Secured Debt Shall For Bad Credit

Description

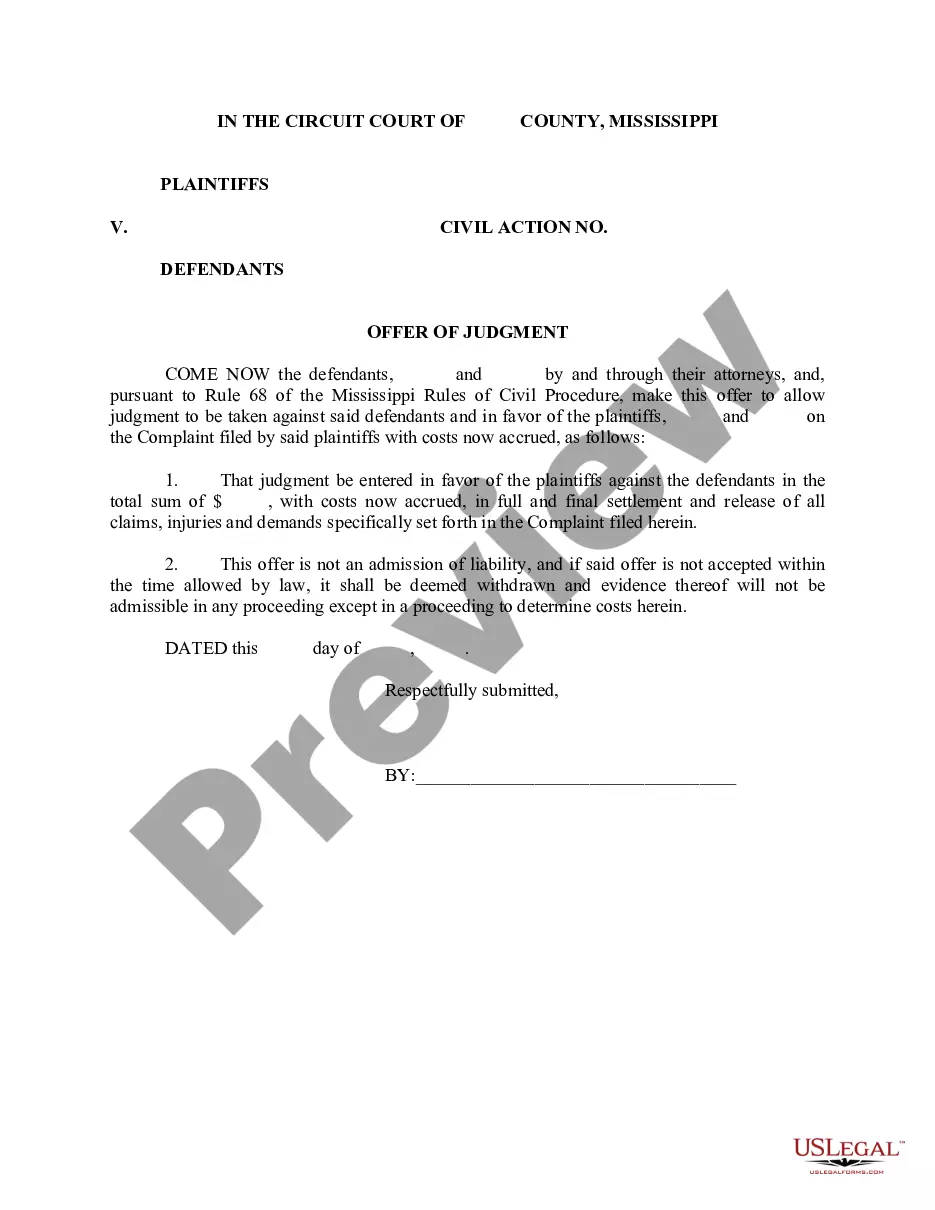

How to fill out Land Deed Of Trust?

Regardless of whether for commercial aims or personal issues, everyone must handle legal circumstances at some stage in their life.

Filling out legal documents requires meticulous care, beginning with choosing the appropriate form template. For instance, if you select an incorrect version of the Secured Debt Shall For Bad Credit, it will be denied upon submission. Hence, it is crucial to have a reliable source of legal documents such as US Legal Forms.

With an extensive US Legal Forms catalog available, you will never have to waste time searching for the correct template online. Utilize the library’s straightforward navigation to find the suitable form for any circumstance.

- Locate the template you require using the search bar or catalog browsing.

- Review the form’s description to ensure it aligns with your circumstances, state, and locality.

- Click on the form’s preview to examine it.

- If it is the incorrect form, return to the search option to find the Secured Debt Shall For Bad Credit template you need.

- Download the template if it fulfills your requirements.

- If you already possess a US Legal Forms account, simply click Log in to access previously stored documents in My documents.

- If you do not have an account yet, you can download the form by clicking Buy now.

- Select the appropriate pricing option.

- Fill out the profile registration form.

- Choose your payment method: utilize a credit card or PayPal account.

- Select the file format you prefer and download the Secured Debt Shall For Bad Credit.

- Once downloaded, you can complete the form using editing software or print it out and fill it in manually.

Form popularity

FAQ

Letters of explanation addressing these issues should include: An explanation of the negative event. The date it happened. The name of the creditor. Your account number. Your signature and date (if typed or hand-written)

If you have pledged property as collateral for a loan, the loan is called a secured debt. Examples of secured debt include homes loans and car loans. The loan is secured by the car or home, which means that the person you owe the debt to can repossess the car or foreclose on the home if you fail to pay the debt.

Secured loans for bad credit usually come with higher interest rates and fees than are available to people with a good credit score, so they're typically more expensive. They also mean the asset you are securing them against is at risk if you fail to keep up payments.

As it's very unlikely that a lender would write off a secured loan, the only way to get rid of one is to pay it off. There are three main ways to do this: continue making your regular payments as normal. negotiate with the lender and agree a different payment plan.

Letters of explanation addressing these issues should include: An explanation of the negative event. The date it happened. The name of the creditor. Your account number. Your signature and date (if typed or hand-written)