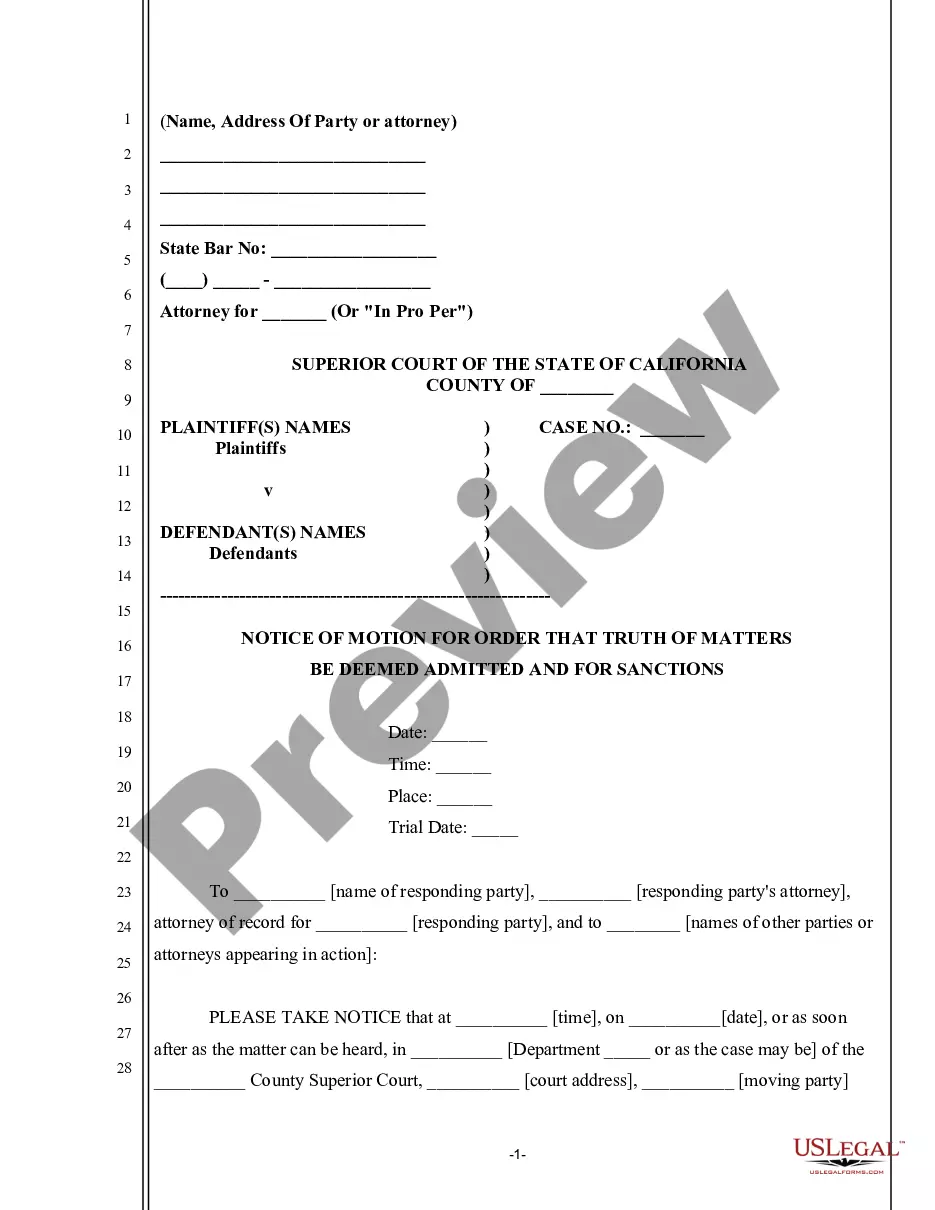

This form is a deed of trust modification. It is to be entered into by a borrower, co-grantor, and the lender. The agreement modifies the mortgage or deed of trust to secure a debt described within the agreement. Other provisions include: renewal and extension of the lien, co-grantor liability, and note payment terms.

Change Deed Trust With Future Advance Clause In New York

Description

Form popularity

FAQ

Mortgage States and Deed of Trust States StateMortgage StateDeed of Trust State New Hampshire Y New Jersey Y New Mexico Y New York Y 47 more rows

In real estate law, "assignment" is simply the transfer of a deed of trust from one party to another.

Is New York a Mortgage State or a Deed of Trust State? New York is a Mortgage state.

Deeds of trust are the most common instrument used in the financing of real estate purchases in Alaska, Arizona, California, Colorado, the District of Columbia, Idaho, Maryland, Mississippi, Missouri, Montana, Nebraska, Nevada, North Carolina, Oregon, Tennessee, Texas, Utah, Virginia, Washington, and West Virginia, ...

To change a deed in New York City, you will need a deed signed and notarized by the grantor. The deed must also be filed and recorded with the Office of the City Register. Transfer documents identifying if any taxes are due must also be filed and recorded with the City Register.

A deed of trust can benefit the lender because it allows for a faster and simpler way to foreclose on a home — typically months or even years faster.

Power of Sale Clause A power of sale provision is a significant element of a deed of trust, as it states the conditions when a trustee can sell the property on behalf of the beneficiary. Typically, this predicts when you will be delinquent on your mortgage.

After the trust is drawn up, transfer the title from your name to the trust's. The new deed names the trust as the grantee. Sign the deed in the presence of a notary public. Record the new deed in the county clerk's office where your home is located.

Use a Non-Judicial Settlement Agreement Effectively, if all of the parties to a trust agree to alter its terms, then the trust can be amended. Short of obstructing the trust's initial purpose, an NJSA provides trustees and beneficiaries with a virtually unlimited ability to amend the terms of a trust.

In California, you can modify your living trust to reflect changes in your life circumstances or wishes. To amend a living trust in California, you'll need to create a written amendment document that clearly states the changes you want to make to your trust.