Deed Of Trust Modification Form Fort Worth Tx In Dallas

Description

Form popularity

FAQ

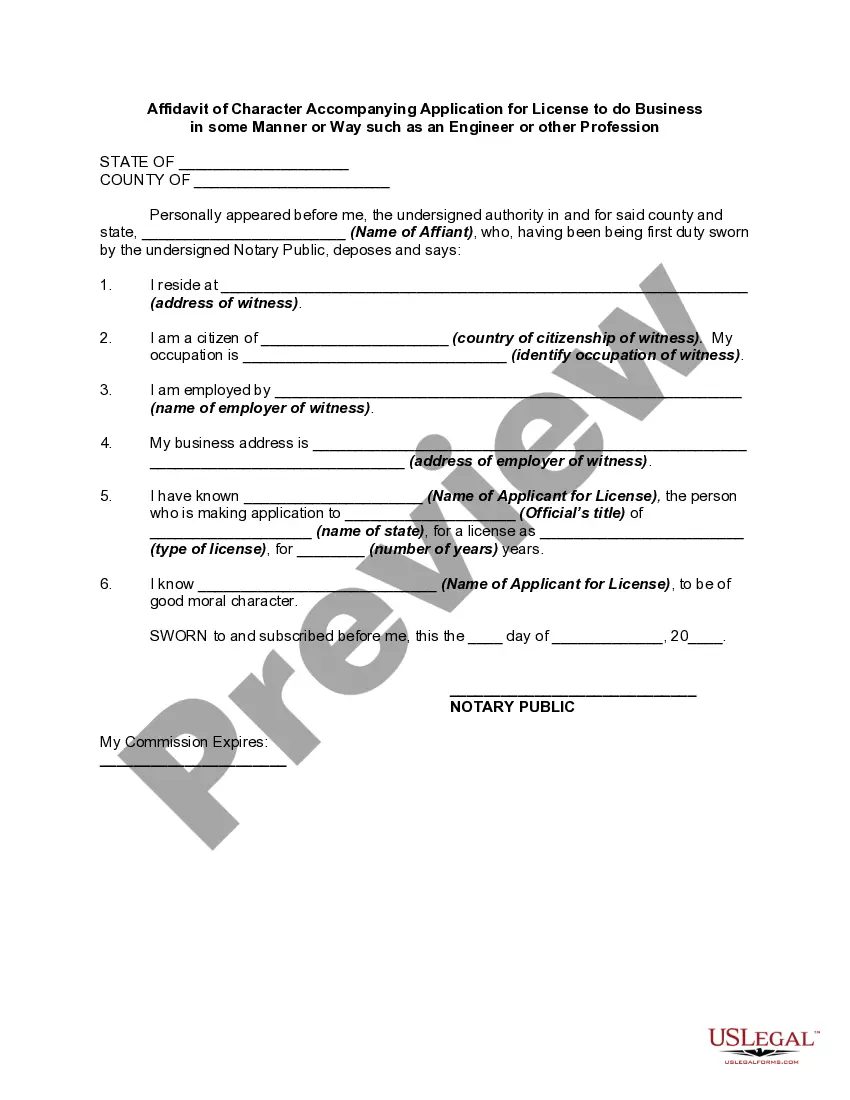

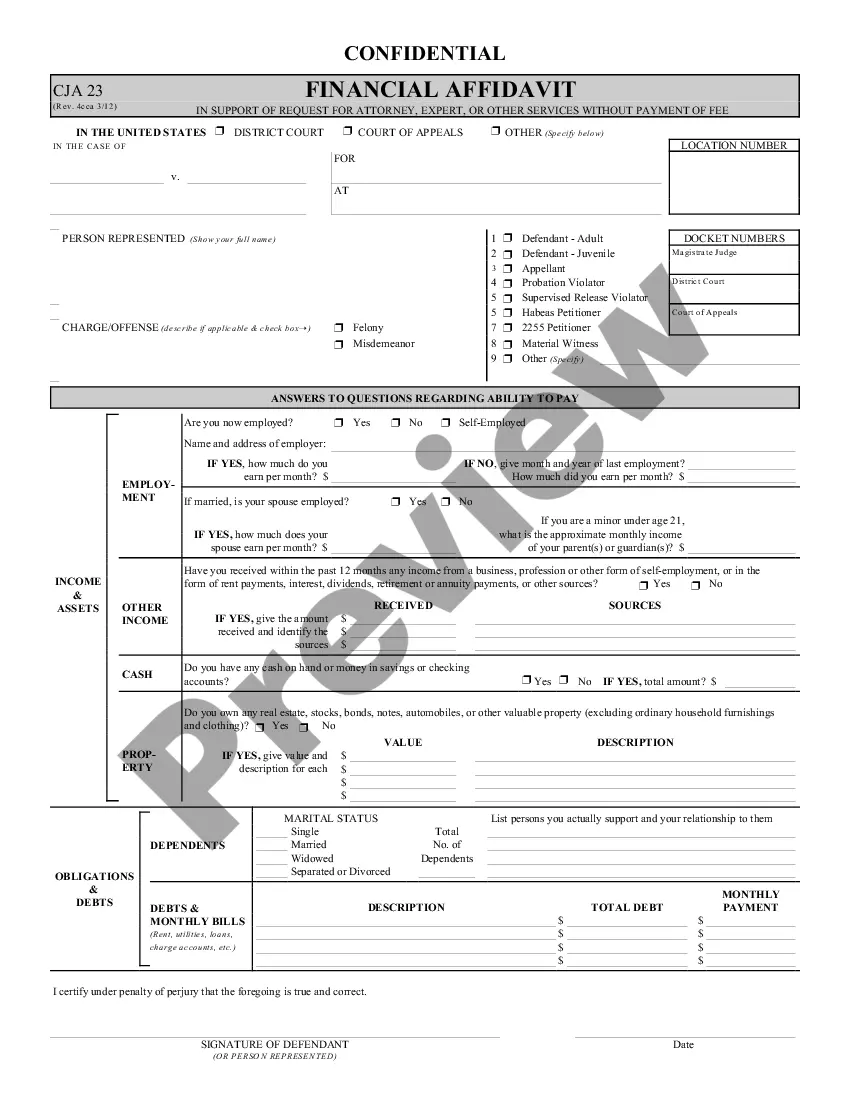

The appropriate person must sign the document, and that person's signature must be notarized (i.e., Release, Deed of Trust, Deed, etc.). A Release issued by the Internal Revenue Service is not required to be notarized. The document must include legal descriptions when applicable.

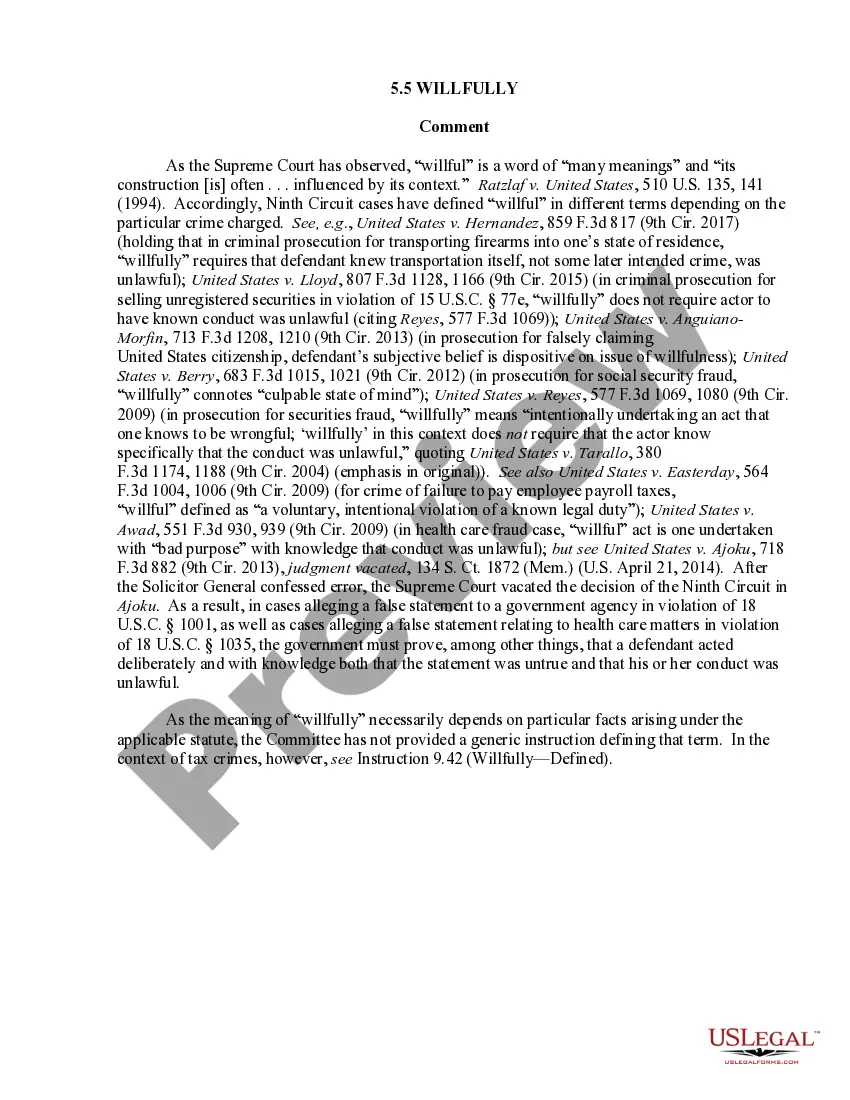

Deed of Trust Modification means, with respect to any Deed of Trust, a modification agreement entered into between the Borrower or the Project Owner, as applicable, and the Lender, modifying the terms and conditions of the Deed of Trust in order to (i) add to the lien of the Deed of Trust Additional Lots, or (ii) make ...

Processing a Release of Deed of Trust Execution: The lender or authorized agent signs the release, and it is notarized as required. Recording: The release is submitted to the county recorder's office for official recording, making it part of the public record.

Transfers of real property must be in writing and notarized. Deeds should be recorded in the county where the property is located. To ensure a legal change to the property title, you'll want the services of an attorney. A qualified attorney will prepare and file the real estate transfer deed.

You can seek assistance from an estate planning attorney or use online services like to guide you. After preparing the trust documents, have them executed in the presence of a notary public to render the whole trust agreement legally binding.

Deed of Trust Modification means, with respect to any Deed of Trust, a modification agreement entered into between the Borrower or the Project Owner, as applicable, and the Lender, modifying the terms and conditions of the Deed of Trust in order to (i) add to the lien of the Deed of Trust Additional Lots, or (ii) make ...

Your deeds and legal documents will be prepared professionally and correctly by a Texas licensed attorney. Board Certified by the Texas Board of Legal Specialization in Residential Real Estate Law.

The Trustee is usually the person that prepares the Deed of Trust. It is usually a lawyer or an employee of the Lender. The Lender can change the Trustee at any time.

Deed of Trust Modification means, with respect to any Deed of Trust, a modification agreement entered into between the Borrower or the Project Owner, as applicable, and the Lender, modifying the terms and conditions of the Deed of Trust in order to (i) add to the lien of the Deed of Trust Additional Lots, or (ii) make ...

Yes, you can sell a home with a Deed of Trust. However, just like a mortgage, if you're selling the home for less than you owe on it, you'll need approval from the lender.