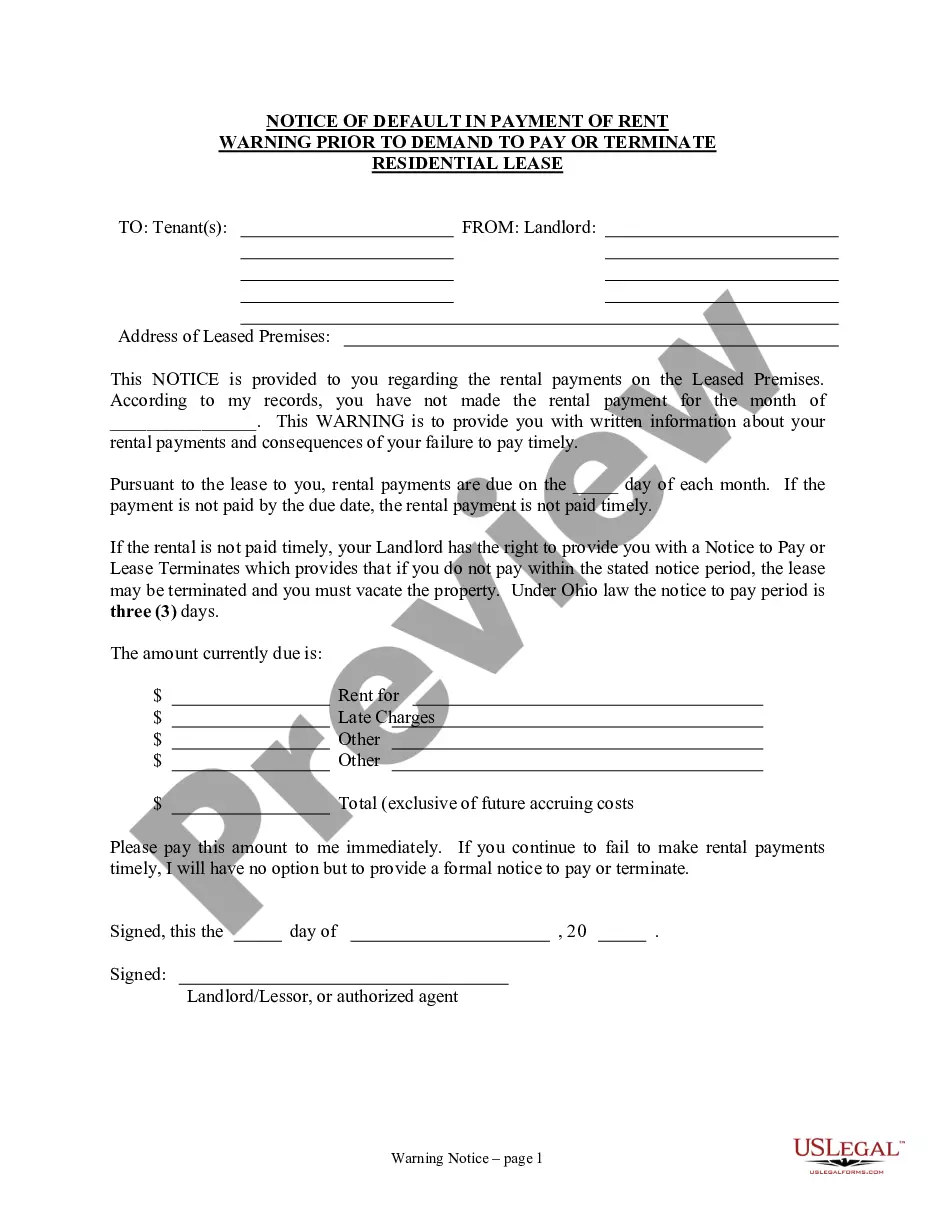

This Deed of Trust (the “Trust Deed”) sets out the terms and conditions upon which: Settlor Name (the “Settlor”), of Settlor Address, settles that property set out in Schedule A (the “Property”) upon Trustee Name (the “Trustee”), being a Company duly registered under the laws of state with registered number ...

– Quitclaim deed must be written and signed by grantor before a notary public. – Must include legal description, property address, county, date, grantor and grantee names, and transfer amount (if any). – File the quitclaim deed with the County Clerk or City Registrar.

Start the process by creating a trust document. This document includes the trust's terms, the names of beneficiaries, and how you want assets in the trust distributed when you die. After the trust is drawn up, transfer the title from your name to the trust's. Sign the deed in the presence of a notary public.

Steps for Deed Recording in NYC It must be signed by the seller and acknowledged by a notary public. Submit the Deed for Recording: Take the original deed to the NYC Register's Office. You can find the office at 66 John Street, 13th floor, New York, NY 10038.

Erecording, or electronic document recording, is the process of transmitting real property documents electronically to the local government entity charged with recording and maintaining public records.