Secured Debt Shall With A Sinking Fund In New York

State:

Multi-State

Control #:

US-00181

Format:

Word;

Rich Text

Instant download

Description

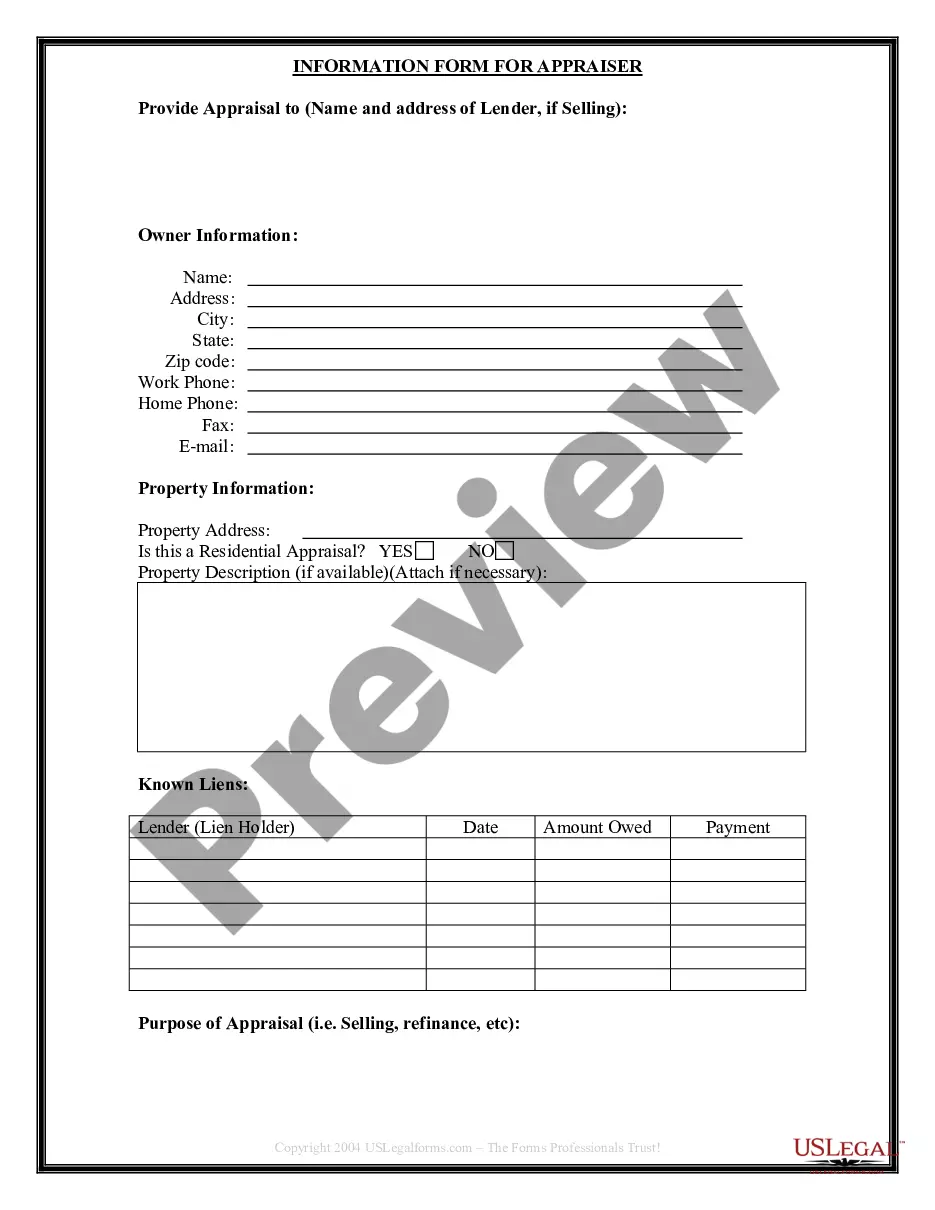

The form titled "Land Deed of Trust" is a legal document used in New York that secures a debtor's indebtedness through the establishment of a sinking fund. This form is crucial for attorneys, partners, owners, associates, paralegals, and legal assistants who are involved in managing secured debts, as it outlines the responsibilities and obligations of the debtor to the secured party. Key features include the specifics of payment terms, details regarding any future advances, and the trustee's rights in case of default. The document requires the debtor to insure the property and maintain it, as well as to keep taxes paid. In case of default, the secured party has the right to sell the property to recover the outstanding debt. It is essential to provide the legal description of the property in the document and ensure all parties have defined roles. Filling out the form involves accurately completing all sections, particularly payment schedules and involved parties, while retaining the original terms stated in the Deed of Trust. Specific use cases for this form would include securing loans for real estate purchases, refinancing existing debts, or managing partnership contributions where property serves as collateral. Overall, this document serves as a foundational tool for managing secured loans effectively.

Free preview

Form popularity

FAQ

There's no limit to the number of sinking funds you can have, but the more you have, the longer it can take to hit each savings goal.

Sinking funds are in 'trust' for the scheme and should not be returned to lessees upon assignment, or at any time. Interest earned on funds should be added to the funds unless the lease states otherwise. If funds are held in 'trust' then a tax will be charged on the interest earned.