Personal Property Business Form Without In Orange

Description

Form popularity

FAQ

Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming do not levy state income taxes, while New Hampshire doesn't tax earned wages. States with no income tax often make up the lost revenue with other taxes or reduced services.

And Ohio have significant state income taxes. And understanding the tax landscape of each state isMoreAnd Ohio have significant state income taxes. And understanding the tax landscape of each state is crucial. This knowledge helps in making informed decisions about relocation.

While Florida does have property taxes they are primarily focused on real estate rather thanMoreWhile Florida does have property taxes they are primarily focused on real estate rather than personal property. This means that most of the tax revenue comes from taxes on land. And buildings.

All of the data below comes from the Census Bureau's 2022 1-year American Community Survey (ACS) Estimates. Hawaii. Hawaii has the lowest property tax rate in the U.S. at 0.27%. Alabama. Alabama is generally one of the more affordable states in the country. Colorado. Nevada. Utah. West Virginia.

You can report all of your business income and business expenses on Schedule C, which you file with your personal income tax return (Form 1040). The business itself is not taxed separately, and all business tax deductions are taken on your individual tax return.

An annual filing of a Business Property Statement is a requirement of section 441(d) of the California Revenue and Taxation Code.

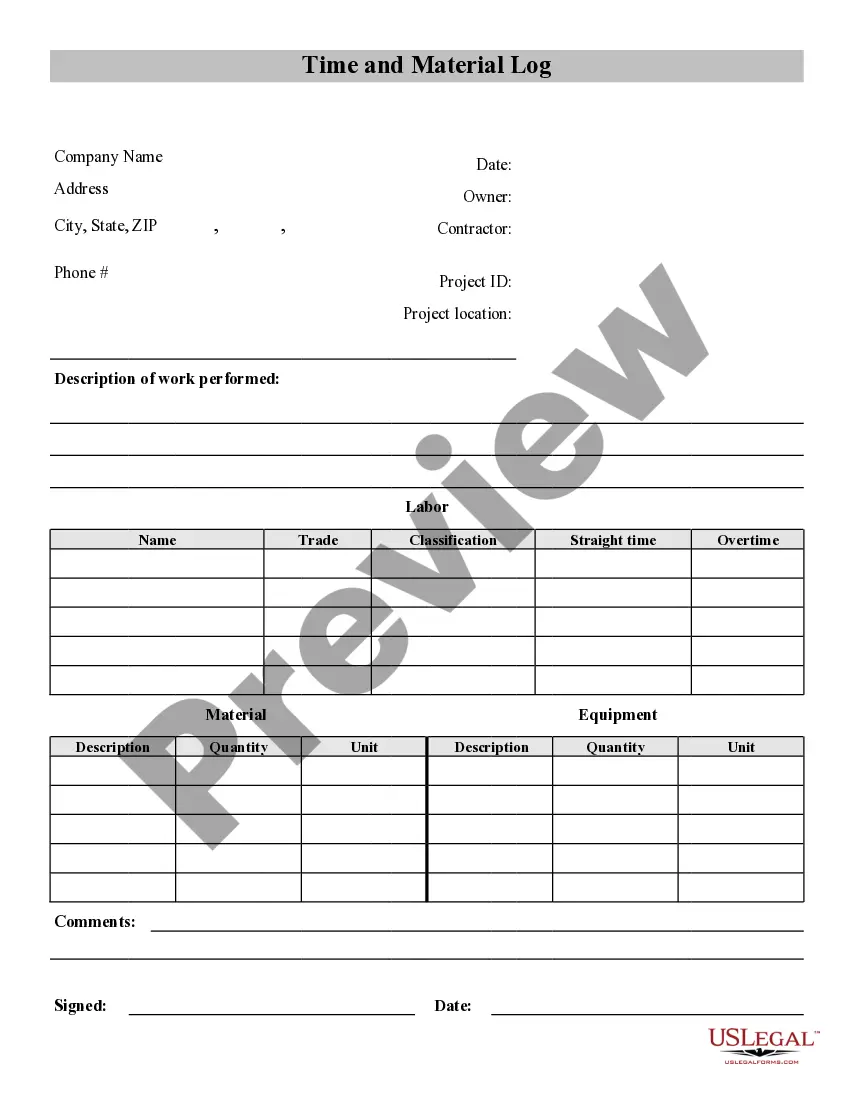

Business Personal Property Tax is a tax assessed on tangible personal property businesses own. This type of property includes equipment, furniture, computers, machinery, and inventory, among other items not permanently attached to a building or land.

The state of Georgia provides the following exemptions: All personal clothing and effects, household furniture, furnishings, equipment, appliances, and other personal property used within the home, if not held for sale, rental or other commercial use, shall be exempt from all ad valorem taxation.

The Form 571L or 571A constitutes an official request that you declare all assessable business property situated in this county which you owned, claimed, possessed, controlled or managed on the tax lien date. The form is approved by the State Board of Equalization (BOE) but forms are administered by the county.

Business Personal Property Tax is a tax assessed on tangible personal property businesses own. This type of property includes equipment, furniture, computers, machinery, and inventory, among other items not permanently attached to a building or land.