Secure Debt Shall Forget The Day In Miami-Dade

Description

Form popularity

FAQ

Yes. It is rather common for collection agencies to report a debtor to credit bureaus without notifying the debtor. When a debt becomes overdue, the creditor has several options. One of those options is to simply sell the account to a collections agency.

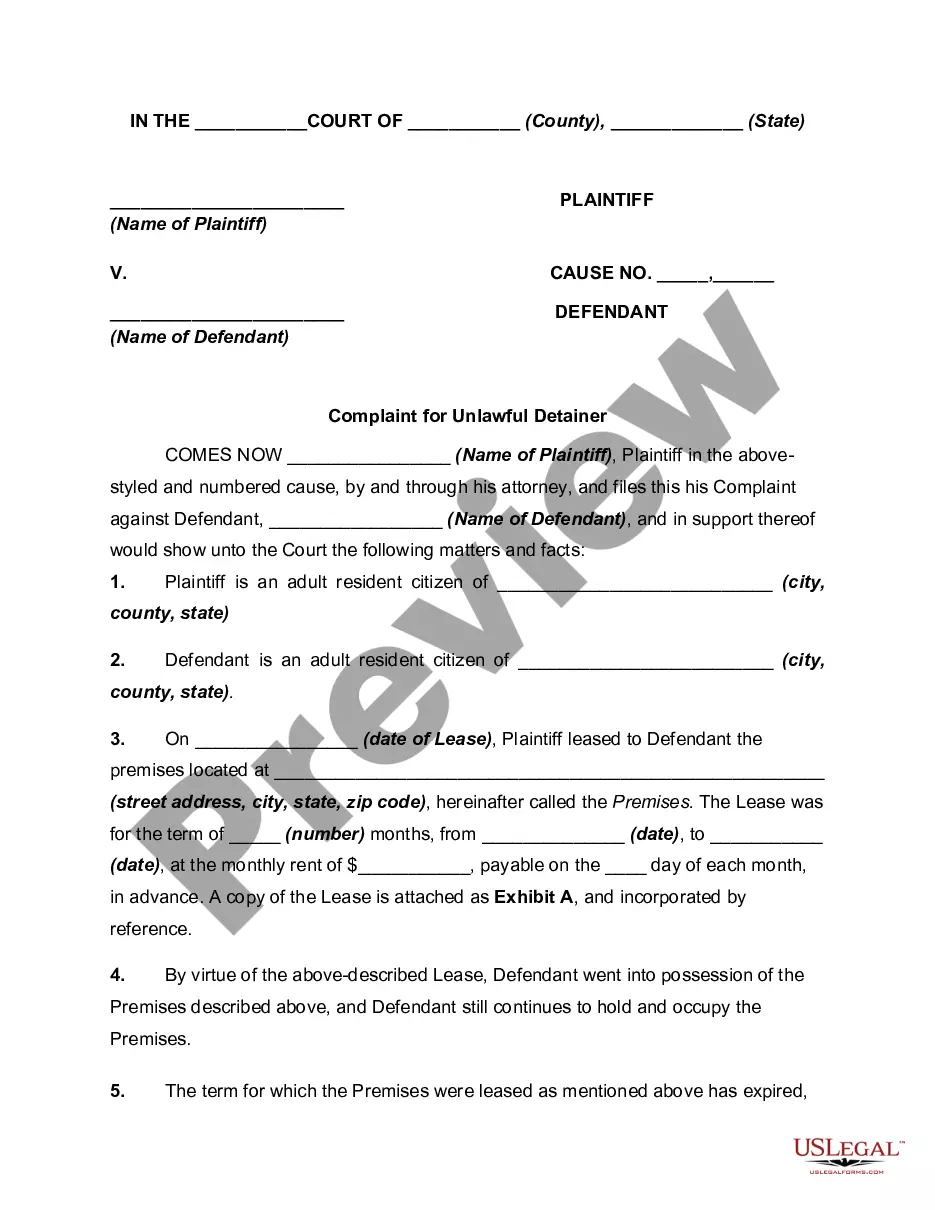

The claim can be filled and submitted online at the Miami-Dade County Clerk's Office. You may print out the application and file the claim in person at a local courthouse if you choose. More resources are available on the Miami-Dade County Law Library site.

Conclusion: Going to small claims court may be worth it for $500, but it will determine how you weigh your costs versus benefits. At a minimum, it is worth it to send a demand letter.

You, the plaintiff, must file a “Statement of Claim” form, available at your Clerk's office. This must be fully completed and signed to receive a pre-trial conference date. If your claim is based upon written documentation, attach a copy of the contract to the Statement of Claim form. You may file by mail or in person.

Specifically, the rule states that a debt collector cannot: Make more than seven calls within a seven-day period to a consumer regarding a specific debt. Call a consumer within seven days after having a telephone conversation about that debt.

The claim can be filled and submitted online at the Miami-Dade County Clerk's Office. You may print out the application and file the claim in person at a local courthouse if you choose. More resources are available on the Miami-Dade County Law Library site.

Specifically, the rule states that a debt collector cannot: Make more than seven calls within a seven-day period to a consumer regarding a specific debt. Call a consumer within seven days after having a telephone conversation about that debt.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

Specifically, the rule states that a debt collector cannot: Make more than seven calls within a seven-day period to a consumer regarding a specific debt. Call a consumer within seven days after having a telephone conversation about that debt.

Most states or jurisdictions have statutes of limitations between three and six years for debts, but some may be longer. This may also vary depending, for instance, on the: Type of debt. State where you live.