Deeds Of Trust For Sale In Clark

Description

Form popularity

FAQ

Three parties are involved in a deed of trust: the trustor (or the borrower), the trustee (the third party who holds legal title to the property) and the beneficiary (the lender).

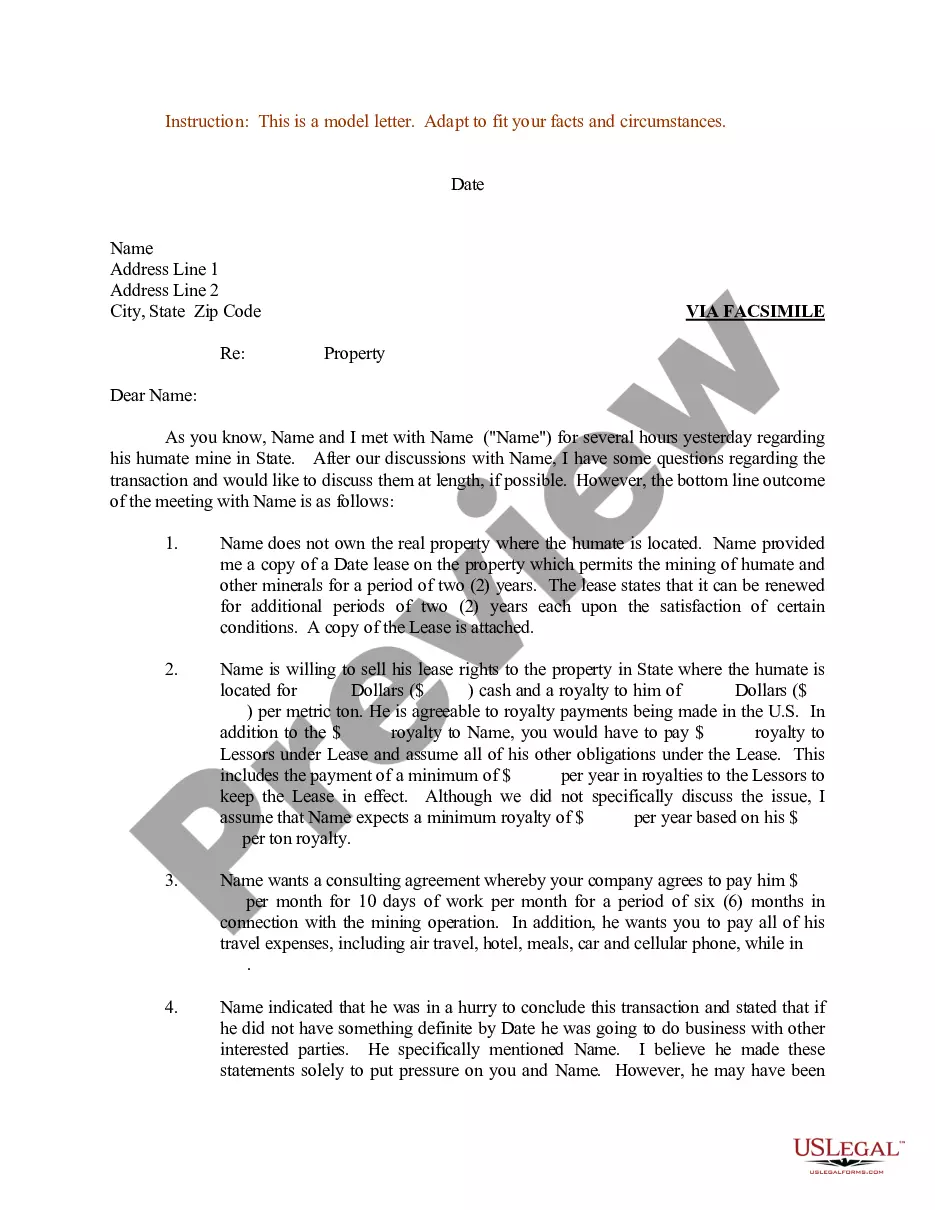

Where to Get a Deed of Trust? To get a Deed of Trust, you must file the proper paperwork with the proper court as generally outlined above. These documents must be filed with the county clerk or recorder, and the lender typically sends them to the recording office after the property closing.

You will usually be discharged after four years, but some trust deeds can last for longer. This information will be included in the terms of the trust deed. If the trust deed does not become protected, your discharge will only be binding on those creditors who agreed to the arrangement.

Colorado is unique in that it is the only state in the union to have a public trustee system. As a result, all deeds of trust must name the public trustee for the respective property's county as trustee.

For Deeds, Mortgages or other property related records, consult the County Recorder of the county where the transaction occurred. See for county recorder contact information.

Yes, you can sell a home with a Deed of Trust. However, just like a mortgage, if you're selling the home for less than you owe on it, you'll need approval from the lender.

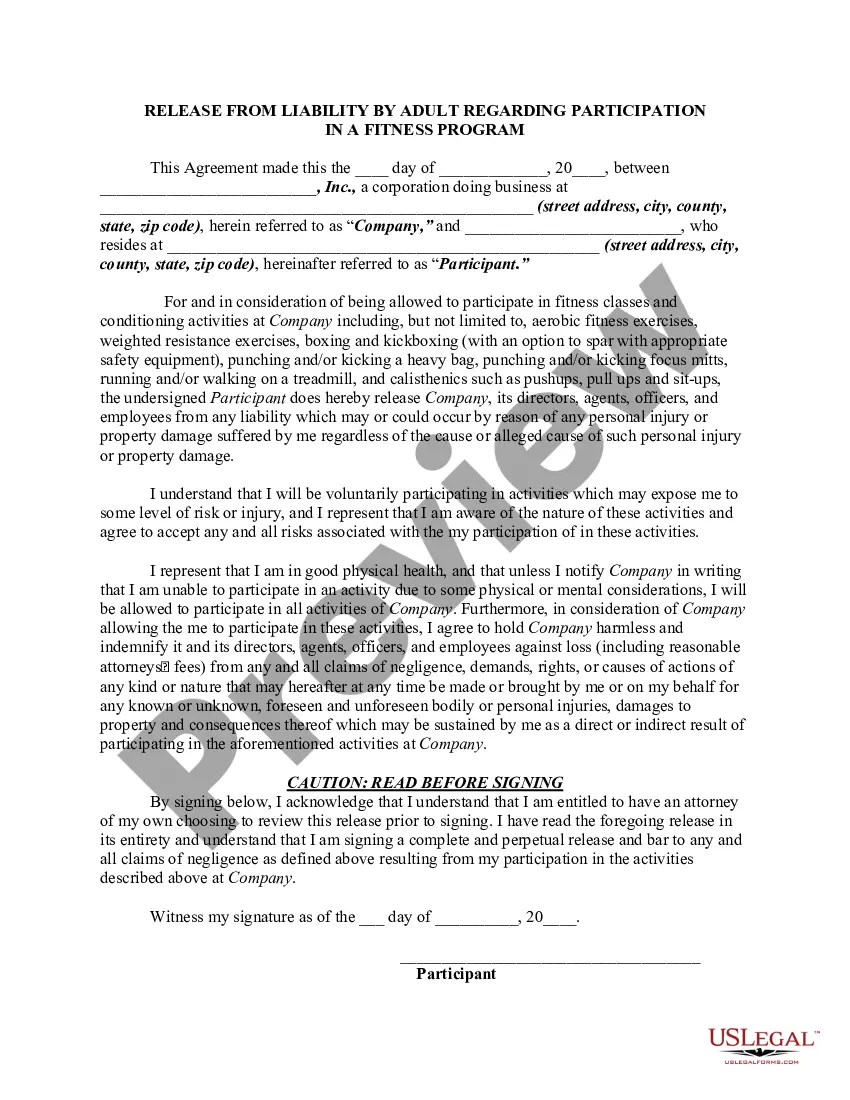

Requirements for Release of Deed of Trust Accurate Information: The release must include precise details of the original deed of trust, including recording information and property description. Authorized Signatures: The lender or an authorized representative must sign the release, and it often requires notarization.

A trust deed gives the third-party “trustee” (usually a title company or real estate broker) legal ownership of the property.

A power of sale clause in a trust deed allows the trustee to sell investments in a trust upon default by Borrower.

Lenders who do not have power-of-sale clauses in their mortgages must foreclose on borrowers who have defaulted through judicial foreclosure, which requires a hearing. If the lender is successful at the hearing, the court will order the sale of the property at auction.