Trust Deed Format For Temple In Georgia

Description

Form popularity

FAQ

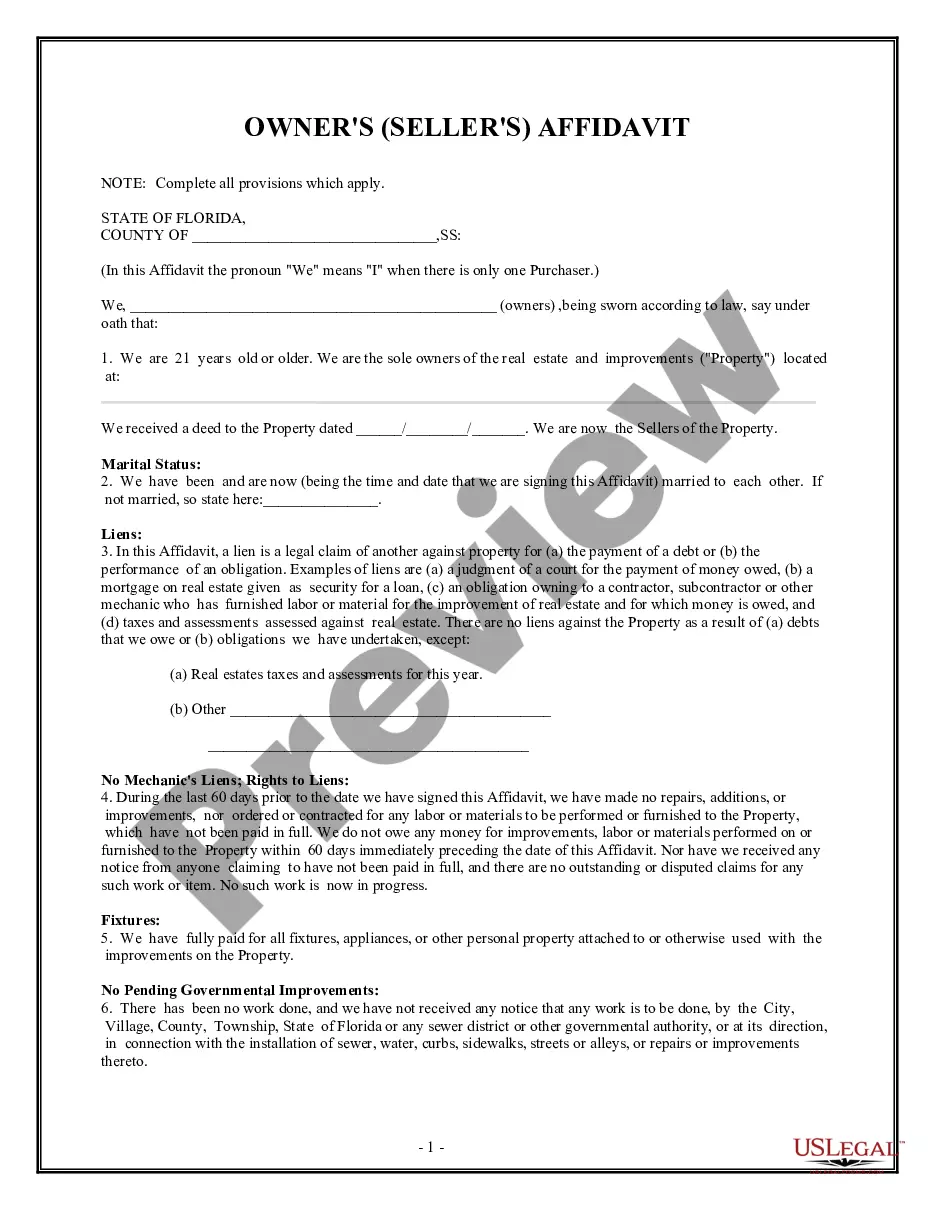

Where to Get a Deed of Trust? To get a Deed of Trust, you must file the proper paperwork with the proper court as generally outlined above. These documents must be filed with the county clerk or recorder, and the lender typically sends them to the recording office after the property closing.

A security deed (deed to secure debt) is the customary security instrument in Georgia. Georgia does not use a Deed of Trust.

Is Georgia a Mortgage State or a Deed of Trust State? Georgia is a Deed of Trust state.

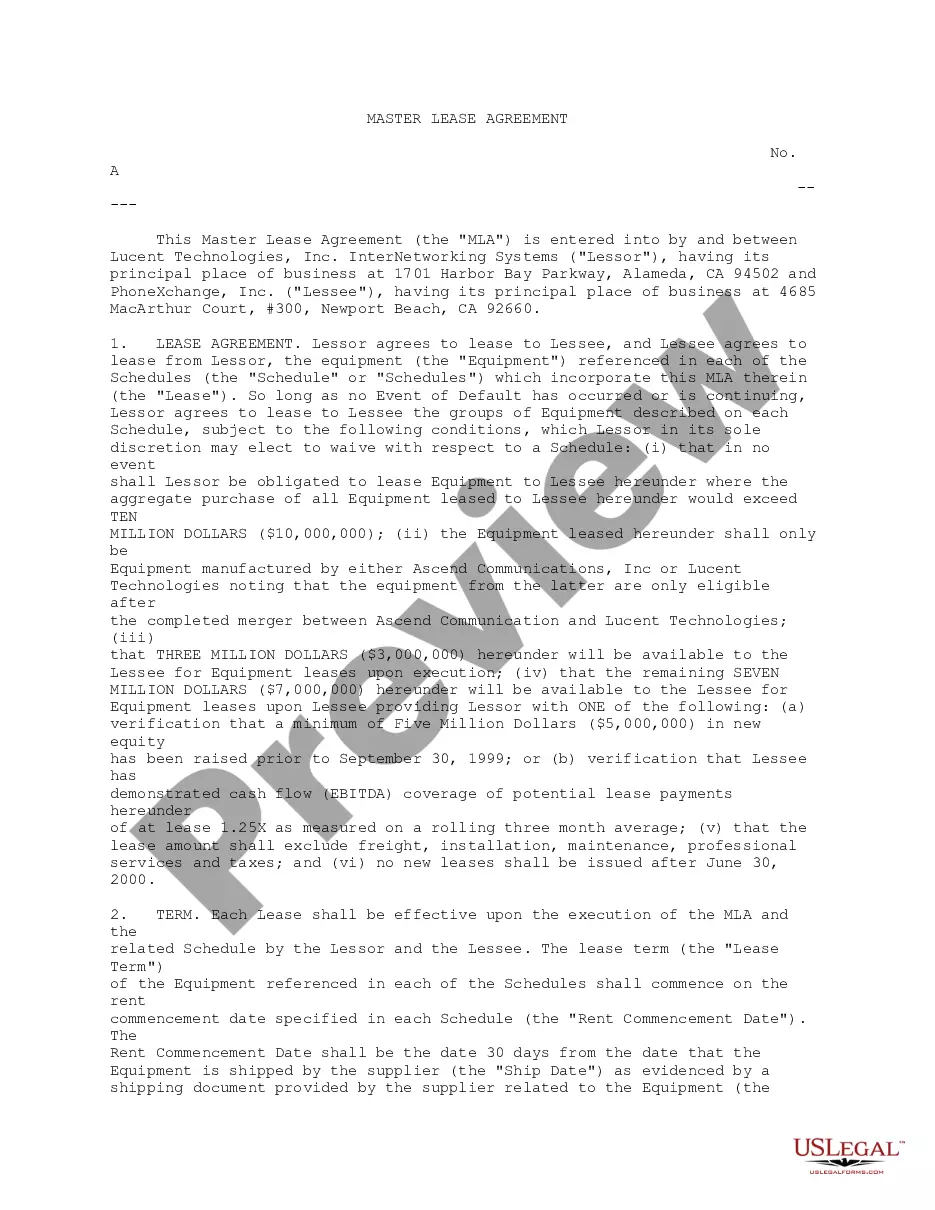

This Deed of Trust (the “Trust Deed”) sets out the terms and conditions upon which: Settlor Name (the “Settlor”), of Settlor Address, settles that property set out in Schedule A (the “Property”) upon Trustee Name (the “Trustee”), being a Company duly registered under the laws of state with registered number ...

Transfer Your Home Into the Trust You must complete the deed transferring ownership of the property before a witness and a notary public and have the deed notarized. You must submit the deed and a PT-61 tax transfer document to the Superior court clerk in your county.

Deeds of trust are the most common instrument used in the financing of real estate purchases in Alaska, Arizona, California, Colorado, the District of Columbia, Idaho, Maryland, Mississippi, Missouri, Montana, Nebraska, Nevada, North Carolina, Oregon, Tennessee, Texas, Utah, Virginia, Washington, and West Virginia, ...

Trust is the reason we're willing to exchange our hard-earned paychecks for goods and services, pledge our lives to another person in marriage, cast a ballot for someone who will represent our interests.

How do I fill this out? Gather information about trustees, settlors, and trust creation date. Identify the powers of the trustees and whether the trust is revocable or irrevocable. Fill out each section ingly, following the prompts. Ensure all acting trustees sign the document. Notarize the document if required.

Types of trust Bare trust. This is the simplest trust and gives all assets to the beneficiary as long as they're 18 years old or over (in England and Wales). Interest in possession trust. Discretionary trust. Mixed trust. Trust for a vulnerable person. Non-resident trusts.

For example, a sole proprietorship of a business might choose to place their business in a trust that they can revoke or amend at any time prior to their death and where they are the beneficiary until their death. Or they could create a trust and leave the business in the trust in their will.