Private Property In Business Definition In North Carolina

Description

Form popularity

FAQ

Personal property is a type of property that includes any movable object or intangible asset of value that can be owned by a person and is distinct from real property. Examples include vehicles, artworks, and patents.

As defined by North Carolina law, private property would be owned by a private individual and not a commercial or other business interest.

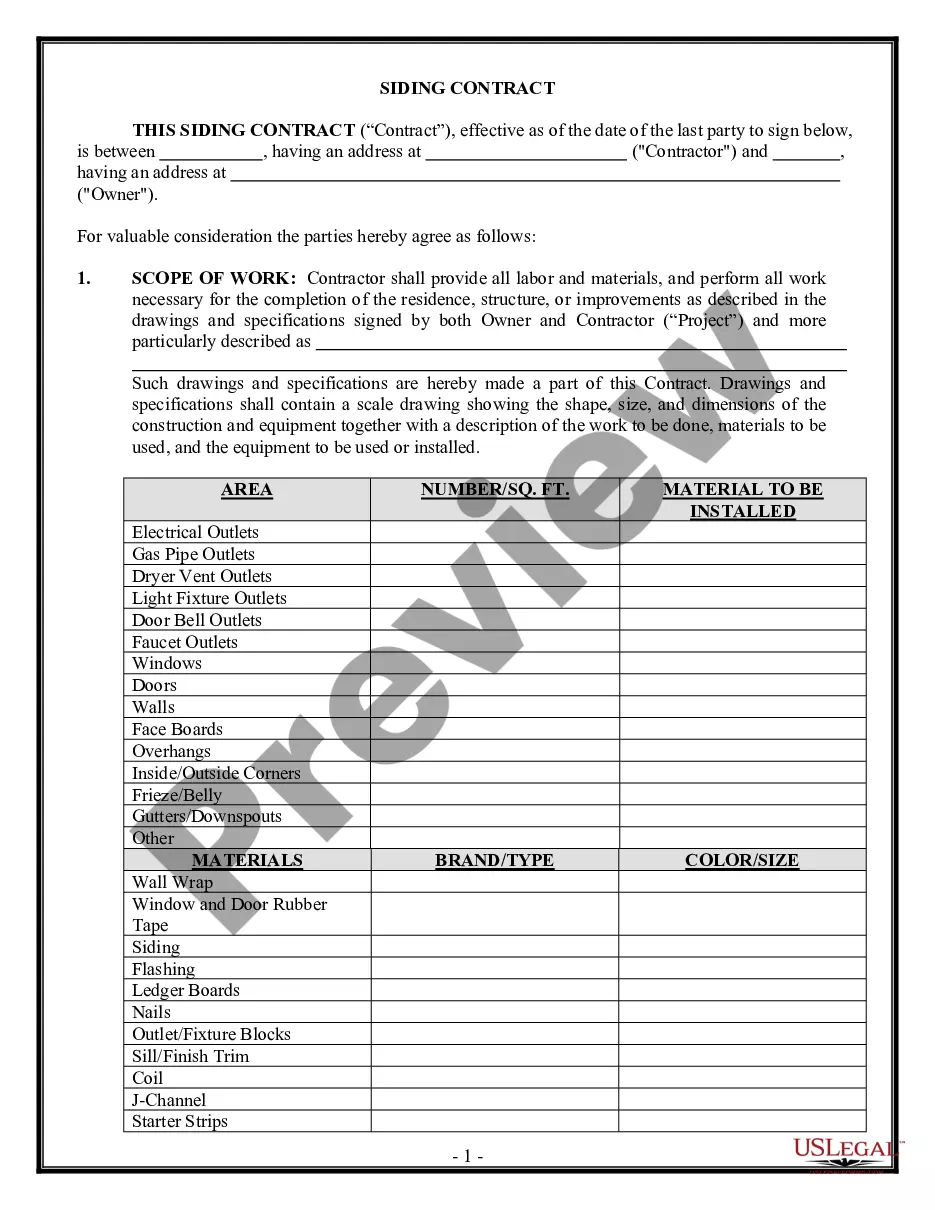

In general, business personal property is all property owned, possessed, controlled, or leased by a business except real property and inventory items. Business personal property includes, but is not limited to: Machinery. Computers. Equipment (e.g. FAX machines, photocopiers)

A business asset is an item of value owned by a company. Business assets span many categories. They can be physical, tangible goods, such as vehicles, real estate, computers, office furniture, and other fixtures, or intangible items, such as intellectual property.

The properties used by a business are known as tangible assets or fixed assets; whereas the rights in the properties of a business are known as intangible assets. The assets which are physically in the possession of a company are recorded as fixed assets or tangible assets.

Business personal property is any tangible property owned, engaged, used, or possessed in the conduct of a trade or business. This includes, but not limited to, machinery, equipment, furniture, fixtures, computers, software, farm equipment, Leasehold improvements, and supplies.

Commercial property, also called commercial real estate, investment property or income property, is real estate (buildings or land) intended to generate a profit, either from capital gains or rental income.

Yes. An individual and an entity such as an LLC can own a property together as tenants in common. If the deed is silent as to percentage of ownership, they would be 50/50 owners.

Tax Characteristics: A Limited Liability Company is NOT taxed on its income. Otherwise, Members are taxed on the income of the LLC unless they elect to be taxed as a corporation.