Trust Deed Format For Gratuity In Cook

Description

Form popularity

FAQ

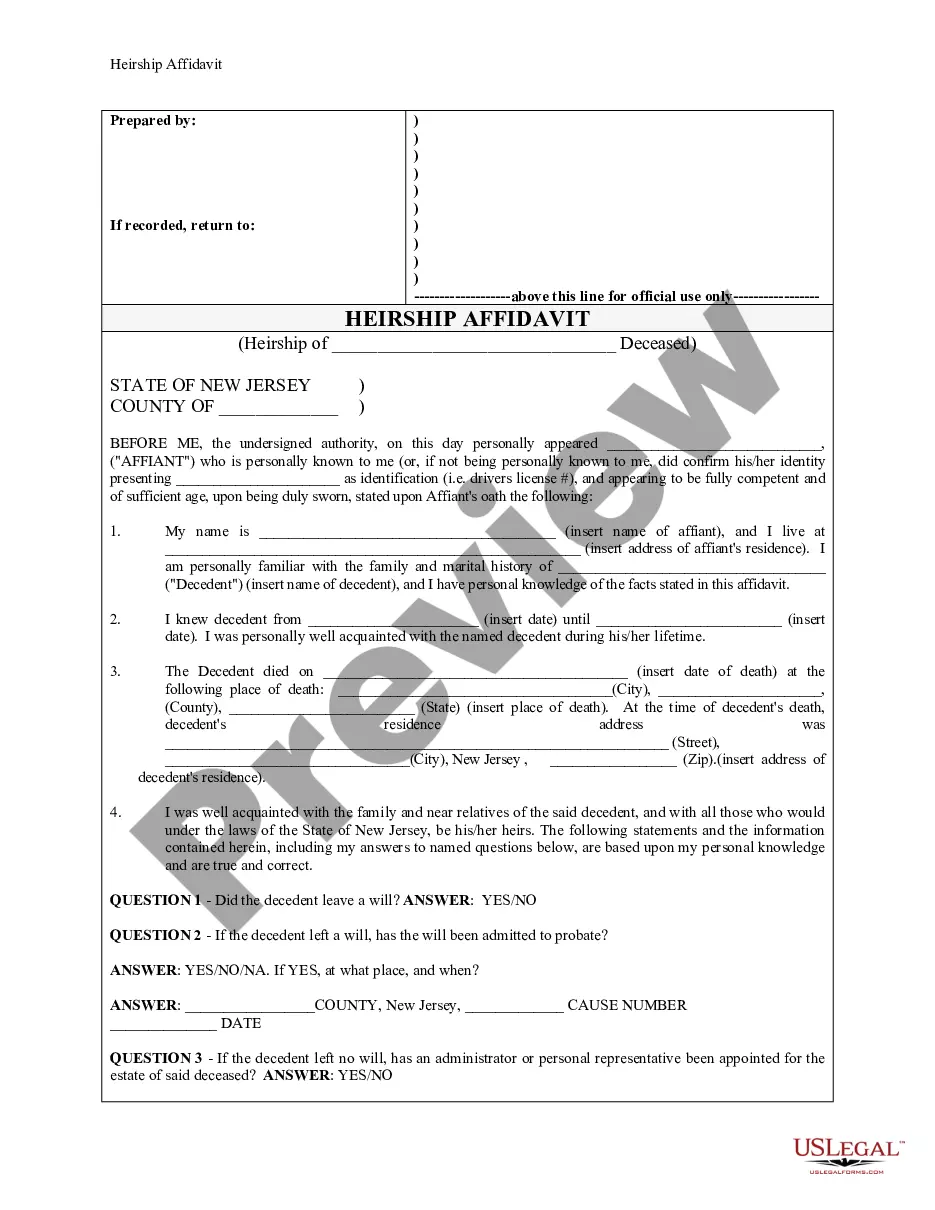

This Deed of Trust (the “Trust Deed”) sets out the terms and conditions upon which: Settlor Name (the “Settlor”), of Settlor Address, settles that property set out in Schedule A (the “Property”) upon Trustee Name (the “Trustee”), being a Company duly registered under the laws of state with registered number ...

How do trusts work? A trust is a fiduciary1 relationship in which one party (the Grantor) gives a second party2 (the Trustee) the right to hold title to property or assets for the benefit of a third party (the Beneficiary). The trustee, in turn, explains the terms and conditions of the trust to the beneficiary.

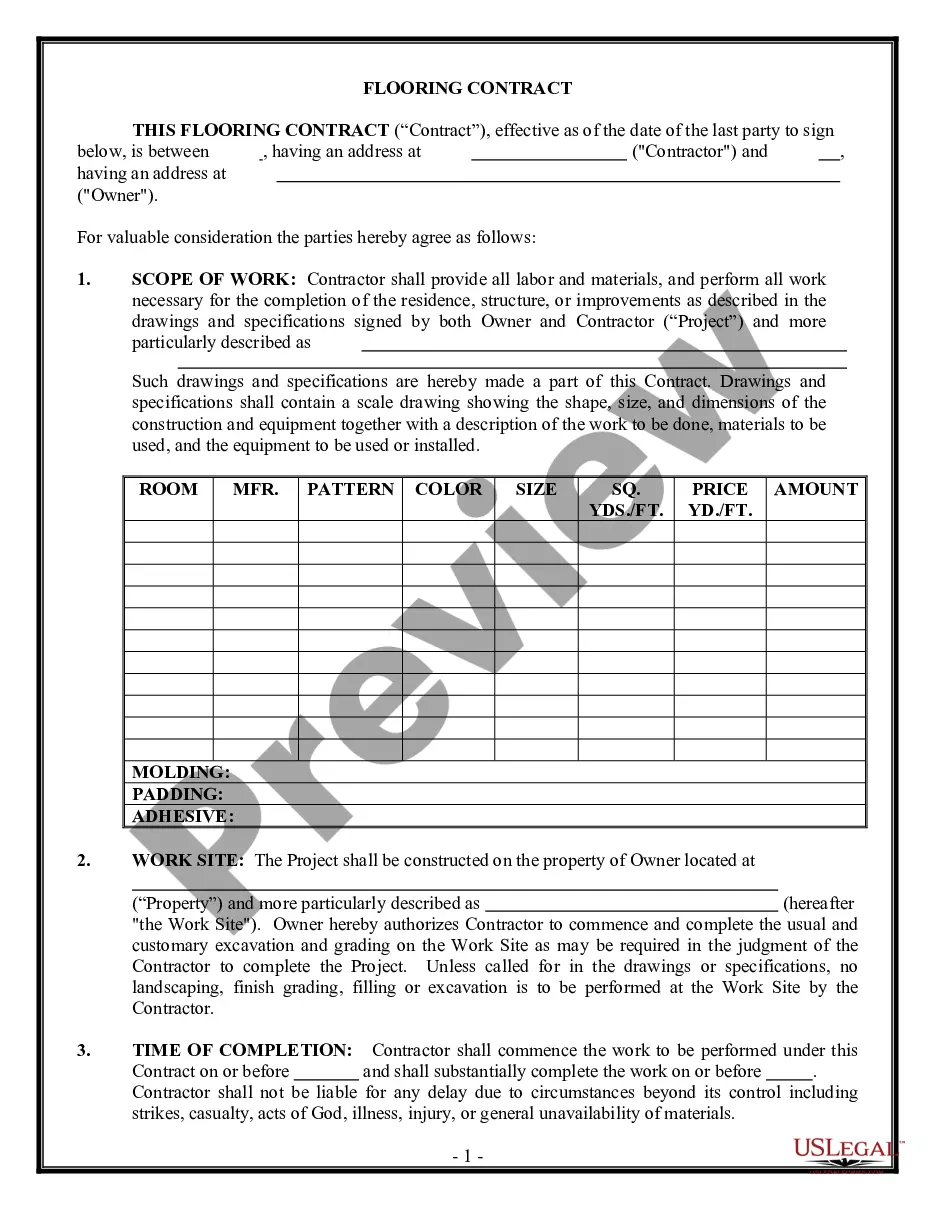

A deed of trust will include the same type of information stated in a mortgage document, such as: The identities of the borrower, lender, and trustee. A full description of the property to be placed in trust. Any restrictions or requirements on the use of the property while it is in trust.

A trust provides a mechanism for a person (the settlor) to provide property to another person (the trustee) for the benefit of a third person (the beneficiary or beneficiaries) while imposing certain restrictions and conditions over the property. The property is held and administered by the trustee.

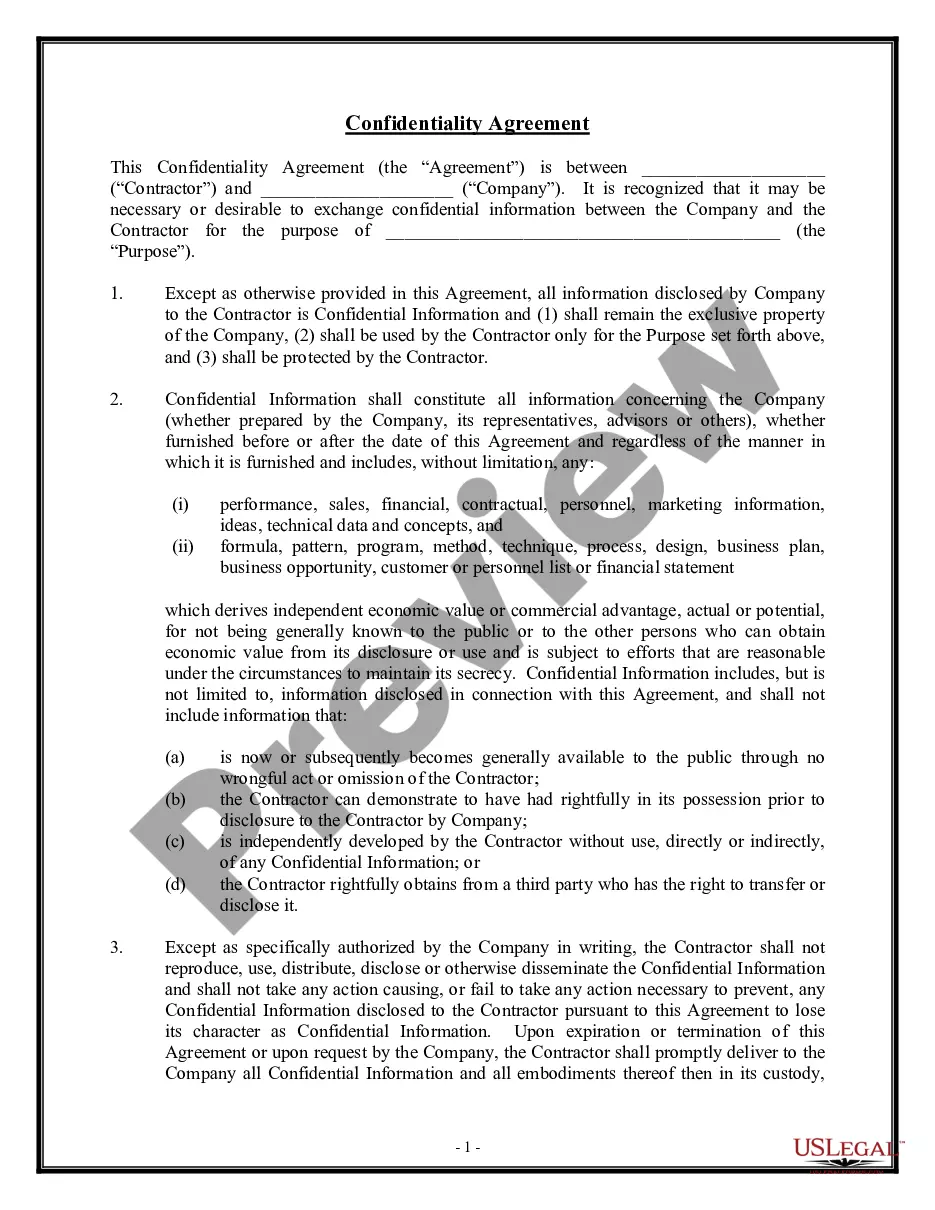

The trust deed: The trust deed (or, in the case of a testamentary trust, the will) is the formal document which sets out how the trust will run and what the trustee is allowed to do. It is very important that the trust deed or will is drafted by a solicitor.

How to Create a Living Trust in California Take an inventory of your assets. Select your trustee. Designate your Beneficiaries. Write up your Declaration of Trust. Sign your Trust in front of a Notary Public (optional). Transfer assets and property to the Trust.

This Deed of Trust (the “Trust Deed”) sets out the terms and conditions upon which: Settlor Name (the “Settlor”), of Settlor Address, settles that property set out in Schedule A (the “Property”) upon Trustee Name (the “Trustee”), being a Company duly registered under the laws of state with registered number ...

Colorado is unique in that it is the only state in the union to have a public trustee system. As a result, all deeds of trust must name the public trustee for the respective property's county as trustee.

Requirements for Release of Deed of Trust Accurate Information: The release must include precise details of the original deed of trust, including recording information and property description. Authorized Signatures: The lender or an authorized representative must sign the release, and it often requires notarization.

You cannot apply for a trust deed on your own. A 'trustee' helps you with your application. You must get debt advice to find out if a trust deed is right for you. A protected trust deed is a Scottish debt solution which is similar to an IVA.