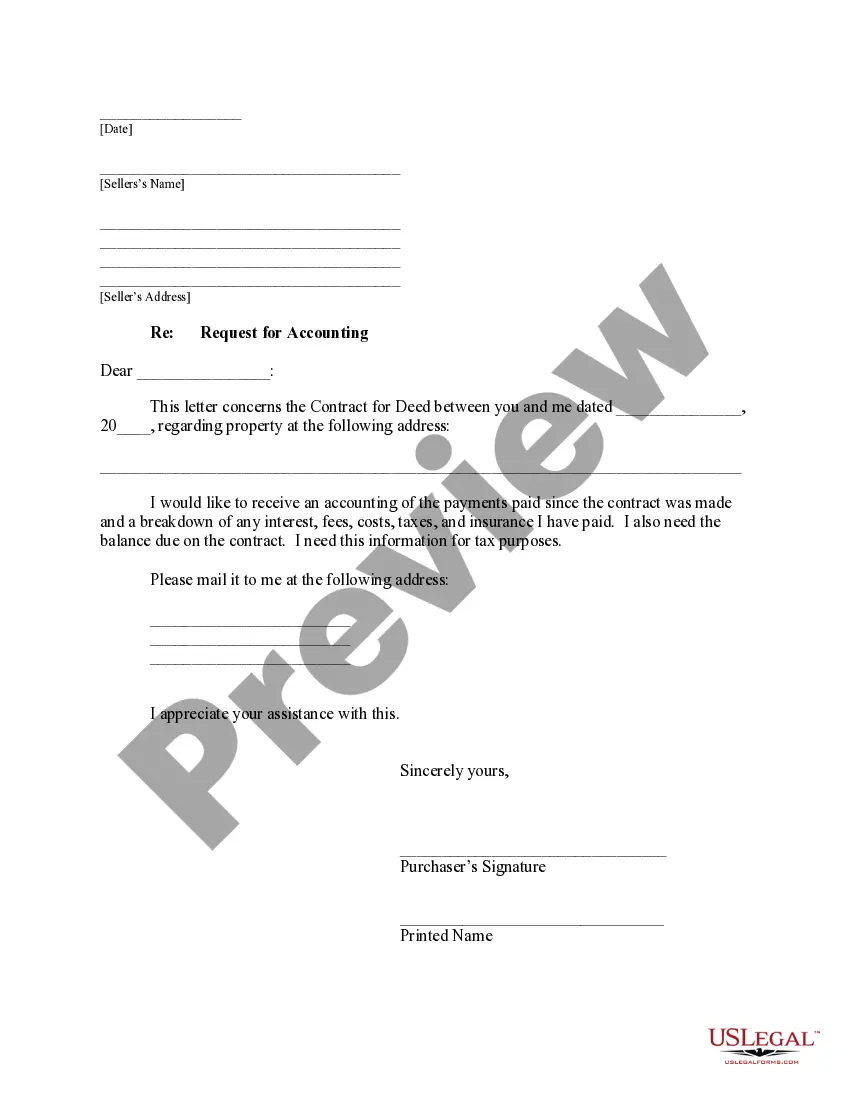

This form is a deed of trust modification. It is to be entered into by a borrower, co-grantor, and the lender. The agreement modifies the mortgage or deed of trust to secure a debt described within the agreement. Other provisions include: renewal and extension of the lien, co-grantor liability, and note payment terms.

Deed Of Trust Without Promissory Note In Cuyahoga

Description

Form popularity

FAQ

A deed of trust will include the same type of information stated in a mortgage document, such as: The identities of the borrower, lender, and trustee. A full description of the property to be placed in trust. Any restrictions or requirements on the use of the property while it is in trust.

Example: When used in a real estate transaction, the promissory note covers the promise to repay the amount owed, interest, and maturity date — while the deed of trust or mortgage outlines the other responsibilities of the parties involved more precisely.

Yes you can complete and record your own deed. It must b properly signed, witnessed, and notarized.

Unlike a deed of trust or mortgage, the promissory note is typically not recorded in the county land records (except in a few states like Florida). Instead, the lender holds on to this document until the amount borrowed is repaid.

Deeds and additional ownership documentation (circa 1810 to present) is available online or in person at the Recorder's Office, located on the 4th floor of the Cuyahoga County Administration Building. Circa 1860-1945, available at the Cuyahoga County Archives.

If you want to obtain a copy of the deed to your home, contact your local county recorder. In Ohio, county recorders are responsible for maintaining land records and making them accessible to the public.

In a deed of trust, the borrower (trustor) transfers the Property, in trust, to an independent third party (trustee) who holds conditional title on behalf of the lender or note holder (beneficiary) for the purpose of exercising the following powers: (1) to reconvey the deed of trust once the borrower satisfies all ...

Where to Get a Deed of Trust? To get a Deed of Trust, you must file the proper paperwork with the proper court as generally outlined above. These documents must be filed with the county clerk or recorder, and the lender typically sends them to the recording office after the property closing.

You may use the Recorded Document Search or call the Recorders Public Information Department at 216-443-7300 for further details. This site is provided to allow the citizens of Cuyahoga County, and the world, access to information housed at our office.

In Ohio, the local county recorder is the main office that collects, files, and maintains property records. Each county has its own office, and in Ohio, that means at least 88 offices. Property records must be filed with the county recorder's office where the property is located.