Deed Of Trust Modification With Future Advance Clause In Palm Beach

Description

Form popularity

FAQ

As per Florida law, irrevocable trusts may be modified by the grantor and the beneficiaries, but only via execution of nonjudicial settlement agreements.

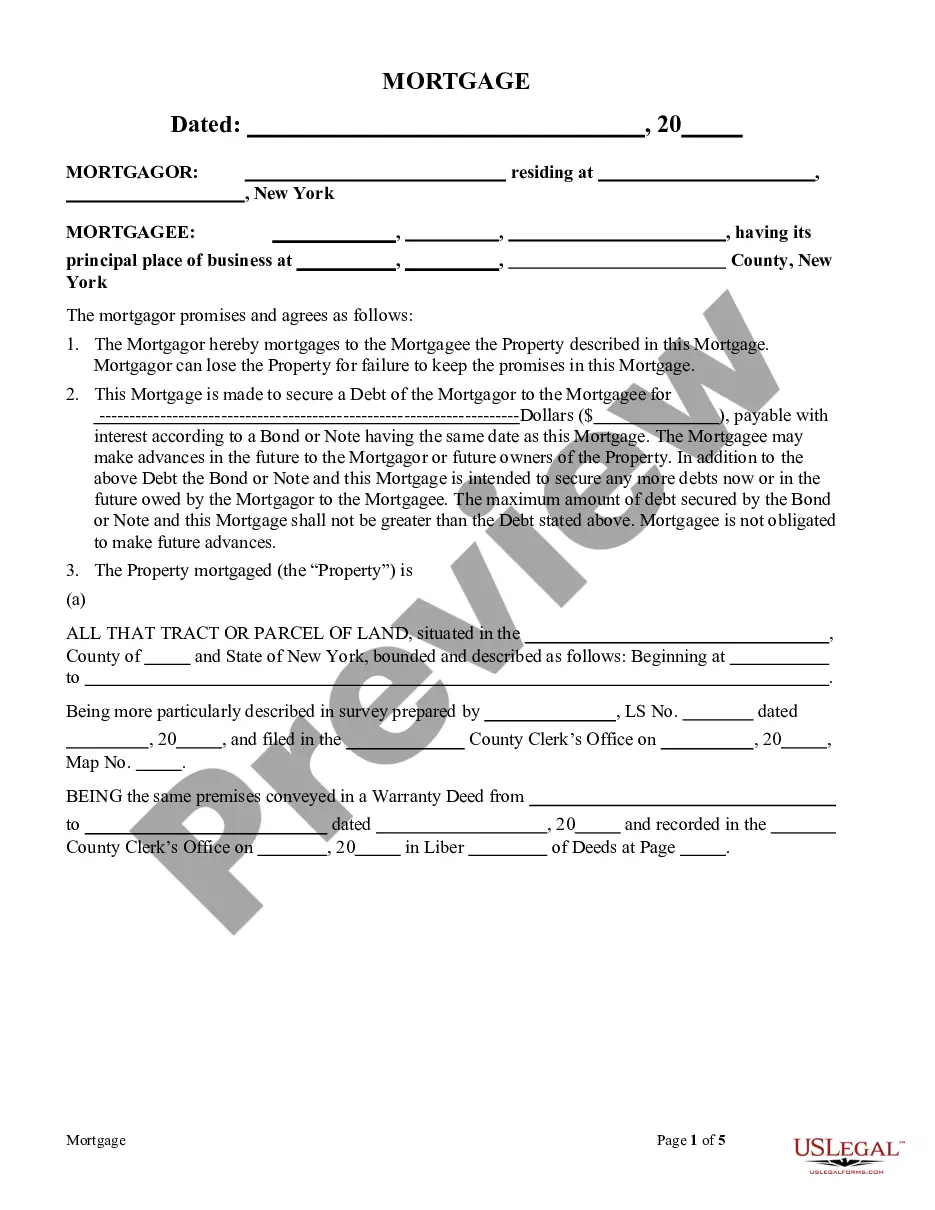

Deed of Trust Modification means, with respect to any Deed of Trust, a modification agreement entered into between the Borrower or the Project Owner, as applicable, and the Lender, modifying the terms and conditions of the Deed of Trust in order to (i) add to the lien of the Deed of Trust Additional Lots, or (ii) make ...

When Can You Modify an Irrevocable Trust? Florida law allows courts to modify irrevocable trusts if the change reflects the grantor's intentions.

Fortunately, California law allows for the amendment, modification or termination of an otherwise irrevocable trust--under the proper circumstances and using the proper procedures.

The person wishing to change the deed (grantor) must present a government-issued photo identification. The grantor(s) names and addresses must be legibly printed in the body of the deed. The deed must be signed by all current owners while in the presence of two independent witnesses and a notary.

In case of an IRREVOCABLE TRUST, its terms CANNOT BE MODIFIED, AMENDED or TERMINATED WITHOUT the PERMISSION of the grantor's named beneficiary or beneficiaries.

A deed of trust can benefit the lender because it allows for a faster and simpler way to foreclose on a home — typically months or even years faster.

The terms of a trust can only be validly amended when the amendment complies with the existing trust deed and rules. We assist by reviewing the existing trust rules and providing amendment documentation that ensure that the variation of trust terms remain compliant and effective. What's included: letter of advice.

Disadvantages of a Trust Deed For borrowers, if financial circumstances change, default on repayment can result in property foreclosure.