Secure Debt Any Withholding In San Diego

Description

Form popularity

FAQ

By law, landlords cannot refuse to return the deposit without a valid reason. §§ 92.101-92.109. Upon move out, they must give you your security deposit within 30 days. Any deductions would have to be noted upon an itemized list. You can sue your landlord for damages in small claims court.

AB 12 amends California Civil Code Section 1950.5 to limit the maximum security deposit for a dwelling unit to one month's rent, regardless of whether the unit is furnished or unfurnished.

California. California law stipulates that a holding deposit becomes non-refundable if a prospective tenant fails to occupy the unit after agreeing to do so. However, landlords must provide tenants with a written holding deposit agreement detailing the conditions under which the deposit may be retained.

A landlord can only deduct certain items from a security deposit. The landlord can deduct for: Cleaning the rental unit when a tenant moves out, but only to make it as clean as when the tenant first moved in. Repairing damage, other than normal wear and tear, caused by the tenant and the tenant's guests.

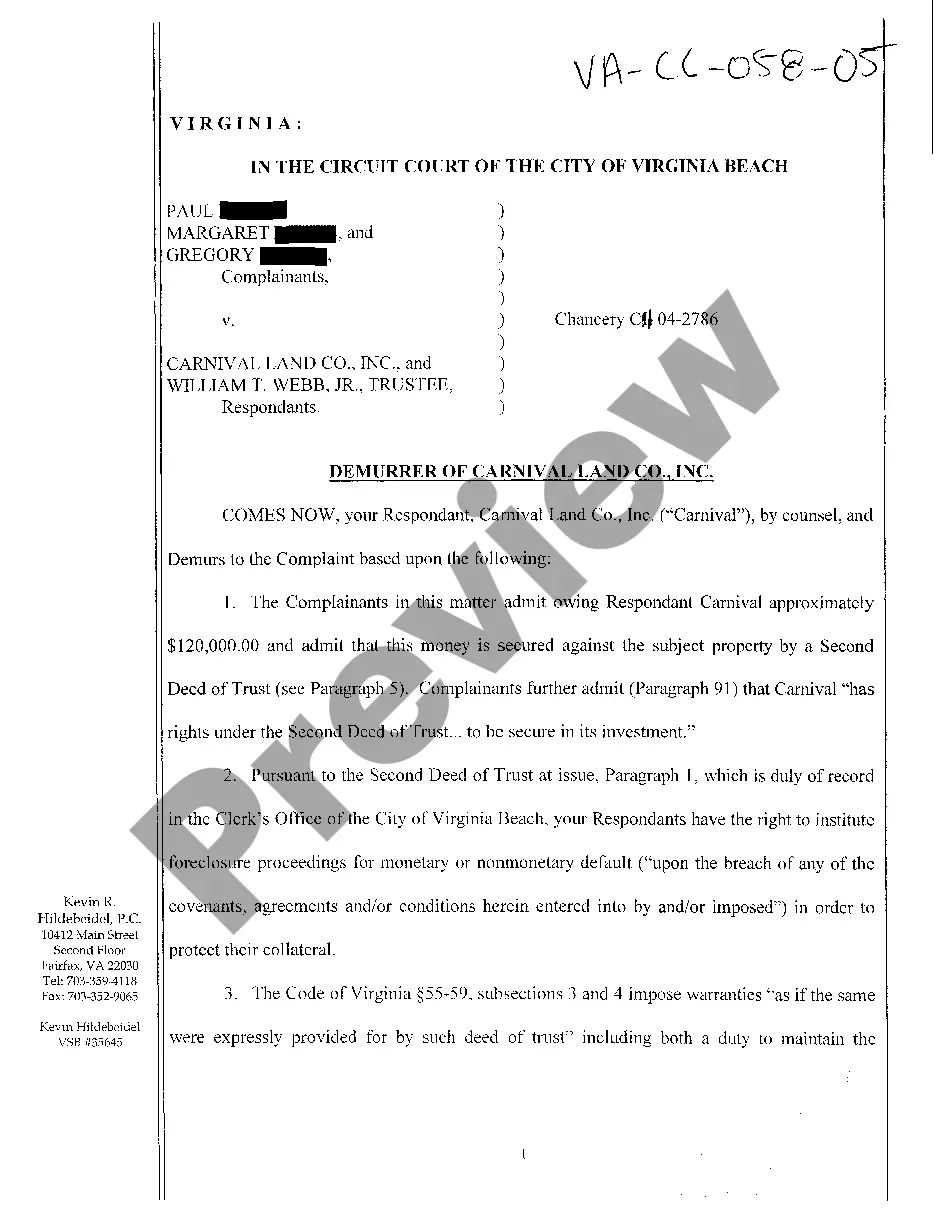

Once the recorder's office has recorded the Abstract of Judgment, it officially becomes a lien on the real property the debtor owns in the county now or may acquire later.

If the judgment debtor owns real property, you may record an Abstract of Judgment with the County Recorder which will act as a lien against all real property owned by the judgment debtor in the county in which the lien is recorded. Complete an Abstract of Judgment (EJ-001)PDF and submit to the court to be issued.

Exemption from the Enforcement of Judgments Type of PropertyCode Social Security Direct Deposit Accounts (the account itself) CCP § 704.080 Wages CCP § 704.070 Public Assistance (Welfare) CCP § 704.170 W&I § 17409 Charity; Fraternal Benefit Funds CCP § 704.17027 more rows

Most judgments (the court order saying what you're owed) expire in 10 years. This means you can't collect on it after 10 years. To avoid this, you can ask the court to renew it. A renewal lasts 10 years.

To do this, fill out an EJ-001 Abstract of Judgment form and take it to the clerk's office. After the clerk stamps it, record it at the County Recorder's Office in the county where the property is located. Place a lien on a business.

The IRS considers most types of forgiven debt taxable unless you meet specific exemptions, such as bankruptcy or insolvency. California's state tax laws also treat canceled debt as taxable income, but there are some exceptions where you might avoid taxation.