Deed Of Trust For Form 17 In Pennsylvania

Description

Form popularity

FAQ

Similar to the first question, transferring a deed after death in Pennsylvania involves submitting the will to probate, or if there's no will, following Pennsylvania's intestate laws. A new deed must then be created, showing the new ownership, and recorded with the county.

Yes. But it is usually a good idea to have someone with certain expertise in the field such as an attorney or title company prepare it for you to make sure it's correct.

To add, remove, or change a name on a deed, have a lawyer, title company, or other real estate professional prepare the deed. Then, record the new deed with the Department of Records. Note: We recommend that you do not prepare a deed on your own.

Yes, you can make your own Grant Deed. A lawyer is not required to prepare a valid and enforceable deed.

Where to Get a Deed of Trust? To get a Deed of Trust, you must file the proper paperwork with the proper court as generally outlined above. These documents must be filed with the county clerk or recorder, and the lender typically sends them to the recording office after the property closing.

May I make out my own deed? Yes you may, however, we always recommend consulting an attorney regarding property transfers and changes, because minor changes in the wording of the document can completely change the legal meaning of the document.

A real estate lawyer assists in preparing the new deed, ensuring it's signed before a notary public, recording it with the county's Recorder of Deeds office, paying any applicable fees, and obtaining a copy of the recorded deed.

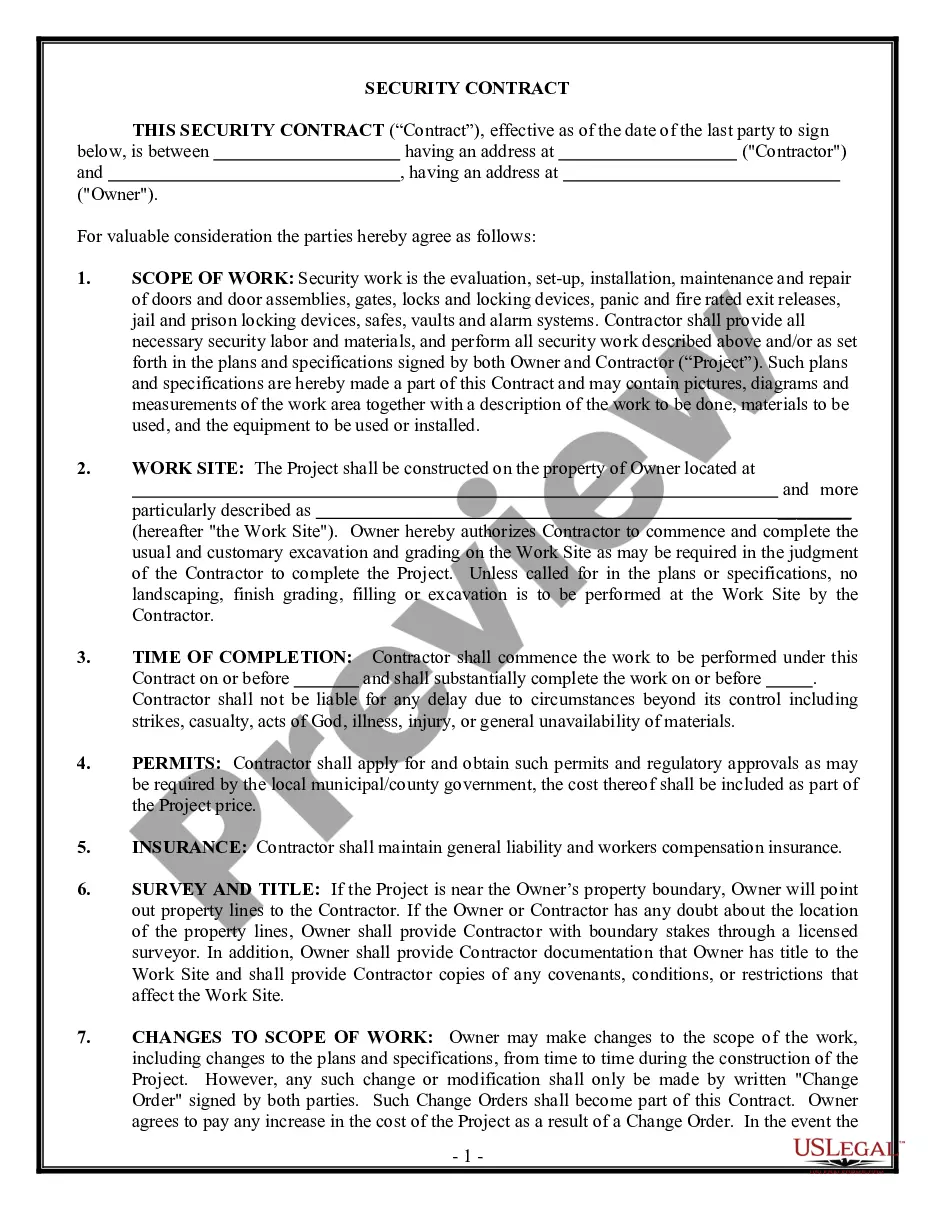

A Deed to Trust form used to transfer the grantor's title and interest in real property in Pennsylvania to a trustee of a trust for the grantor's benefit. This standard document allows the drafter to choose between warranty and quitclaim deed language.

Cons of Manufacturer Warranties Limited Coverage Scope: Manufacturer warranties often have limitations on the specific components or issues they cover. Certain parts or conditions may be excluded from the warranty coverage, requiring you to review the warranty terms and conditions carefully.

Where to Get a Deed of Trust? To get a Deed of Trust, you must file the proper paperwork with the proper court as generally outlined above. These documents must be filed with the county clerk or recorder, and the lender typically sends them to the recording office after the property closing.