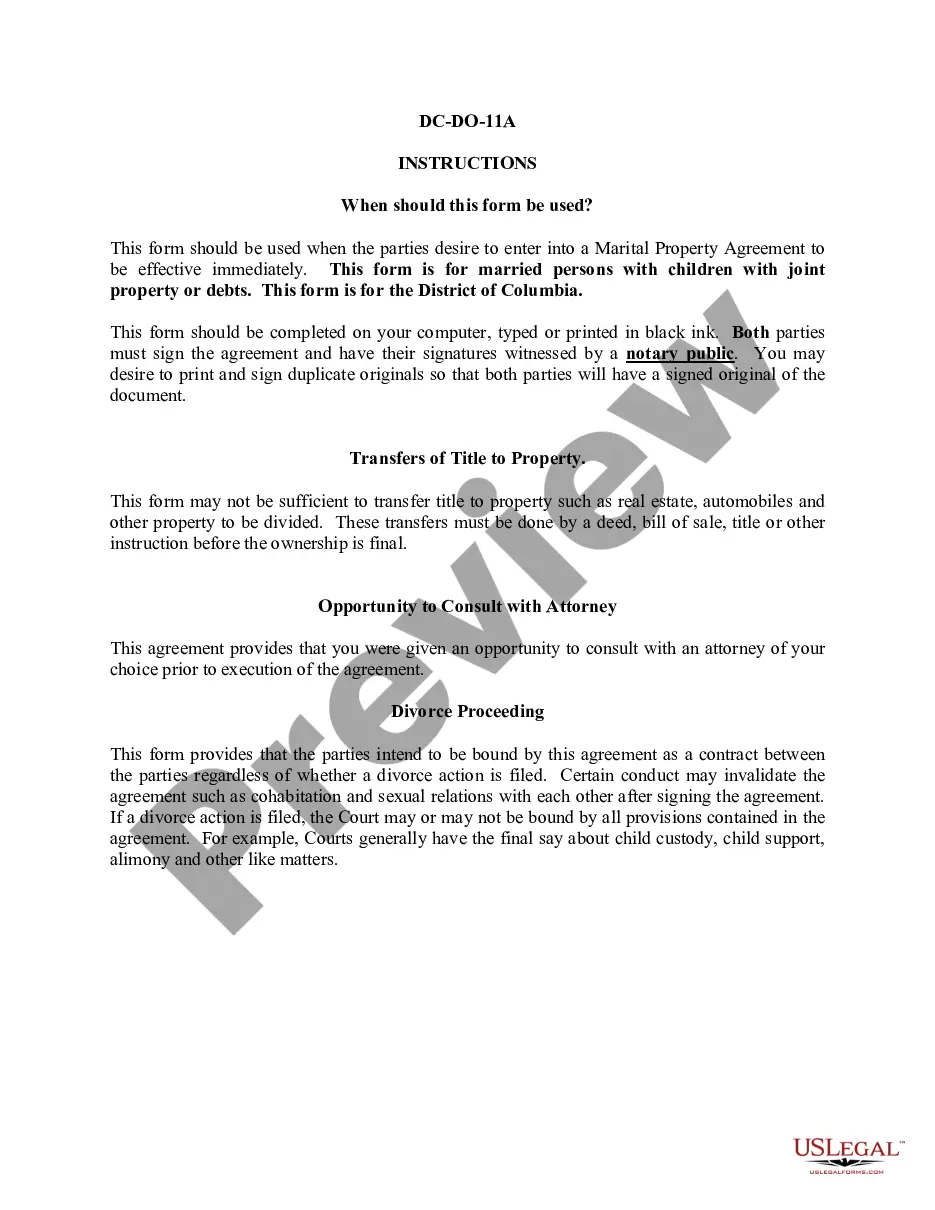

This form is a deed of trust modification. It is to be entered into by a borrower, co-grantor, and the lender. The agreement modifies the mortgage or deed of trust to secure a debt described within the agreement. Other provisions include: renewal and extension of the lien, co-grantor liability, and note payment terms.

Deed Of Trust Records With Future Advance Clause In Minnesota

Description

Form popularity

FAQ

A power of sale clause in a trust deed allows the trustee to sell investments in a trust upon default by Borrower.

Definition of "subject to" A term used when acquiring title to property which has an existing mortgage or deed of trust, indicating that the new owner will continue to make the payments on the debt owed.

The lien priority of a future advance is determined by the law of the state in which the real property security is located. Lien priority under state law may depend on specific factors, such as whether: The future advance is deemed obligatory or optional. The intervening lien is a mechanic's lien.

Under Minnesota law, the statute of limitations depends on the severity of the crime you face, ranging from 3 years to no limit. Any period which the defendant: does not usually reside in Minnesota. Participates in a pretrial diversion program related to the crime.

Yes, Minnesota has a law that lets you transfer the title to real estate when you die to avoid probate. It is an estate planning tool called a Transfer on Death Deed (TODD). It is like the "payable on death" (POD) designation on a bank account.

(a) A vendee who fails to record a contract for deed, as required by subdivision 1, is subject to a civil penalty, payable under subdivision 5, equal to two percent of the principal amount of the contract debt, unless the vendee has not received a copy of the contract for deed in recordable form, as required under ...

In Minnesota, typically the legal description of a property will denote “abstract” or “Torrens,” but if not, our office can assist with such determination and how to place documents correctly of record in any Minnesota county. 4) Mortgages: Minnesota is a mortgage state, not a deed of trust state.

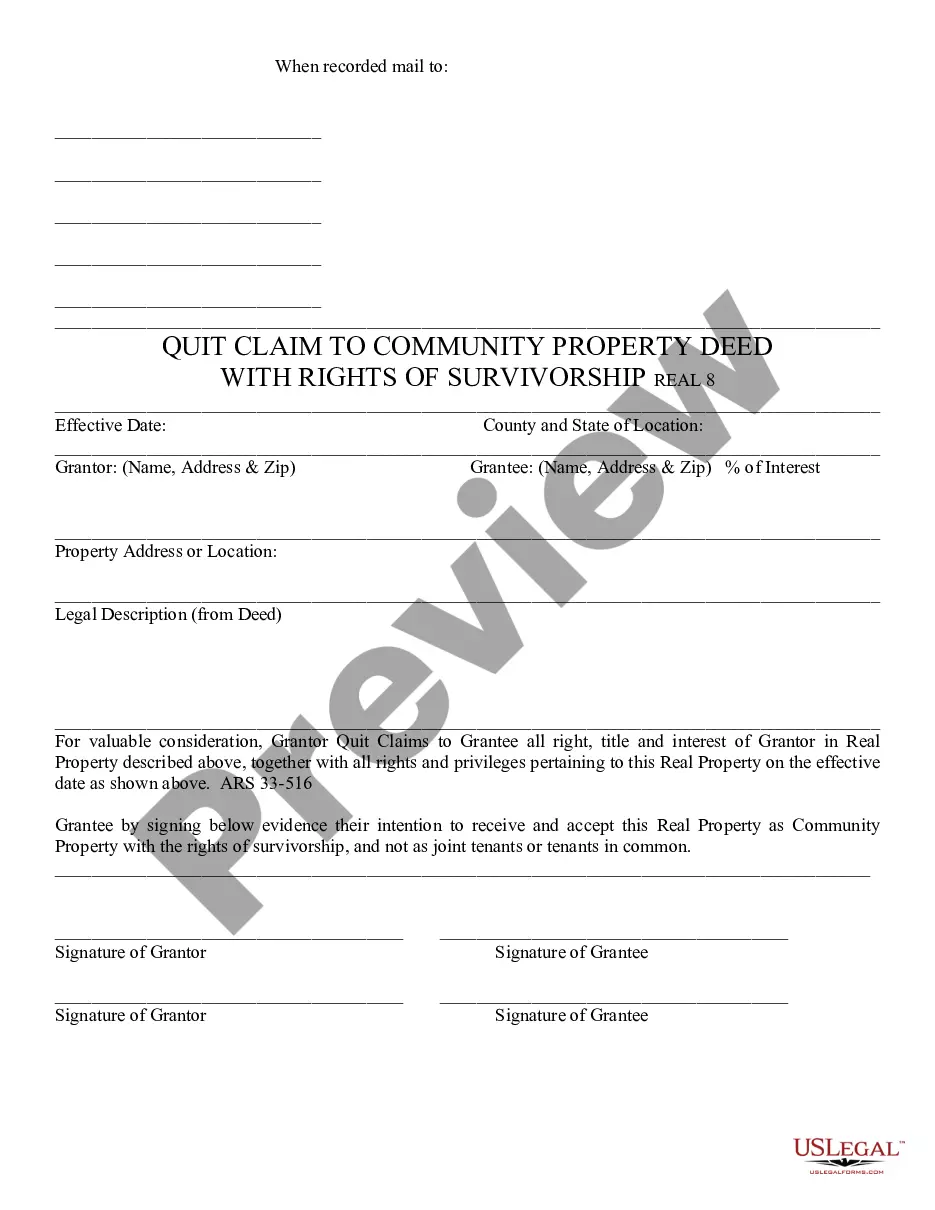

Current Owner and New Owner Information. A Minnesota deed must include the names of the current owner (the grantor) signing the deed and the new owner (the grantee) receiving title to the property. Deeds customarily state each party's address and marital status.

When there is no additional consideration over $3,000 for executing and delivering the corrective deed over and above the consideration already taxed for the original deed, only the minimum deed tax of $1.65 is charged on the quit claim deed.

(2) record the contract for deed in the office of the county recorder or registrar of titles in the county in which the land is located.