Personal Property Business Form Withholding In Oakland

Description

Form popularity

FAQ

Taxes, like real estate taxes, can represent a great LLC tax loophole. You can write off property taxes up to a maximum of $10,000. If you're writing off your property taxes, you should know that you may even be able to write off your homeowners' association fees!

The median property tax rate in Oakland, CA is 1.83%, considerably higher than both the national median of 0.99% and the California state median of 1.21%. With the median home value in Oakland, the typical annual property tax bill reaches $7,453, exceeding the national median of $2,690.

The California Constitution states in part that, "Unless otherwise provided by this Constitution or the laws of the US, (a) All property is taxable". That is, unless otherwise exempted, all forms of tangible property are taxable in California and the Assessor is required to assess business personal property.

Personal property can be classified as either business property or personal-use property. Business property includes items used for commercial purposes, while personal-use property includes items acquired and used for personal enjoyment. Therefore, the statement is correct.

California Property Tax Planning under Proposition 19 If the LLC is the original owner, then as long as no new person gains more than 50% ownership/control of the LLC, then there will be no reassessment of the underlying property.

San Francisco taxes businesses based on gross receipts as well as business personal property like machinery, equipment or fixtures.

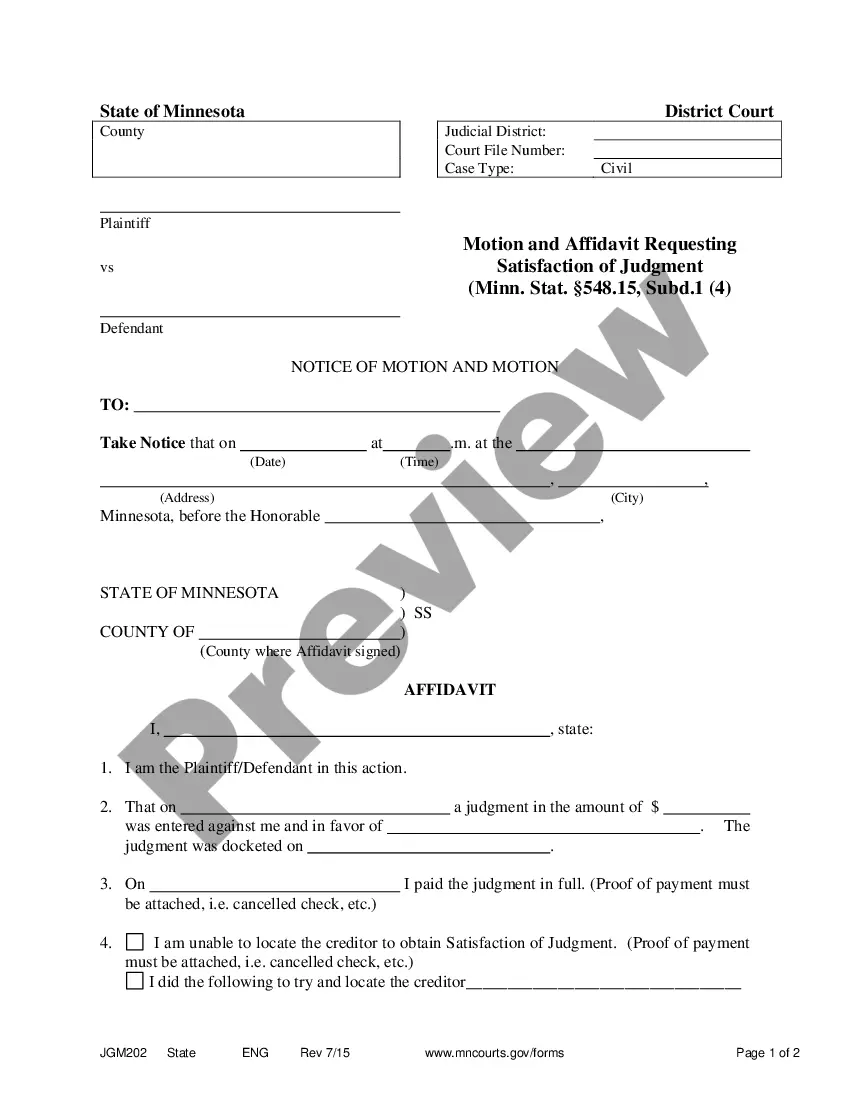

This form constitutes an official request that you declare all assessable business property situated in this county which you owned, claimed, possessed, controlled, or managed on the tax lien date, and that you sign (under penalty of perjury) and return the statement to the Assessor's Office by the date cited on the ...

Certain properties, or portions of properties, are exempt from taxation under the California Constitution. The most common types are homeowner, disabled veterans, welfare, charitable, and institutional exemptions. Visit the Assessor's Exemption webpage for more information.

Property Tax Rates Across Oakland, California Property taxes in Oakland, California, are vital in funding essential local services such as public schools, road maintenance, and emergency services. The median tax rate in Oakland is 1.83%, significantly higher than the U.S. national median of 0.99%.