Secure Debt Shall Withhold In Washington

Description

Form popularity

FAQ

Things Debt Collectors Cannot Do Debt collectors cannot garnish your wages or take your home or possessions without a court judgment, however, an exception exists for federally guaranteed student loans that are in default.

How Does Wage Garnishment Work in Washington? In Washington, most creditors can garnish the lesser of (subject to some exceptions—more below): 25% of your weekly disposable earnings, or. your weekly disposable earnings less 35 times the federal minimum hourly wage.

However, the fastest way to stop wage garnishment in Washington is to file for bankruptcy. If you qualify, then a bankruptcy filing will immediately put an end to a wage garnishment order for medical debt, consumer debt, and more.

However, the fastest way to stop wage garnishment in Washington is to file for bankruptcy. If you qualify, then a bankruptcy filing will immediately put an end to a wage garnishment order for medical debt, consumer debt, and more.

The Washington Collection Agency Act and federal Fair Debt Collection Practices Act prohibit harassment, false or misleading statements and unfair practices by collection agencies. If you believe a collection agency has unreasonably harassed or misled you, you can sue it. You could win damages and lawyer fees.

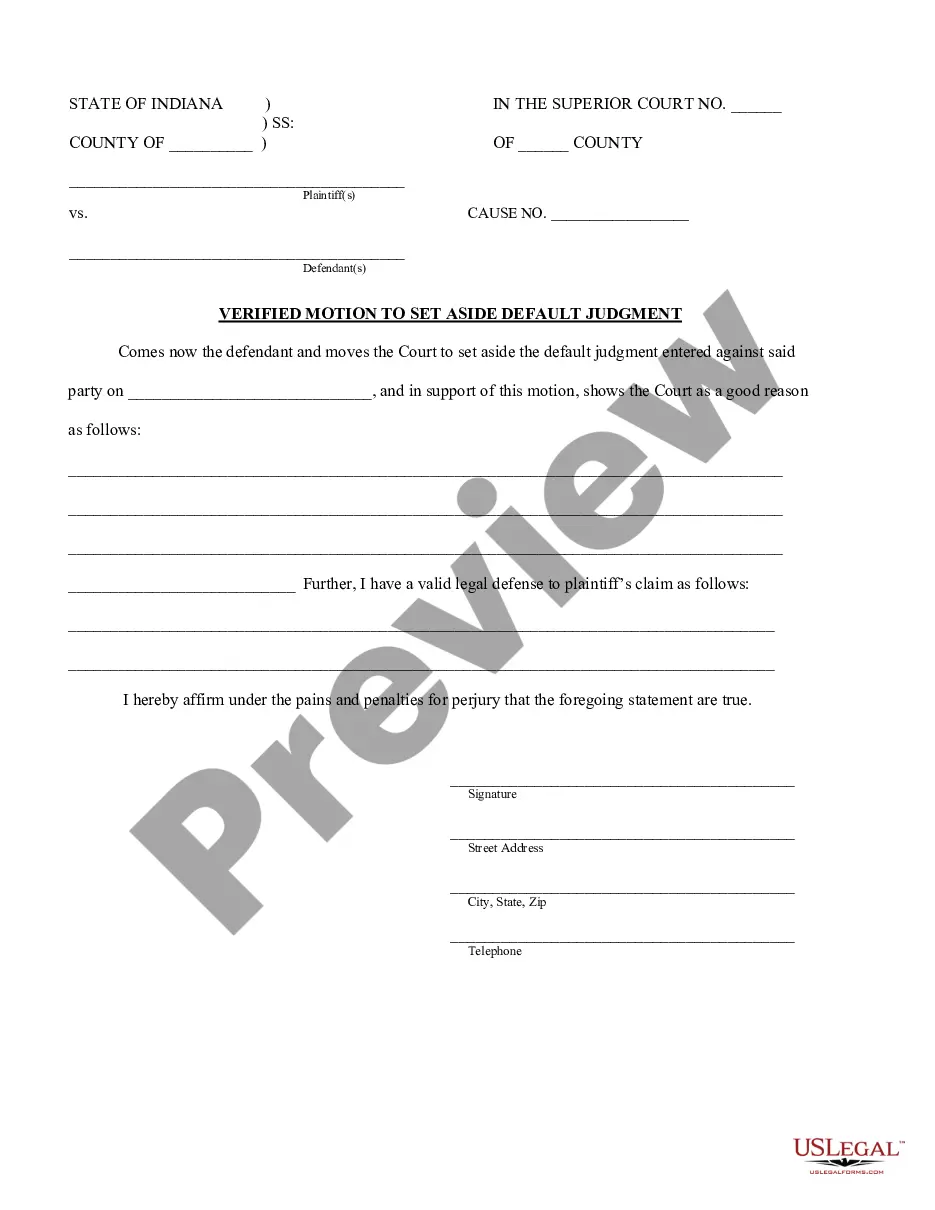

At a minimum, your written objection to the garnishment should include the following information: the case number and case caption (ex: "XYZ Bank vs. John Doe") the date of your objection. your name and current contact information. the reasons (or "grounds") for your objection, and. your signature.

Maybe. A Judgment Creditor may try to have the sheriff sell your real property (land, house, and other buildings). The homestead law protects up to $125,000 of equity in your home from most Judgment Creditors. If you live on the property claimed as a homestead, the exemption is automatic.

In Washington, the homestead exemption is $40,000 and includes land, mobile homes, and improvements. If you have a life insurance policy where the beneficiary is not yourself, the proceeds and avails are exempt from creditor claims.

Unless you take steps to protect them, most assets are not protected in a lawsuit. One of the few exceptions to this is your employer-sponsored IRA, 401(k), or another retirement account. At Bratton Estate and Elder Care Attorneys, our lawyers recommend putting an asset protection plan in place before you need it.