Change Deed Trust With Future Advance Clause In Montgomery

Description

Form popularity

FAQ

The word mortgage comes from the Old French word “morgage”, which directly translates to “dead pledge”. (The prefix of the word, “mort”, means dead, while the suffix, “gage”, means pledge.)

A Trust Deed remains on your credit file for six years from its start date, alongside previous default notices, and before you're discharged you won't be able to obtain credit.

Commonly, both terms are used to mean the same type of legal document. A deed of trust is a legally binding document that contains a declaration of trust, but which also contains other statements (technically called 'trusts') that describe how the assets in trust should be dealt with.

Upon request of Borrower, the original holder of the Note may make Future Advances to Borrower, prior to cancellation of this Deed to Secure Debt. Such Future Advances, with interest thereon, shall be secured by this Deed to Secure Debt when evidenced by promissory notes stating that said notes are secured hereby.

Promissory notes also often contain the following clauses: waiver of presentment, negotiable instrument, payable on demand, interest rate, schedule of interest payments, schedule of payments, events of default, cure period, remedies, acceleration on default, method of payment, principal is secured, collateral as ...

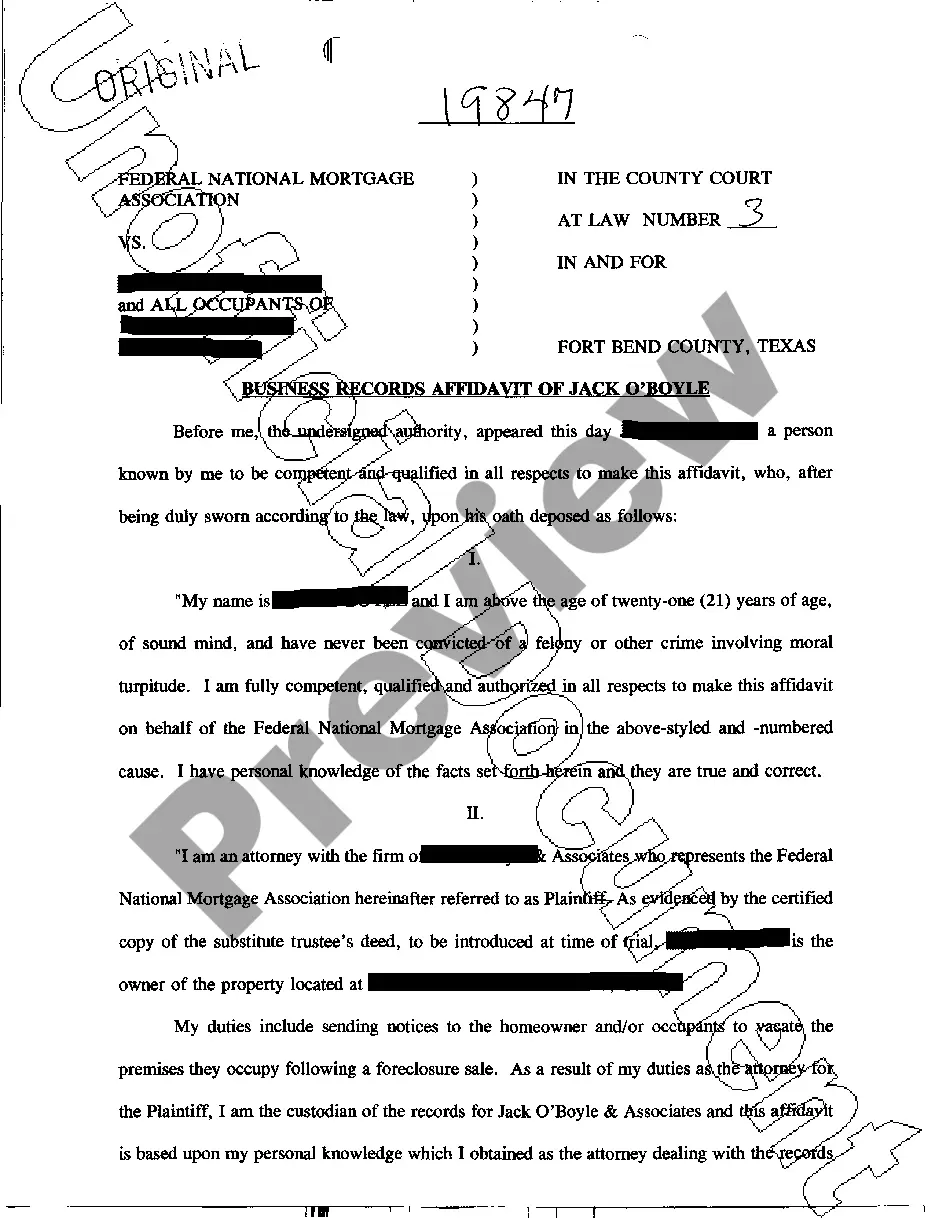

A Deed of Trust in Texas transfers title of real property in trust. It is the equivalent to a mortgage used in other states and provides a secured interest for a lender against real estate.

Future Advancement Opportunity refers to the potential for progression, growth, and elevation in one's career or professional journey that lies ahead. It encompasses opportunities for upward mobility, increased responsibilities, higher-level roles, and expanded influence within an organization or industry.

A trust deed gives the third-party “trustee” (usually a title company or real estate broker) legal ownership of the property.

Deeds of trust are typically an alternative to a mortgage used in different states. The direct nature of a contract for deed allows for personalized negotiations directly between buyer and seller, fostering a more dynamic and adaptable transaction.