Secure Debt Any Format In San Jose

Description

Form popularity

FAQ

Which debt solutions write off debts? Bankruptcy: Writes off unsecured debts if you cannot repay them. Any assets like a house or car may be sold. Debt relief order (DRO): Writes off debts if you have a relatively low level of debt. Must also have few assets. Individual voluntary arrangement (IVA): A formal agreement.

Which debt solutions write off debts? Bankruptcy: Writes off unsecured debts if you cannot repay them. Any assets like a house or car may be sold. Debt relief order (DRO): Writes off debts if you have a relatively low level of debt. Must also have few assets. Individual voluntary arrangement (IVA): A formal agreement.

The simple answer to this question is 'yes', because some debt solutions involve getting some or all of your unsecured debt written off. These solutions are most often used by people who are unlikely to be able to afford to repay their debts in full within a reasonable time.

Debt forgiveness is when a lender or creditor agrees to wipe out all or part of a debt. You may be able to apply if you have unsecured debts like credit cards, student loans or tax debt. Medical debts and mortgages may also qualify for some types of relief.

Both secured and unsecured debt can be discharged in Chapter 13 bankruptcies, but non-dischargeable unsecured debts cannot be discharged in California.

While a credit score of negative (-1) or NH means you simply do not have a credit history. It indicates that an individual has no credit accounts, meaning they have not yet taken out any loans or credit from which to build their credit profiles.

Status codes key 0 – payments up to date. 1 – payments up to 1 month late. 2 – payments up to 2 months late. 3 – payments up to 3 months late. 4 – payments up to 4 months late.

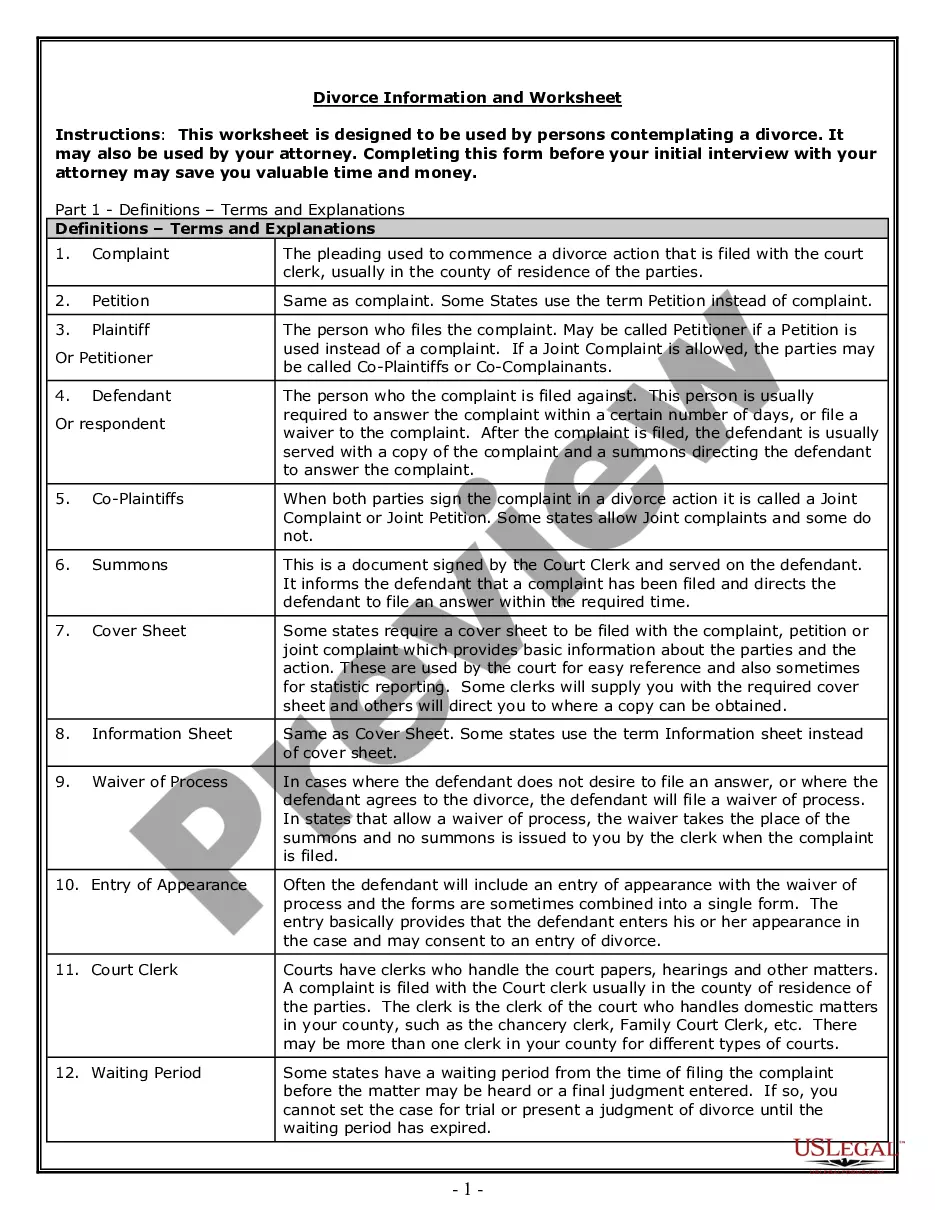

How To Fill In A Proof Of Debt Form Box 1 – This is your business name. Box 2 – This is your business address. Box 3 – This is the total amount you are owed. Box 4 – List any supporting documents you have. Box 5 – List any un-capitalised interest on the claim.

D: Defaulted on Contract. DEL: Delinquency. DLA: Date of Last Activity. ECOA: Equal Credit Opportunity Act. EFX or EF: Equifax.

Fill in your full name and contact details as the creditor. Specify the full debt amount owed with supporting documents attached. Describe the debt origins and timeline. Attach any credit agreements, invoices, demands sent to the debtor, and related correspondence.