Bill Sale Form Printable With Gst In Ohio

Description

Form popularity

FAQ

Start by determining whether you have a compliance obligation in a state. If so, register with your state's taxing agency before collecting any sales tax. After you've gone through the state's registration process, you are then permitted to collect sales tax on your transactions.

Writing a state of Ohio bill of sale is a simple process. Start by using our easy-to-use, customizable template. Provide the legal names, addresses, and contact information of both the buyer and the seller. Describe the item being sold, including the make, model, year, color, and any unique identifiers.

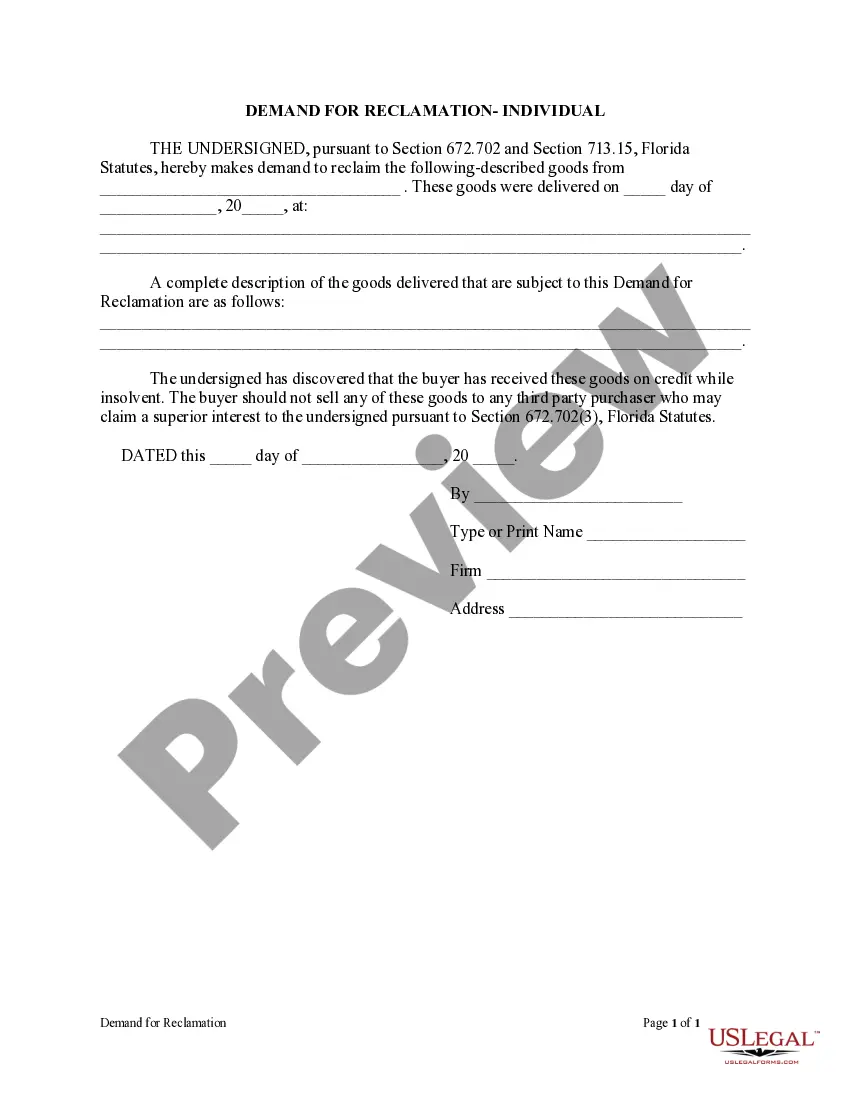

Many states don't mandate notarization for bills of sale. States like California, Texas, Florida, Ohio, and New York allow transactions without a notarized document. In these states, a signed bill of sale is often sufficient for legal purposes, provided it includes all required information.

Get a bill of sale from a regulatory agency. Many government agencies, like the Department of Motor Vehicles, for instance, offer bill of sale forms for public use. Using a form directly from a government agency ensures that you have all of the information required for your state.

Writing a state of Ohio bill of sale is a simple process. Start by using our easy-to-use, customizable template. Provide the legal names, addresses, and contact information of both the buyer and the seller. Describe the item being sold, including the make, model, year, color, and any unique identifiers.

Common exemptions from Ohio sales and use tax: Groceries and food sold for off premises consumption. Prescription medicines. Housing related utilities, such as gas, electric, water and steam. Many items used in farming or manufacturing.

Some goods are exempt from sales tax under Ohio law. Examples include most non-prepared food items, items purchased with food stamps, and prescription drugs.

Visit IRS to apply to become a tax-exempt organization. Also, contact the Ohio Department of Taxation and your county and local governments to determine how to apply for applicable exemptions. Register with the Ohio Attorney General's Office if entity is a charitable organization.