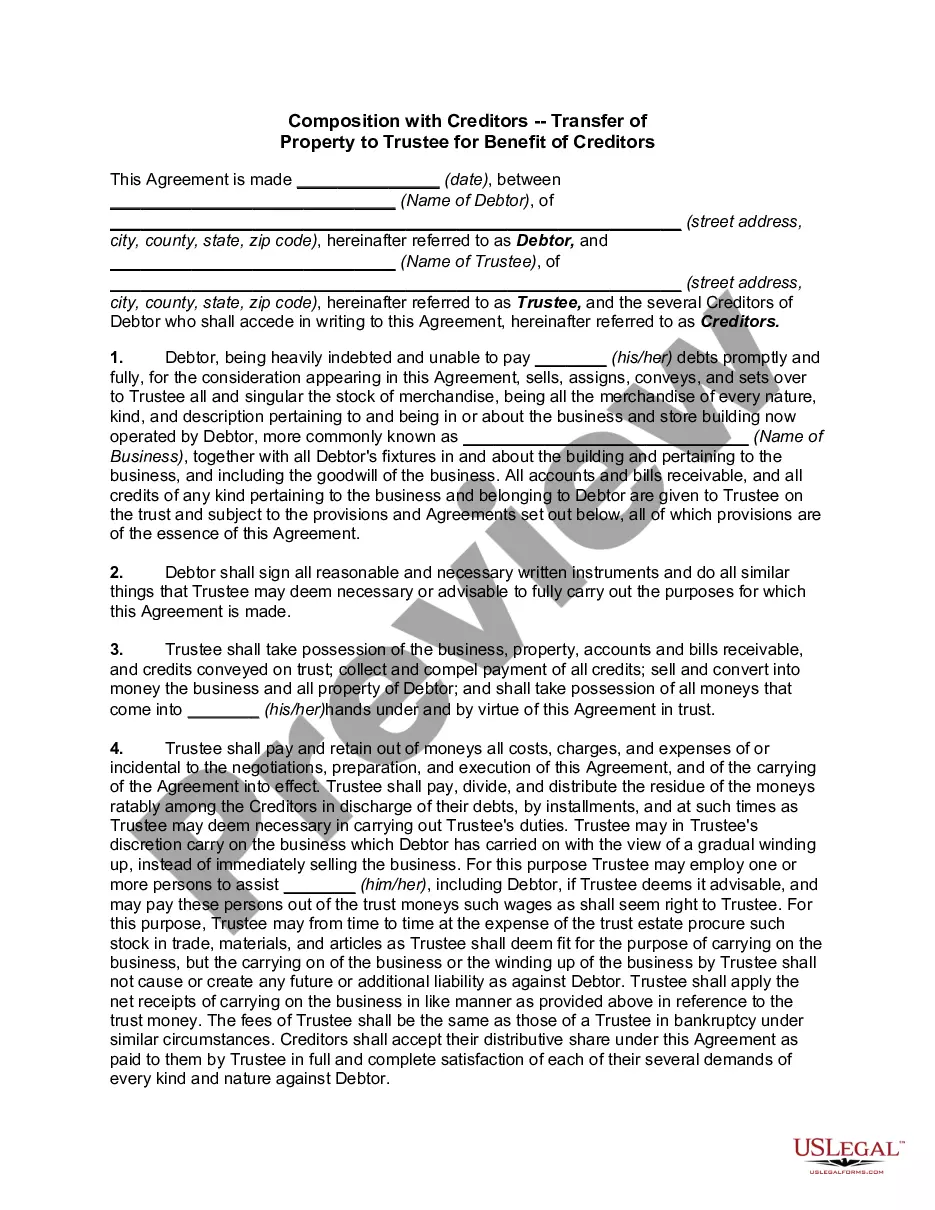

This form is a deed of trust modification. It is to be entered into by a borrower, co-grantor, and the lender. The agreement modifies the mortgage or deed of trust to secure a debt described within the agreement. Other provisions include: renewal and extension of the lien, co-grantor liability, and note payment terms.

Deed Of Trust With Promissory Note In Pima

Description

Form popularity

FAQ

The most common deed form in Arizona is the warranty deed. Warranty deeds provide protection to the buyer in the form of a warranty by the seller that guarantees no issues with the title.

First, search by your address or parcel number to locate your property. The current deed will be located under the "Deed Number" under the section "Owner Information". Once you locate your document, you may view an unofficial copy online. Select the colored box under the section "Pages" to view your document.

Arizona is a Mortgage state and Deed of Trust state.

Mortgage States and Deed of Trust States StateMortgage StateDeed of Trust State Arizona Y Y Arkansas Y Y California Y Colorado Y47 more rows

In Arizona, a land trust works by transferring legal ownership of a property to a trustee, who holds the property on behalf of the beneficiary. The trustee could be an LLC that you control. In that way, you still control the land, but you have more privacy from people trying to research your assets online.

Are you familiar with the deed of trust? In Arizona, this is the primary financial security document that's used when purchasing a home.

Under Arizona law, breach of contract claims must be brought within six years of default. This time limitation applies to Deed of Trust default actions. Therefore, Deed of Trust lenders must act promptly if they want to enforce their rights.

If you have a deed of trust, you'll usually face a nonjudicial foreclosure — meaning the trustee can just impose it. If you have a mortgage, your lender will need to seek a court judgment to seize the home.

Cons of a promissory note Limited legal recourse: While a promissory note is a legal document, enforcing repayment can be challenging if the borrower defaults. Interest costs: If the promissory note includes interest terms, the borrower will incur additional costs.