Secure Debt Any Format In Tarrant

Description

Form popularity

FAQ

Filing Your Case Online Texas's eFileTexas site uses guided interviews to help you create your forms. The website will ask you certain questions and use your answers to build your forms.

Small Claims Case The claim can be for no more than $20,000, excluding statutory interest and court costs but including attorney fees, if any.

If you have been a victim of a criminal offense, you should contact the nearest local law enforcement agency to conduct the investigation and file the appropriate criminal charges through the District Attorney's Office.

Call our Vital Records Division at 817-884-1550 or visit countyclerk.

All documents you want to file with the court must be filed with the District Clerk's Office through e-filing, in person, fax, or by mail. Contact the District Clerk's office with any questions at (817) 884-1574 or dclerk@tarrantcounty.

The Tarrant County Family Courts are in the Tarrant County Family Law Center at 200 East Weatherford Street, Fort Worth, Texas 76196. For parking, look at the parking information provided on the county website. Hours of Operation: Monday–Friday, 8 a.m. to 5 p.m.

EFileTexas. Official E-Filing System for Texas. applying technology that enables everyone access to our justice system. e-Filing is now mandatory for all attorneys filing civil, family, probate, or criminal cases in the Supreme Court, Court of Criminal Appeals, Courts of Appeals, and all district and county courts.

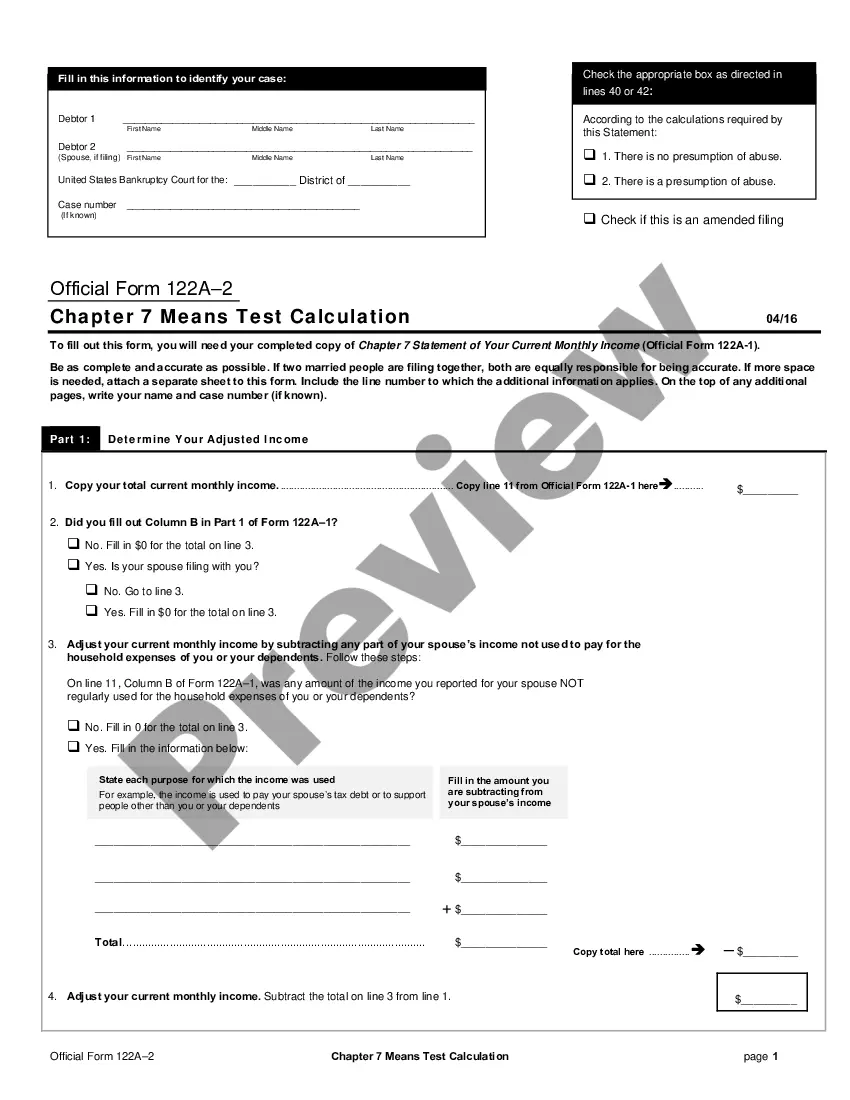

In most situations, if you receive a Form 1099-C, "Cancellation of Debt," from the lender that forgave the debt, you'll have to report the amount of cancelled debt on your tax return as taxable income.

The federal government agency or an applicable financial institution (a creditor) will send a 1099 C form when the lender discharged (canceled or forgiven) debt and the canceled debts are $600 or more. The issuer also reports the amount of debt forgiveness on the form to the Internal Revenue Service (IRS).

With debt forgiveness, creditors pardon some or all of your debt. Various types of debt may qualify for forgiveness. Debt forgiveness can offer relief from overwhelming financial burdens, but it does have downsides. Debt forgiveness is only one option for managing difficulties with repayment.