Secured Debt Shall With A Sinking Fund In Nevada

Description

Form popularity

FAQ

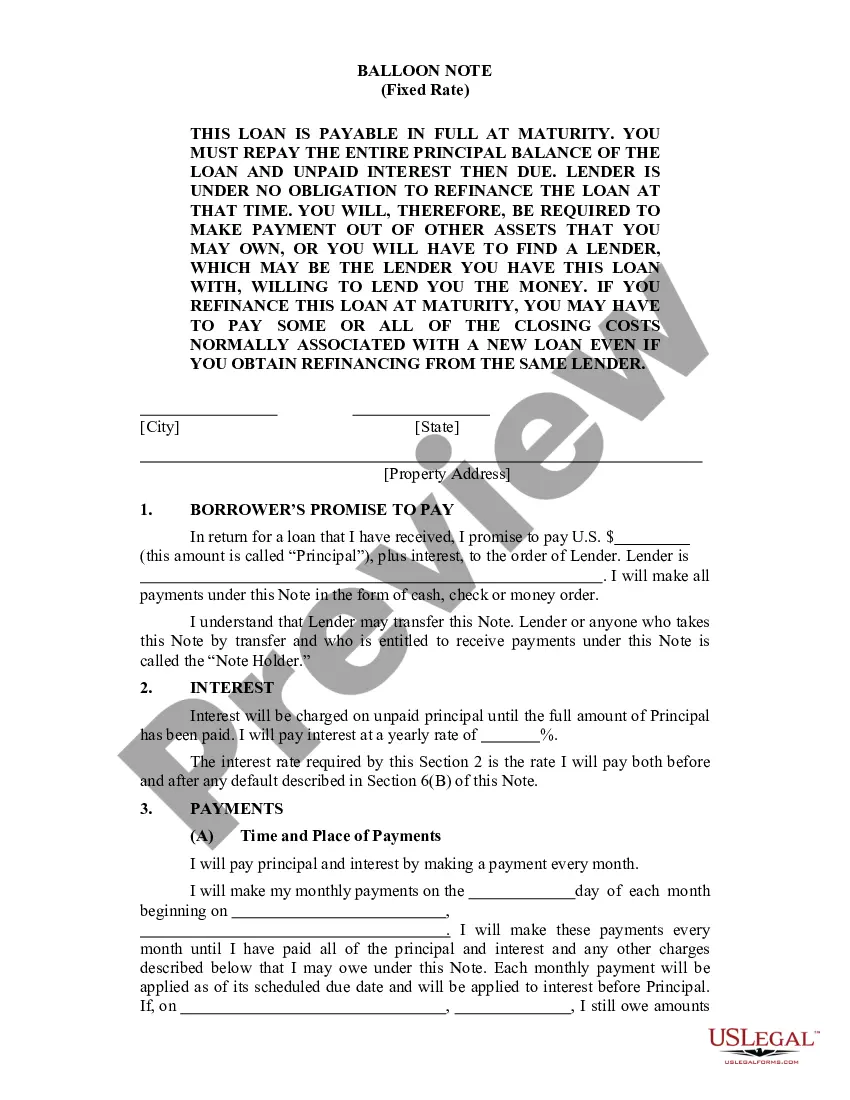

Promissory Notes: For promissory notes, such as mortgages, the statute of limitations is 6 years.

The amount in a strata sinking fund should be sufficient to cover future major capital expenses for the property. This is typically determined by a 10-year plan, accounting for estimated costs of repairs, maintenance, and replacements.

Sinking funds are in 'trust' for the scheme and should not be returned to lessees upon assignment, or at any time. Interest earned on funds should be added to the funds unless the lease states otherwise. If funds are held in 'trust' then a tax will be charged on the interest earned.

Sinking funds are in 'trust' for the scheme and should not be returned to lessees upon assignment, or at any time. Interest earned on funds should be added to the funds unless the lease states otherwise. If funds are held in 'trust' then a tax will be charged on the interest earned.

Let's say you're saving for next year's vacation, your kid's birthday gifts, and your honeymoon all at the same time. In this case, you might want to open multiple savings accounts to keep track of each goal. Each account would act as a separate sinking fund, helping you stay organized and focused on specific expenses.

How to Create a Sinking Fund Step 1: Decide what you're saving up for. An Alaskan cruise, a down payment on a house, Christmas presents, or a wedding reception. Step 2: Decide where you're going to store your sinking fund. Step 3: Decide how much you need to save. Step 4: Set up your sinking fund in the budget.

Follow these steps to fill in a sinking fund schedule. In row 0, the only entries are in the balance and book value columns. Each entry in the payment column is the sinking fund payment. Calculate the interest. Calculate the increase. Calculate the new balance. Calculate the new book value.