Deeds Of Trust In Nebraska In Kings

Description

Form popularity

FAQ

If your deed was recorded in the register of deeds' office, you can always obtain a copy or certified copy of your document. A certified copy is as good as an original. Refer to our homepage link, “reports/copies” for forms and fees.

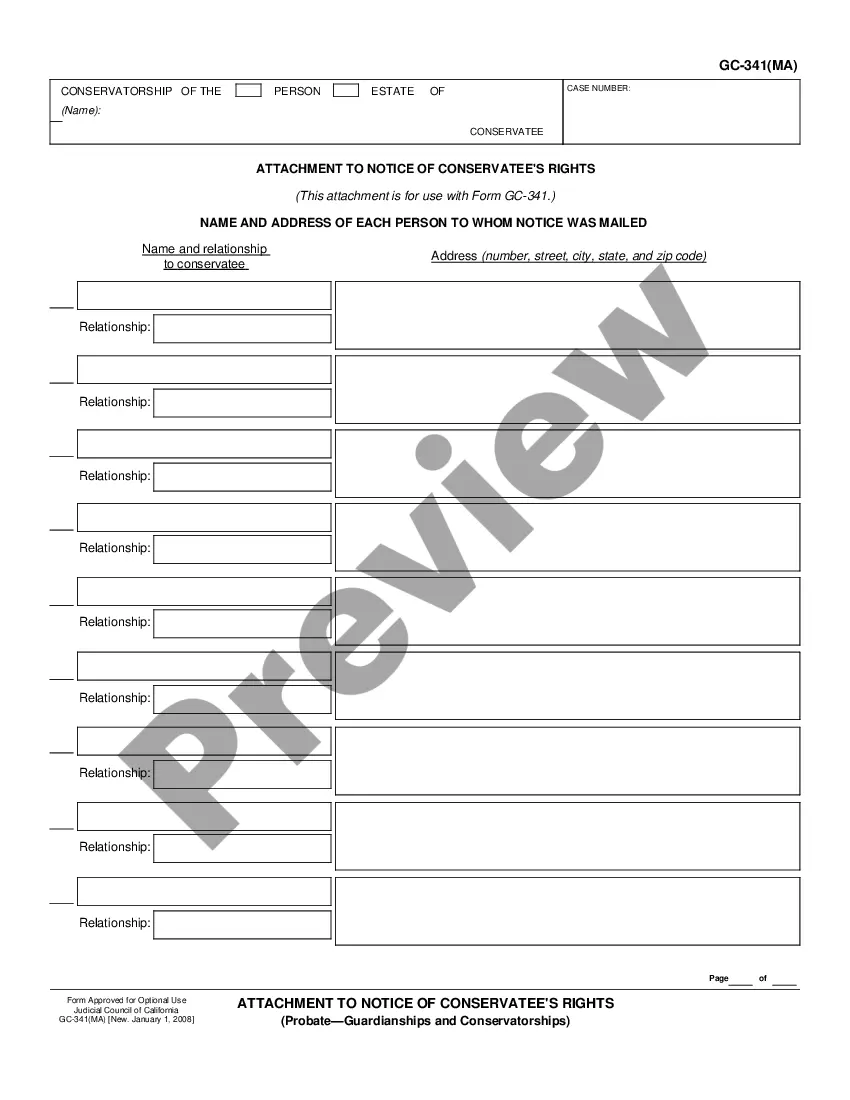

The deed of trust must then be recorded with the county where the property is located, and each of the parties (the trustor, trustee, and lender) should keep a copy of the recorded document.

A deed of trust will include the same type of information stated in a mortgage document, such as: The identities of the borrower, lender, and trustee. A full description of the property to be placed in trust. Any restrictions or requirements on the use of the property while it is in trust.

This Deed of Trust (the “Trust Deed”) sets out the terms and conditions upon which: Settlor Name (the “Settlor”), of Settlor Address, settles that property set out in Schedule A (the “Property”) upon Trustee Name (the “Trustee”), being a Company duly registered under the laws of state with registered number ...

Yes you can complete and record your own deed. It must b properly signed, witnessed, and notarized.

A deed of trust is normally recorded with the recorder or county clerk for the county where the property is located as evidence of and security for the debt. The act of recording provides constructive notice to the world that the property has been encumbered.

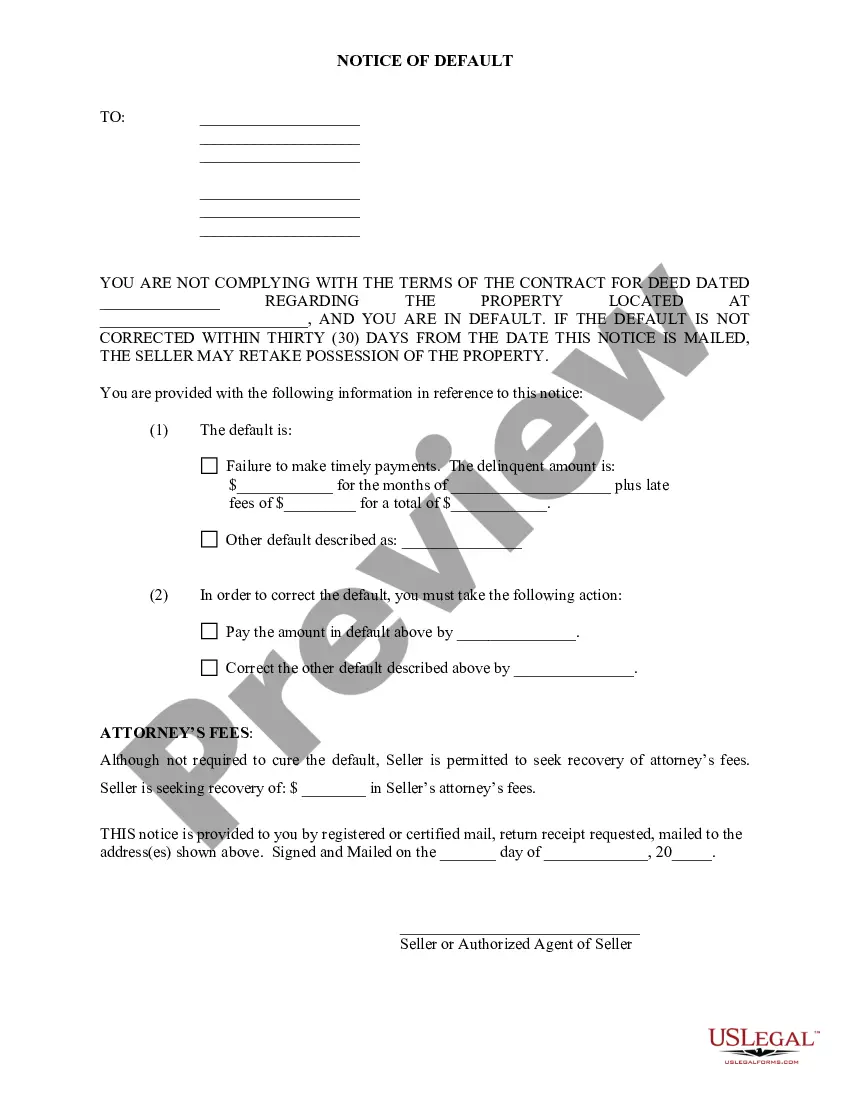

(1) After the expiration of ten years from the date of maturity of any debt or other obligation secured by a deed of trust, mortgage, or real estate sale contract as stated in or ascertainable from the record of such deed of trust, mortgage, or contract and, in cases where the date of such maturity cannot be ...

Disadvantages of a Trust Deed For borrowers, if financial circumstances change, default on repayment can result in property foreclosure.

Nebraska is a Deed of Trust state.