Security Debt Shall With Example

Description

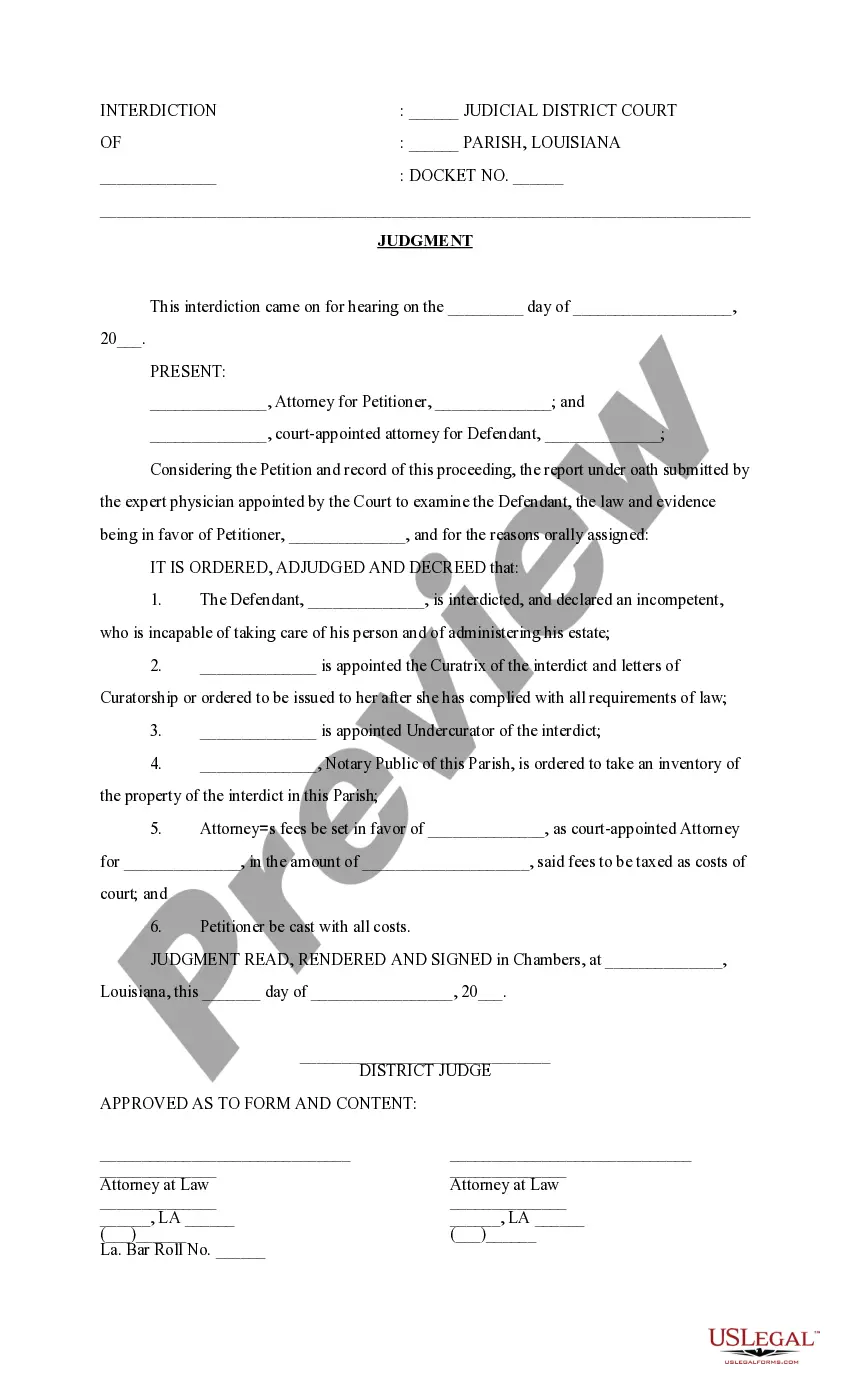

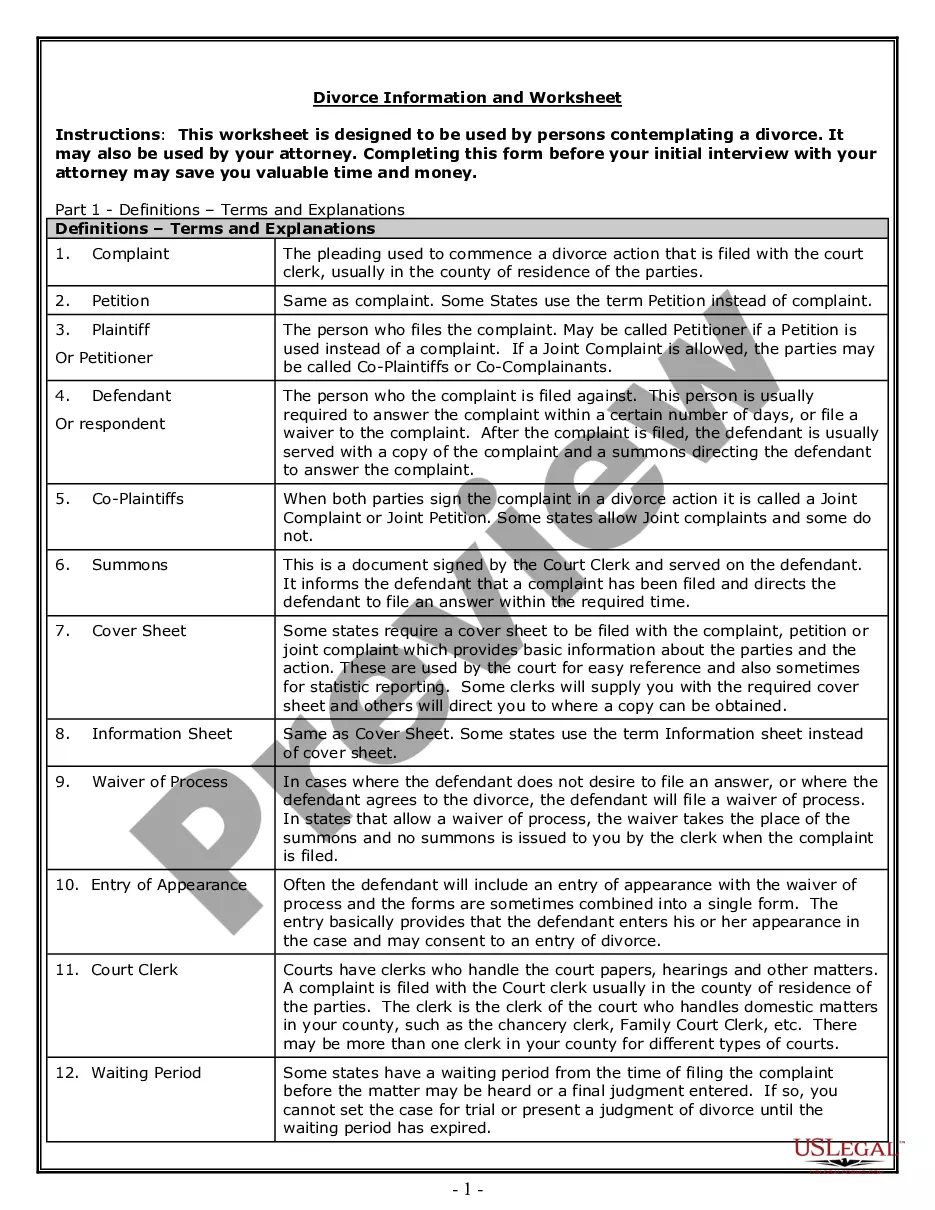

How to fill out Land Deed Of Trust?

Regardless of whether for commercial reasons or personal affairs, everyone must confront legal issues at some point in their lifetime.

Filling out legal documents requires meticulous care, starting from choosing the appropriate form template.

Once downloaded, you can fill out the form using editing software or print it out and complete it manually. With a vast US Legal Forms library available, you won’t need to waste time searching for the correct sample online. Utilize the library’s straightforward navigation to find the right template for any occasion.

- For example, if you pick an incorrect version of the Security Debt Shall With Example, it will be denied upon submission.

- Thus, it is vital to obtain a trustworthy source of legal forms such as US Legal Forms.

- To acquire a Security Debt Shall With Example template, follow these straightforward steps.

- Retrieve the sample you need using the search bar or catalog browsing.

- Review the form's details to ensure it fits your situation, state, and county.

- Click on the form's preview to view it.

- If it is the wrong document, return to the search feature to find the Security Debt Shall With Example template you require.

- Obtain the template when it aligns with your requirements.

- If you possess a US Legal Forms account, simply click Log in to access previously stored templates in My documents.

- If you haven’t created an account yet, you can acquire the form by clicking Buy now.

- Select the suitable pricing option.

- Complete the profile registration form.

- Choose your payment method: utilize a credit card or PayPal account.

- Select the document format you prefer and download the Security Debt Shall With Example.

Form popularity

FAQ

The most common types of debt securities are corporate or government bonds and money market instruments, notes, and commercial paper. When you purchase a bond from an issuer, you're essentially lending the issuer money. In most cases, you may be lending money to receive interest payments on the money loaned.

Bonds and other debt vehicles?such as certificates of deposit (CDs)?are the most common form of HTM investments. Bonds and other debt vehicles have determined (or fixed) payment schedules, a fixed maturity date, and they are purchased to be held until they mature.

The most common types of debt securities are corporate or government bonds and money market instruments, notes, and commercial paper. When you purchase a bond from an issuer, you're essentially lending the issuer money. In most cases, you may be lending money to receive interest payments on the money loaned.

STEP 1: File an application for debt securities listing on one or more stock exchanges and obtain in-principle approval. STEP 7: In consultation with the lead merchant banker, the issuer shall determine the price and volume of the minimum debt securities subscription and shall reveal the same in the offer document.

Short-term debt securities cover such instruments as treasury bills, commercial paper, and bankers' acceptances that usually give the holder the unconditional right to a stated fixed sum of money on a specified date.