Deed Of Trust Records With Future Advance Clause In New York

Description

Form popularity

FAQ

(a) "Future advance" means an indebtedness or other obligation that is secured by a mortgage and arises or is incurred after the mortgage has been recorded, whether or not the future advance was obligatory or optional on the part of the mortgagee.

Power of Sale Clause A power of sale provision is a significant element of a deed of trust, as it states the conditions when a trustee can sell the property on behalf of the beneficiary. Typically, this predicts when you will be delinquent on your mortgage.

Property records are public. People may use these records for background information on purchases, mortgages, asset searches, and other legal and financial transactions.

You can search for property records and property ownership information online, in person, or over the phone with a 311 representative. Property owners of all boroughs except Staten Island can visit ACRIS. To search documents for Staten Island property, visit the Richmond County Clerk's website.

Property records are public. People may use these records for background information on purchases, mortgages, asset searches, and other legal and financial transactions.

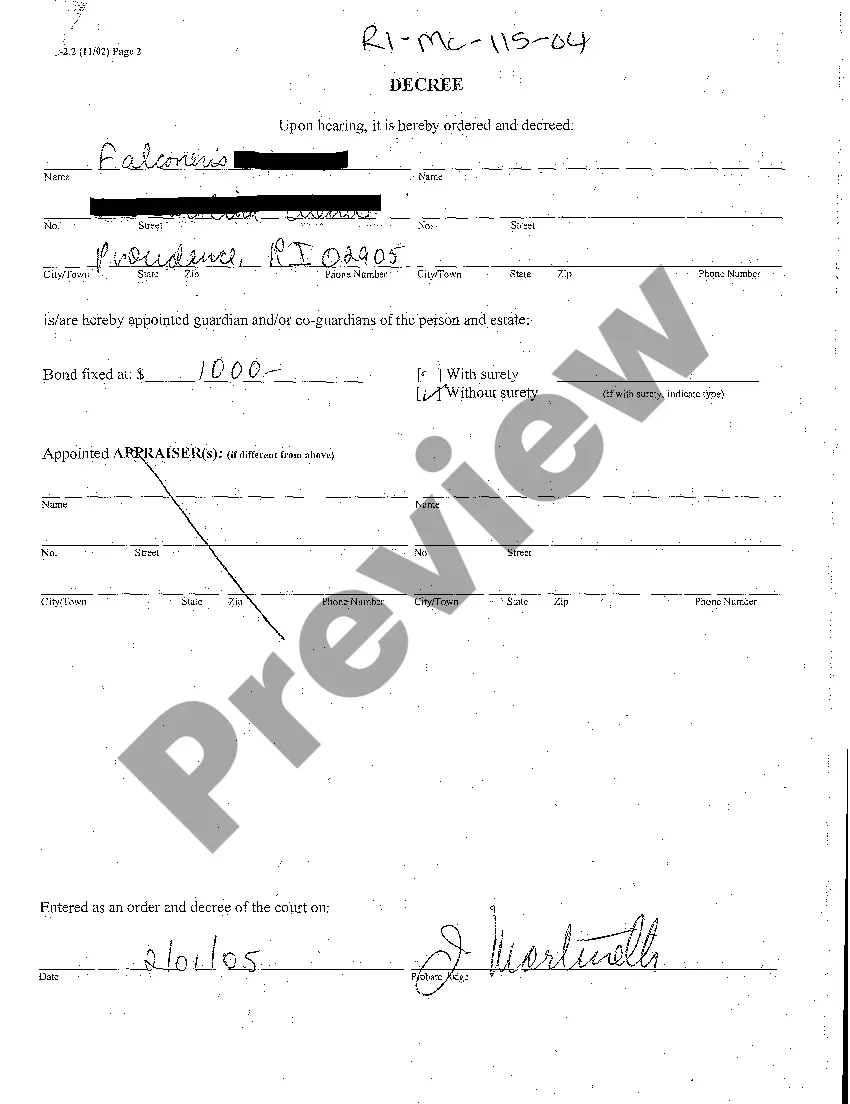

A deed to real property becomes a public document when it is recorded with the Recorder of Deeds subsequent to delivery and acceptance. The initial step in the recording process is the presentation of deed along with copies to the recorder's office in the county where the property is located.

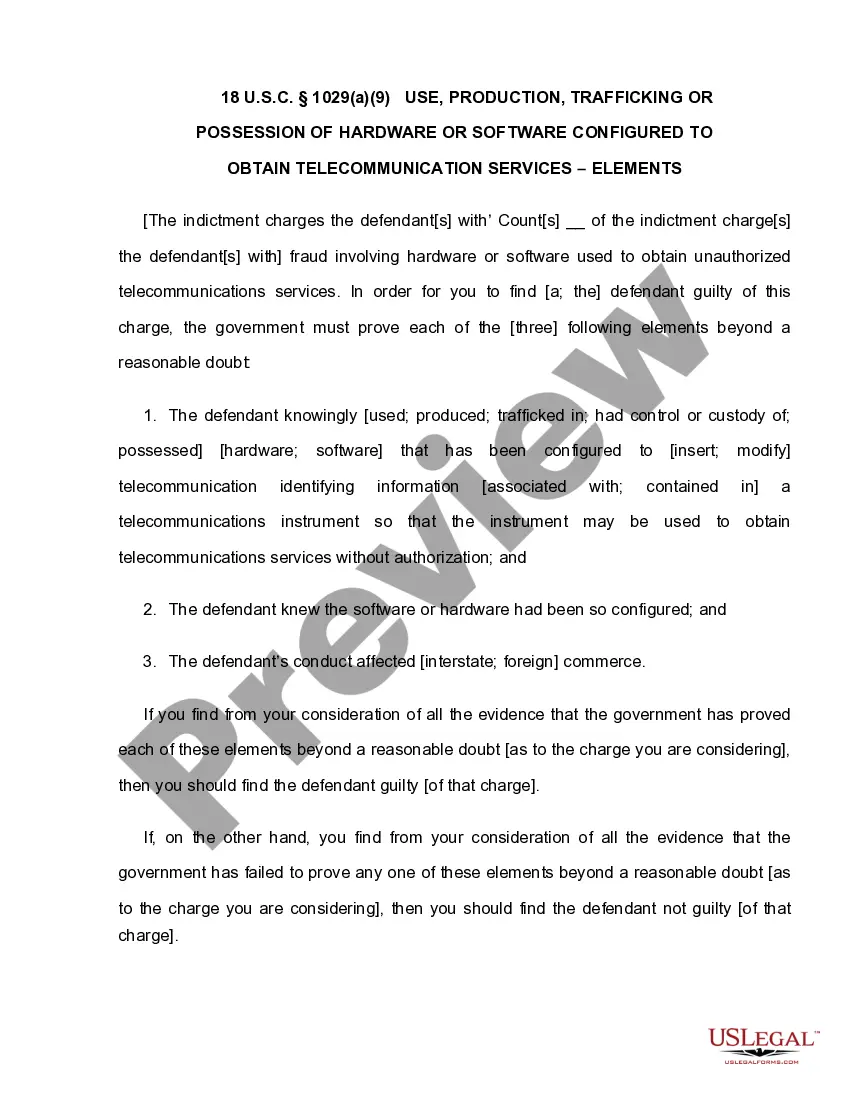

These include vital records (birth and death certificates, marriage and divorce licenses), criminal records, court records, professional licenses (such as medical, law, and driver's licenses), tax and property records, reports on publicly-traded companies, and FOIA or FOIL-able documents related to the operations of ...

Deeds of trust almost always include a power-of-sale clause, which allows the trustee to conduct a non-judicial foreclosure - that is, sell the property without first getting a court order.