Deed Of Trust Records With No Maturity Date In Ohio

Description

Form popularity

FAQ

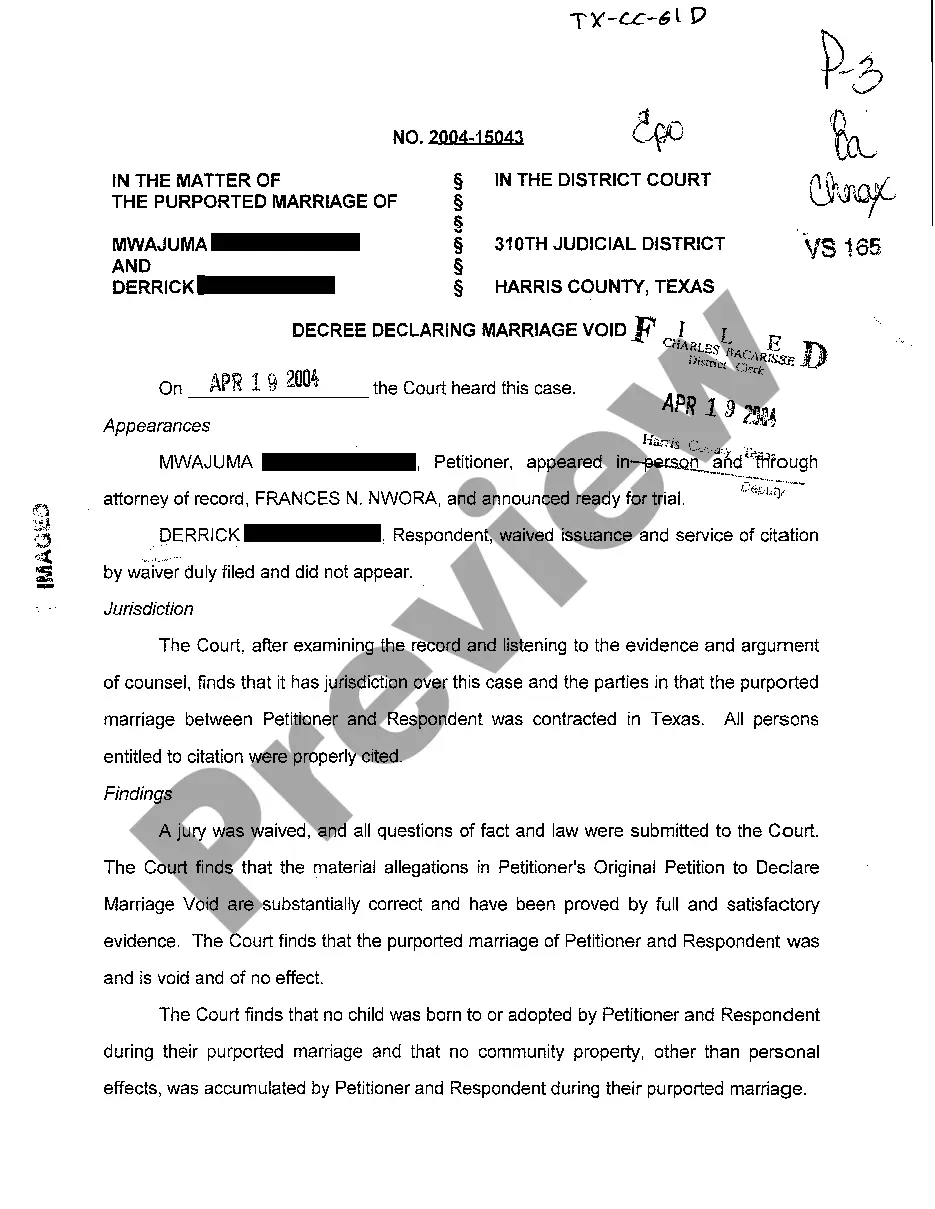

When is a Deed of Trust Invalid? There are two main reasons a deed of trust may be considered invalid: (1) lack of required formalities in executing the deed of trust, or (2) there is some fact outside execution that makes the deed of trust invalid.

Recorded deeds become part of the public record, and provide a clear chain of ownership for a piece of property. This makes it possible for potential buyers, lenders, or other interested parties to search records to verify ownership, see existing liens, etc.

What are unreleased mortgages/deeds of trust? Unreleased mortgages or deeds of trust are legal encumbrances on a property's title that have not been properly discharged or released.

But Ohio law is clear that recording a deed is not required to pass title. Whether recorded or not, a deed in Ohio passes title upon its proper execution and delivery to the grantee. The law states that actual delivery of the document is sufficient to transfer ownership between the parties.

A trust deed remains on your credit file for six years, a timescale that exceeds the term of most trust deeds which are generally completed in three or four years.

The signing shall be acknowledged by the grantor, mortgagor, vendor, or lessor, or by the trustee, before a judge or clerk of a court of record in this state, or a county auditor, county engineer, notary public, or mayor, who shall certify the acknowledgement and subscribe the official's name to the certificate of the ...

Section 5303.01 | Action to quiet title. An action may be brought by a person in possession of real property, by himself or tenant, against any person who claims an interest therein adverse to him, for the purpose of determining such adverse interest.

Section 5301.68 | Granting conservation or agricultural easement. An owner of land may grant a conservation easement to the department of natural resources, a park district created under Chapter 1545.

(B)(1) No surplus lines broker shall solicit, procure, place, or renew any insurance with an unauthorized insurer unless an agent or the surplus lines broker has complied with the due diligence requirements of this section and is unable to procure the requested insurance from an authorized insurer.