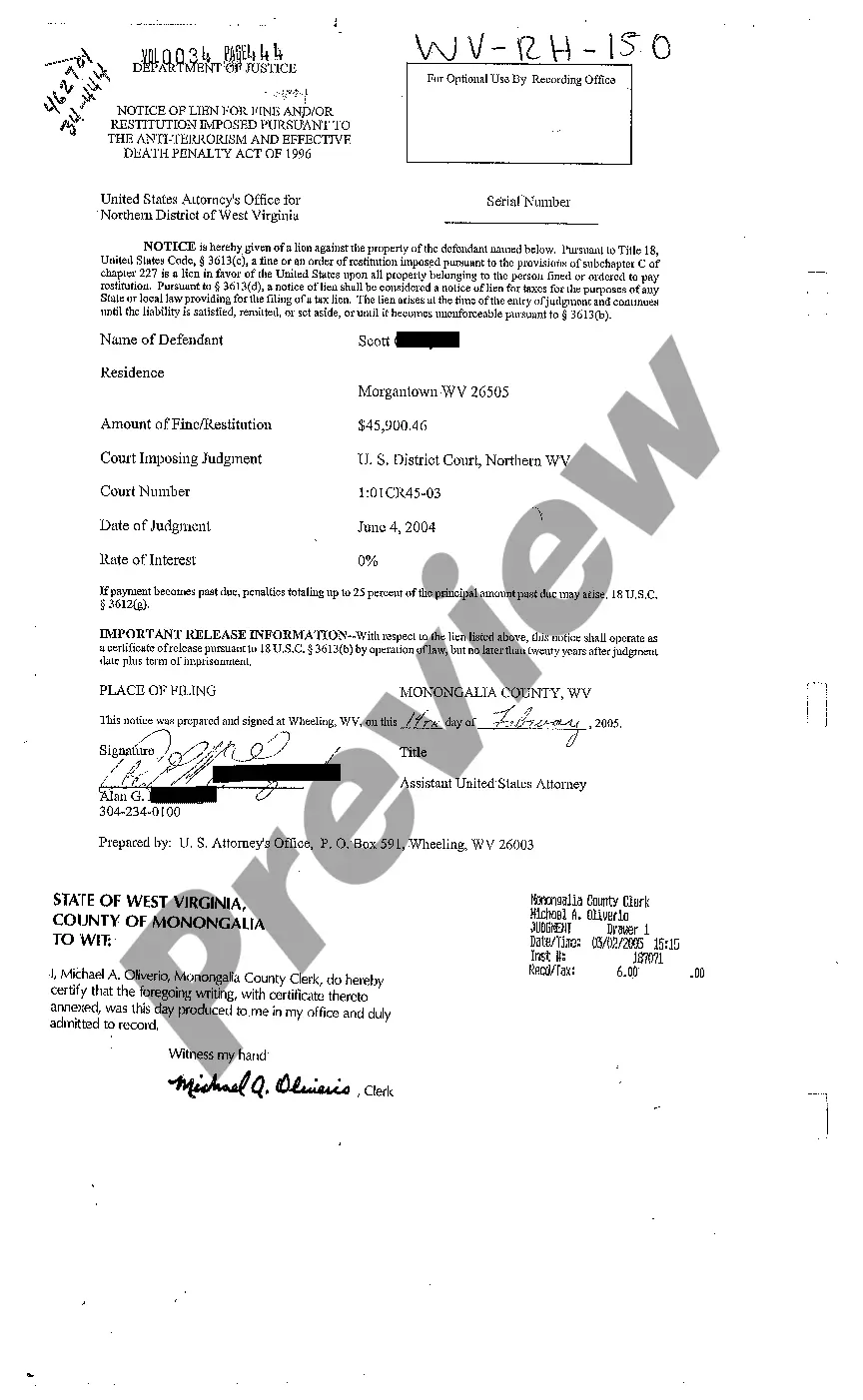

This form is a deed of trust modification. It is to be entered into by a borrower, co-grantor, and the lender. The agreement modifies the mortgage or deed of trust to secure a debt described within the agreement. Other provisions include: renewal and extension of the lien, co-grantor liability, and note payment terms.

Trust Of Deeds For Property In Ohio

Description

Form popularity

FAQ

The Title Holding Trust or Land Trust provides an excellent method for acquiring, holding and disposing of real estate without revealing the true owner's identity. Title is simply transferred to or from the Trustee upon the written authorization and direction of the beneficiary (owner).

Once property has been transferred to a trust, the trust itself becomes the rightful owner of the assets. In an irrevocable trust, the assets can no longer be controlled or claimed by the previous owner.

In Ohio, the only kinds of Trusts, as opposed to Trustees, that may hold title to real estate in the Trust name are Business Trusts, pursuant to ORC Chapter 1746, and Real Estate Investment Trusts, pursuant to ORC Chapter 1747. Any other type of Trust must hold title by way of a Trustee.

Create the trust document. You can get help from an attorney or use WillMaker & Trust (see below). Sign the document in front of a notary public. Change the title of any trust property that has a title document—such as your house or car—to reflect that you now own the property as trustee of the trust.

Trusts may be declared upon registered land, or upon any interest therein, by deed or other instrument in writing, fully and clearly defining the trusts, conditions, and limitations, and the powers and duties of the trustee and giving his name, residence, and post-office address and the name, residence, and post-office ...

In Ohio, the only kinds of Trusts, as opposed to Trustees, that may hold title to real estate in the Trust name are Business Trusts, pursuant to ORC Chapter 1746, and Real Estate Investment Trusts, pursuant to ORC Chapter 1747. Any other type of Trust must hold title by way of a Trustee.

A Deed of Trust is a legal document similar to a home mortgage. It guarantees a real estate transaction between a lender and a borrower. A Deed of Trust definition is most easily expressed as an agreement between a borrower, a lender and a third party known as the Trustee.

Create the trust document. You can get help from an attorney or use WillMaker & Trust (see below). Sign the document in front of a notary public. Change the title of any trust property that has a title document—such as your house or car—to reflect that you now own the property as trustee of the trust.

Where to Get a Deed of Trust? To get a Deed of Trust, you must file the proper paperwork with the proper court as generally outlined above. These documents must be filed with the county clerk or recorder, and the lender typically sends them to the recording office after the property closing.