Deed Of Trust Records With Lien In Queens

Description

Form popularity

FAQ

The seller's attorney will give the original deed to the buyer's attorney at closing. That original then gets recorded at the clerk's office of the local municipality. The clerk's office scans and records the document into the land records and then sends it to the buyer or their attorney.

A safe you can bolt down or attach to a solid wall is a great place to keep house deeds. This way, the safe cannot leave your house in case of a burglary. Just make sure it is properly installed.

Steps for Deed Recording in NYC It must be signed by the seller and acknowledged by a notary public. Submit the Deed for Recording: Take the original deed to the NYC Register's Office. You can find the office at 66 John Street, 13th floor, New York, NY 10038.

The deed, when recorded, became a permanent part of the County property records. If you should lose your original deed, you may obtain a certified copy of your deed from the County Recorder in which the land is located. A county certified copy can be used in the place of the original.

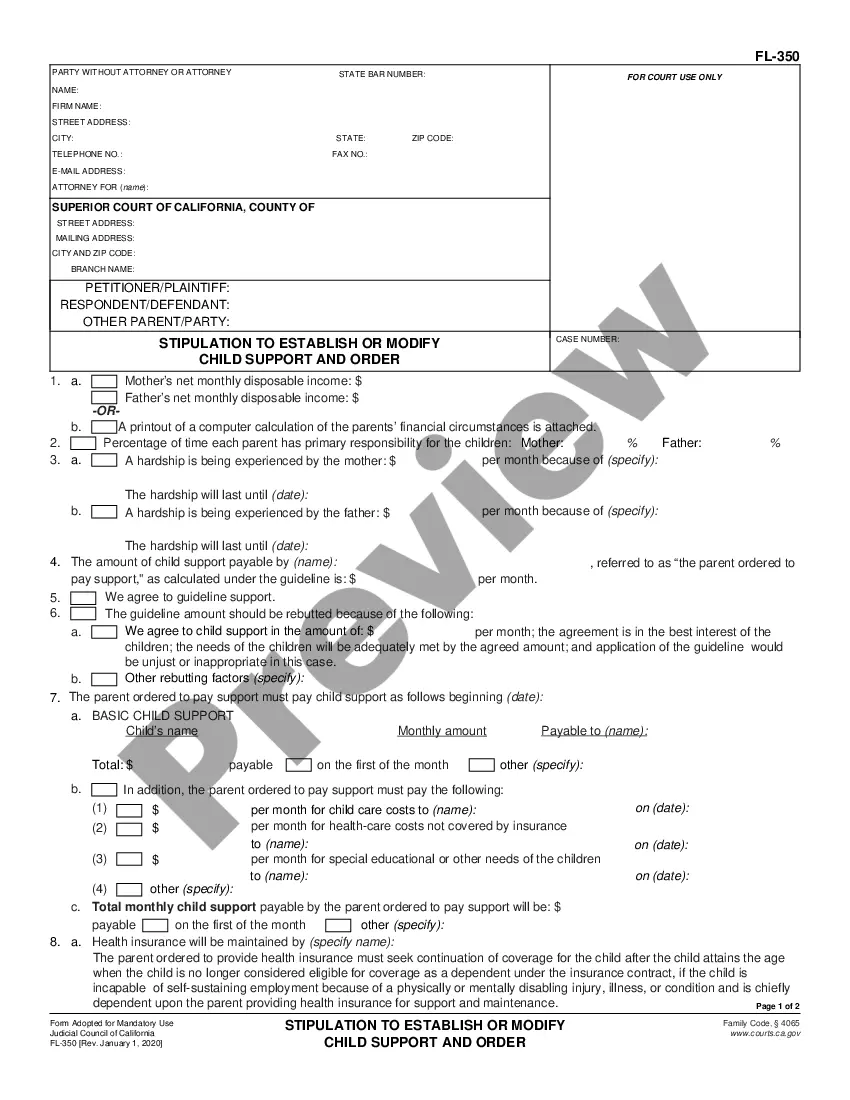

A deed of trust creates a lien on the purchased property when it is executed and delivered by the trustor/borrower to the beneficiary (usually the lender). Once executed and delivered, the deed of trust takes priority as a security against the property in relation to any other liens previously recorded.

When closing on a home, you should receive a copy of your house deed when the title is transferred to you. You can also request an additional copy at any time through your County Recorder's office or Register of Deeds office (the official name may vary by location).

The deed of trust must then be recorded with the county where the property is located, and each of the parties (the trustor, trustee, and lender) should keep a copy of the recorded document.

Property records are public. People may use these records for background information on purchases, mortgages, asset searches, and other legal and financial transactions.

These include vital records (birth and death certificates, marriage and divorce licenses), criminal records, court records, professional licenses (such as medical, law, and driver's licenses), tax and property records, reports on publicly-traded companies, and FOIA or FOIL-able documents related to the operations of ...